AQA Specification focus:

‘Students should be able to use macroeconomic models, including the AD/AS model, to analyse the causes of possible conflicts between policy objectives in the short run and long run.’

Introduction

Macroeconomic models provide powerful tools for analysing policy trade-offs. Understanding how objectives interact helps economists predict conflicts, especially using the aggregate demand and supply framework.

Understanding Policy Conflicts through Models

Economic policy objectives include growth, low unemployment, stable inflation, balance of payments stability, and sustainable public finances. These aims often conflict, particularly in the short run. Using macroeconomic models allows us to illustrate these tensions and evaluate policy effectiveness.

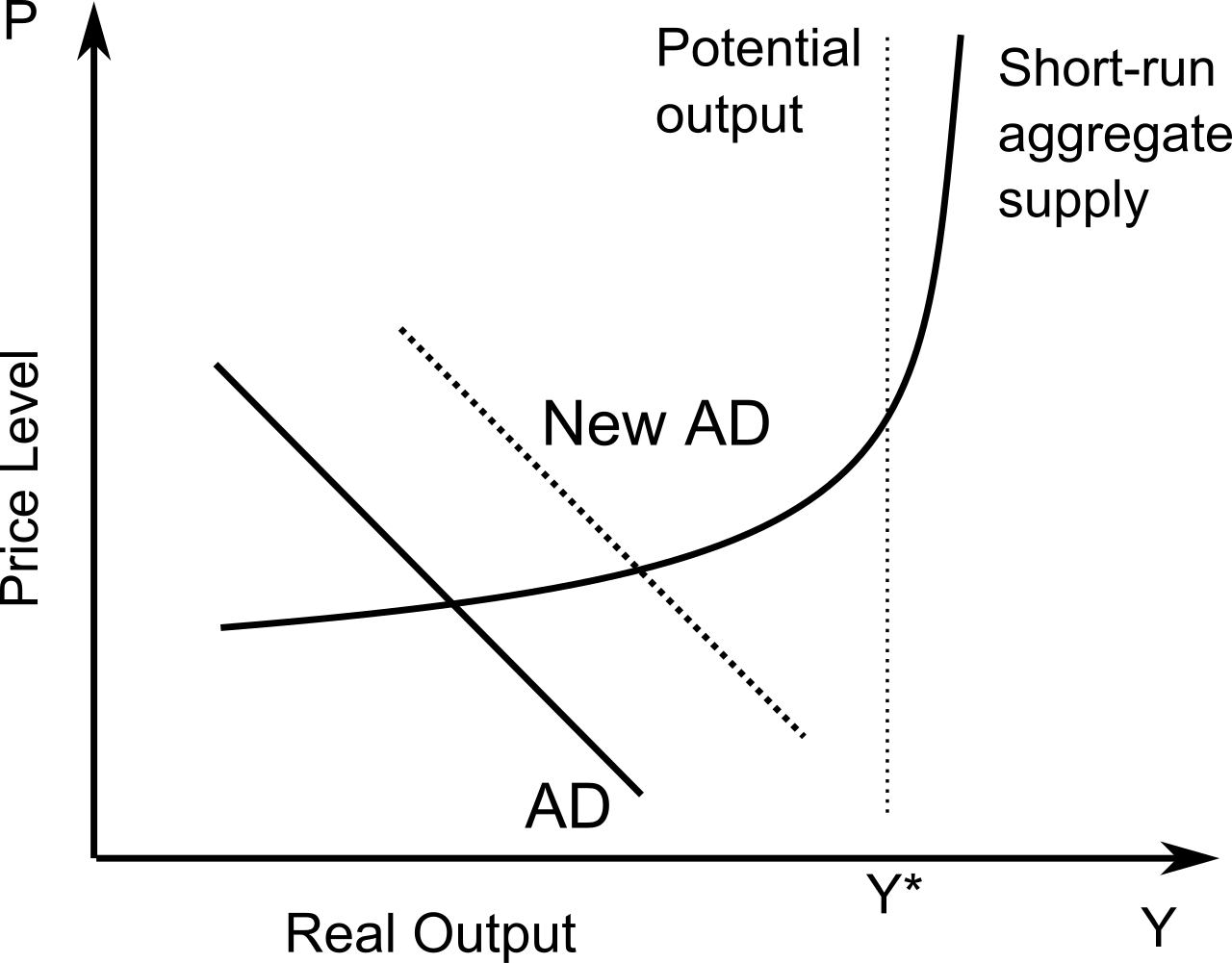

This diagram depicts the intersection of aggregate demand and aggregate supply curves, showing equilibrium output and price levels. It is fundamental for analysing macroeconomic policy conflicts. Source

The AD/AS Model as the Core Analytical Tool

The aggregate demand (AD) and aggregate supply (AS) model is the primary framework for AQA students to analyse conflicts. It captures short-run fluctuations and long-run productive capacity.

Aggregate Demand (AD): The total planned spending on domestic goods and services at different price levels over a given period.

Aggregate Supply (AS): The total planned output of goods and services at different price levels that producers in an economy are willing and able to supply.

The short-run aggregate supply (SRAS) curve is upward-sloping due to sticky wages and costs, while the long-run aggregate supply (LRAS) curve is vertical at the economy’s potential output.

Conflicts Between Growth and Inflation

Policies that stimulate aggregate demand, such as expansionary fiscal or monetary policy, shift AD rightwards. This raises output and employment in the short run but may generate demand-pull inflation if the economy is near capacity.

AD → rightward shift

Real GDP rises

Price level increases

This demonstrates the growth–inflation trade-off, where governments must balance short-term employment gains against rising price pressures.

