AQA Specification focus:

‘How negative and positive output gaps relate to unemployment and inflationary pressures.’

This section explores the relationship between output gaps, unemployment, and inflationary pressures, examining how different economic conditions influence employment levels, price stability, and overall economic performance.

Understanding Output Gaps

An output gap represents the difference between an economy’s actual output and its potential output. Potential output is the level of production achievable if all resources were fully employed efficiently.

Output Gap: The difference between actual GDP and potential GDP, expressed as a percentage of potential GDP.

A positive output gap occurs when actual output exceeds potential output.

A negative output gap arises when actual output is below potential output.

These gaps directly influence employment levels and inflationary trends.

Negative Output Gaps and Unemployment

A negative output gap reflects spare capacity in the economy. This means resources, including labour, are underutilised.

Cyclical unemployment typically rises as firms cut back on production.

Lower demand reduces hiring and increases redundancy risk.

Real GDP falls short of potential GDP, signalling economic inefficiency.

Cyclical Unemployment: Unemployment caused by insufficient aggregate demand leading to reduced output and job losses.

In this situation, price pressures are muted. Firms may even lower prices to attract demand, resulting in disinflationary or deflationary pressures.

Positive Output Gaps and Inflation Pressures

A positive output gap indicates the economy is producing beyond sustainable capacity.

Firms may struggle to meet demand with existing resources.

Labour markets tighten, reducing unemployment to very low levels.

Wage growth accelerates as firms compete for workers.

Cost-push inflation emerges as wages and input costs rise.

Cost-Push Inflation: A rise in the general price level caused by increasing production costs, such as wages or raw materials.

This situation can create overheating in the economy, risking a sharp correction or recession.

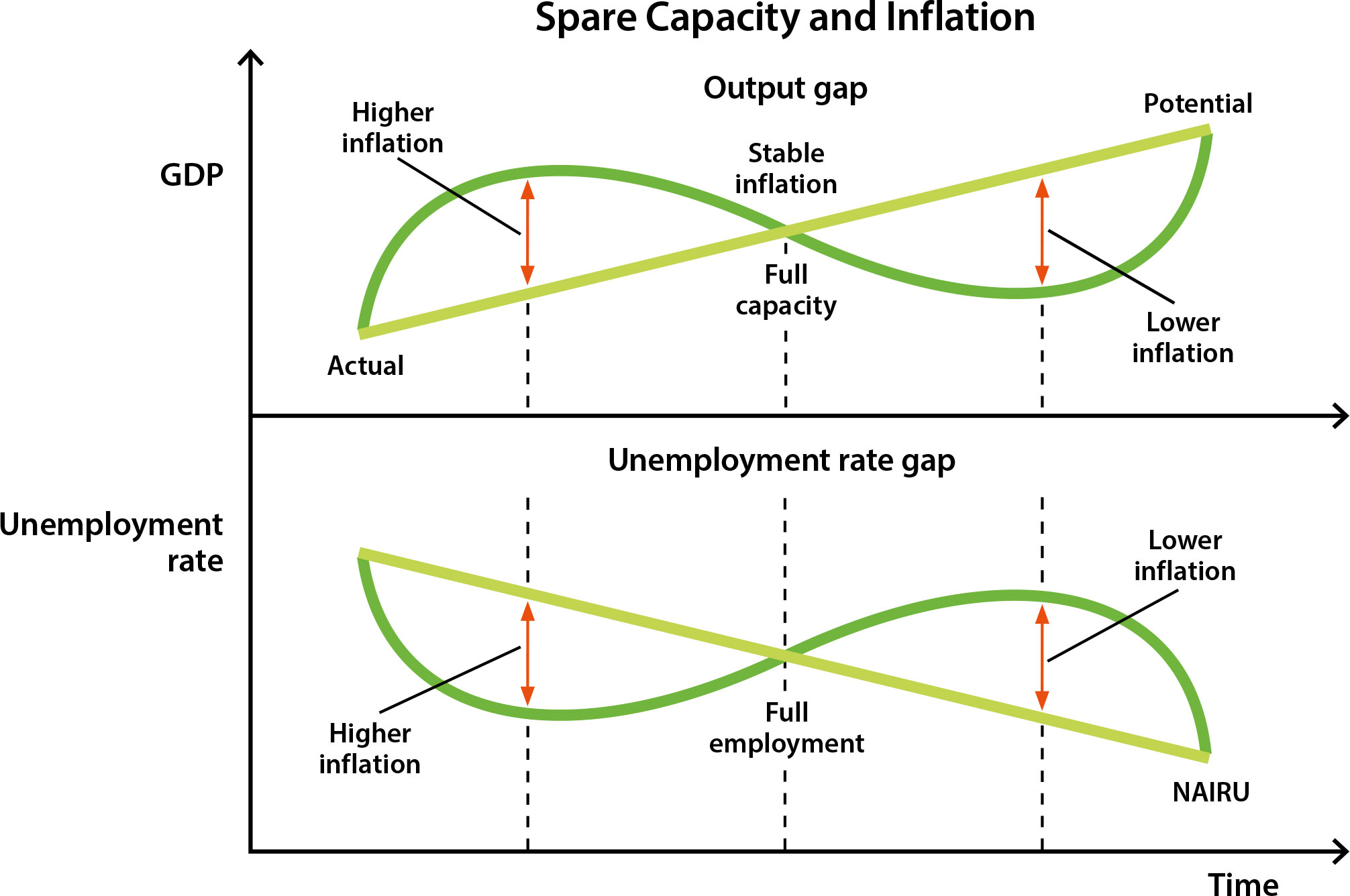

The diagram shows how spare capacity and the output gap influence inflationary pressures. A positive output gap leads to rising inflation, while a negative gap reduces inflationary pressures. Source

Linking Output Gaps to the Phillips Curve

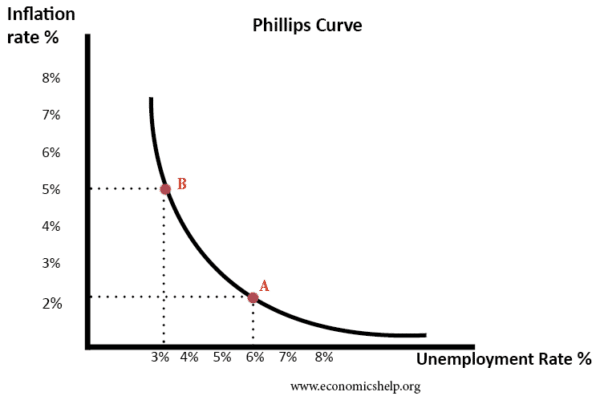

The Phillips Curve illustrates the inverse short-run relationship between unemployment and inflation.

The Phillips Curve illustrates the trade-off between unemployment and inflation in the short run. As unemployment falls, inflation tends to rise, and vice versa. Source

A negative output gap shifts the economy towards lower inflation but higher unemployment.

A positive output gap produces lower unemployment but higher inflationary pressures.

The balance between these outcomes reflects policymakers’ challenges in stabilising economic performance.

Indicators of Output Gaps

Economists use various indicators to assess whether an output gap exists:

Unemployment levels compared to the natural rate of unemployment.

Inflation trends, especially demand-pull and cost-push inflation.

Capacity utilisation rates in manufacturing and services.

GDP growth relative to its long-run trend rate.

Natural Rate of Unemployment: The unemployment rate when the labour market is in equilibrium, accounting for frictional and structural unemployment.

When actual unemployment falls below this level, the economy likely faces a positive output gap.

Demand-Side and Supply-Side Influences

Output gaps emerge from shifts in both aggregate demand (AD) and aggregate supply (AS).

Demand-side factors: fluctuations in consumer spending, government expenditure, investment, or net exports.

Supply-side factors: changes in productivity, labour market efficiency, or technological advancements.

A fall in AD relative to AS widens a negative output gap. Conversely, rapid increases in AD without corresponding supply growth trigger positive output gaps and inflation.

Policy Implications of Output Gaps

Managing output gaps is a key priority for governments and central banks.

In a negative output gap:

Expansionary fiscal policy (higher government spending, tax cuts).

Expansionary monetary policy (lower interest rates, quantitative easing).

In a positive output gap:

Deflationary fiscal policy (reduced spending, higher taxes).

Contractionary monetary policy (higher interest rates, reduced money supply).

These interventions aim to stabilise inflation while minimising unemployment.

Unemployment-Inflation Trade-Off

The relationship between output gaps, unemployment, and inflation pressures demonstrates the classic macroeconomic trade-off:

Reducing unemployment often risks higher inflation.

Controlling inflation may increase unemployment.

This trade-off highlights why economic policy must balance objectives carefully, particularly when facing shocks or sustained imbalances.

Shocks and Output Gap Dynamics

External and internal shocks can rapidly alter the size and direction of output gaps:

Demand shocks: sudden changes in consumer confidence, investment, or trade conditions.

Supply shocks: disruptions to energy markets, technological failures, or productivity shifts.

Global shocks: financial crises, pandemics, or geopolitical conflicts affecting trade and growth.

Such shocks complicate policymaking and can intensify either unemployment or inflation pressures.

FAQ

The natural rate of unemployment reflects the level of unemployment that exists when the labour market is in equilibrium, accounting for frictional and structural unemployment.

If unemployment falls below this rate, it suggests a positive output gap, where inflationary pressures rise.

If unemployment rises above this rate, it indicates a negative output gap, usually linked with spare capacity and lower inflation.

Output gaps are not directly measurable, so policymakers rely on economic models and indicators.

Comparing actual GDP to trend or potential GDP.

Monitoring unemployment relative to the natural rate.

Assessing inflation trends in relation to expected capacity pressures.

Using surveys on capacity utilisation in industry.

Each method carries uncertainty, making output gap estimates subject to revision.

Estimating potential output involves forecasting productivity, labour force size, and technological progress. These variables are uncertain and can change unexpectedly.

Measurement errors also occur if GDP data are revised or if inflationary pressures reflect external shocks, such as energy prices, rather than domestic capacity issues.

If a negative output gap is overestimated, governments may overstimulate the economy, leading to unnecessary inflation.

If a positive gap is underestimated, inflationary pressures may spiral before corrective policies are introduced.

Both errors reduce policy effectiveness and can destabilise growth.

Global shocks can quickly widen or narrow output gaps.

A global recession reduces export demand, widening negative output gaps.

A global boom raises export demand, contributing to positive output gaps.

International commodity price changes can alter inflation pressures, affecting the interpretation of domestic output gaps.

This makes external factors vital when analysing national economic cycles.

Practice Questions

Define a positive output gap and explain briefly what it implies about inflationary pressures. (2 marks)

1 mark for correctly defining a positive output gap as actual output exceeding potential output.

1 mark for recognising that it implies rising inflationary pressures due to increased demand and limited spare capacity.

Using the concept of output gaps, explain how a negative output gap can lead to changes in both unemployment and inflation in an economy. (6 marks)

Up to 2 marks for identifying that a negative output gap occurs when actual output is below potential output.

Up to 2 marks for explaining that unemployment tends to rise due to insufficient demand for goods and services, leading firms to reduce hiring or cut jobs.

Up to 2 marks for explaining that inflationary pressures fall, as reduced demand leads to stable or falling prices (disinflationary or deflationary effects).

Maximum 6 marks available; responses must show clear links between the output gap, unemployment, and inflation for full credit.