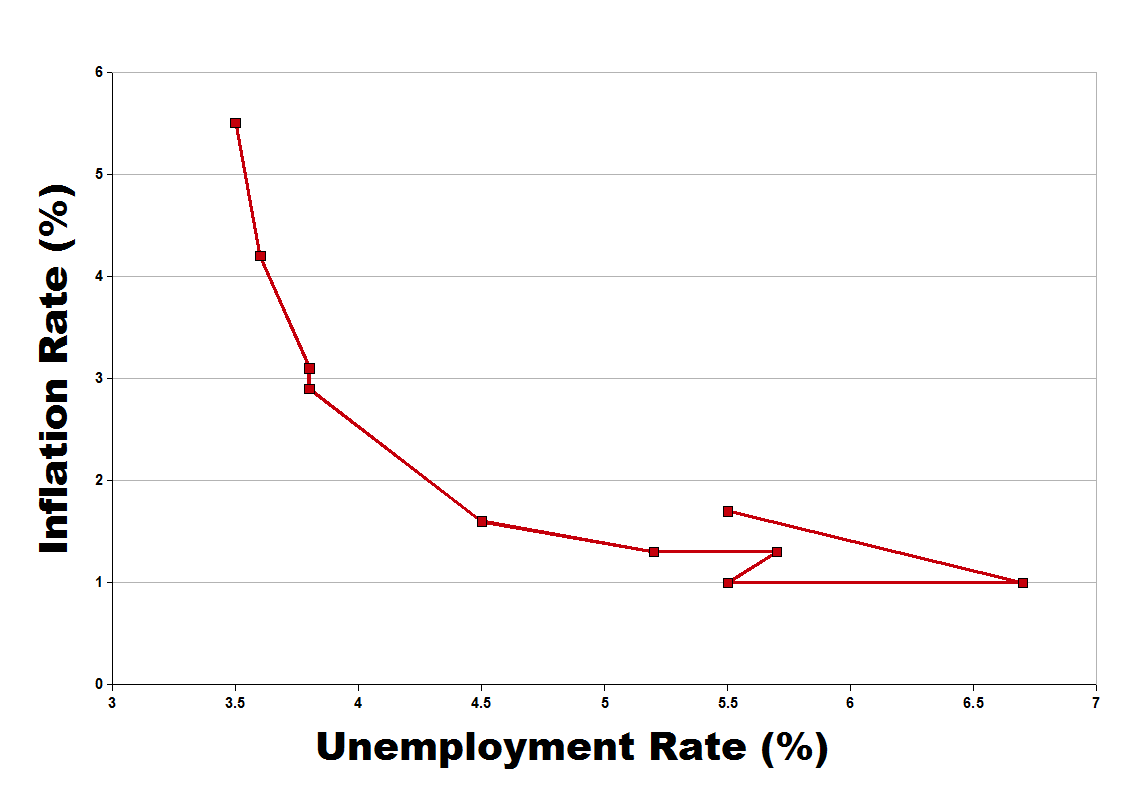

The Phillips curve shows the inverse relationship between inflation and unemployment in the short run, transitioning to a vertical long-run curve at the natural rate of unemployment. Source

Unemployment vs Inflation: The Phillips Curve Link

The AD/AS model connects with the short-run Phillips curve, showing a trade-off between lower unemployment and higher inflation. When AD expands, output rises above potential, reducing unemployment but pushing up inflation. Over time, however, expectations adjust, leading the LRAS to reassert itself, consistent with the long-run vertical Phillips curve.

Output Gaps and Policy Conflicts

Output Gap: The difference between actual output and potential output in an economy.

Positive output gap (actual > potential): leads to overheating, inflationary pressure.

Negative output gap (actual < potential): results in cyclical unemployment and unused capacity.

Managing output gaps often creates tension between stabilising inflation and supporting employment.

The Balance of Payments and Growth

High growth driven by rising AD can worsen the current account of the balance of payments. If domestic consumers demand more imports, trade deficits widen, creating conflict between growth objectives and external stability.

Analysing Conflicts in the Short Run

In the short run, governments may attempt to reduce unemployment by stimulating AD. However, this can trigger:

Inflationary pressures if output nears capacity.

Rising imports, worsening the balance of payments.

Higher public borrowing if fiscal policy is used, conflicting with fiscal sustainability.

Thus, while AD policies improve employment, they may undermine price stability and external balance.

Analysing Conflicts in the Long Run

In the long run, the LRAS curve represents the economy’s productive capacity. Supply-side policies aim to shift LRAS rightwards, achieving growth without inflationary pressure. However, these may conflict with short-term goals:

Labour market reforms may reduce unemployment in the long run but initially create job losses.

Investment in education and infrastructure requires higher government spending or taxation, conflicting with budget balance in the short run.

Environmental sustainability policies may constrain short-run growth but secure long-run stability.

Monetary vs Fiscal Policy Tensions

Expansionary fiscal policy increases AD but risks crowding out private investment if interest rates rise.

Monetary tightening to control inflation may suppress growth and increase unemployment, directly clashing with employment objectives.

These tensions are clearly illustrated through AD/AS shifts and the economy’s movement around its potential output.

Using Models to Reconcile Conflicts

Economists use AD/AS models to demonstrate possible strategies for reducing conflict:

Staggered policies: Demand-side stimulus in recession, followed by supply-side reform for sustainable growth.

Target ranges: Inflation targeting provides a framework to prioritise stability while allowing flexibility for output fluctuations.

Balanced approaches: Coordinating fiscal and monetary policy to align with long-run growth potential.

Such analysis helps policymakers weigh trade-offs and design credible strategies.

FAQ

The AD/AS model shows how shifts in demand or supply affect both output and the price level. This helps policymakers anticipate inflationary pressures or unemployment risks.

By analysing potential output gaps, they can predict unintended consequences such as rising imports, wage pressures, or unsustainable borrowing when stimulating growth.

The LRAS curve is vertical because, in the long run, output is determined by productive capacity rather than price levels.

This means changes in AD cannot permanently increase output above full capacity. Instead, attempts to push output higher simply create higher inflation.

Expectations influence wage-setting, investment, and inflationary behaviour. If workers expect higher inflation, they may demand higher wages, shifting SRAS leftwards.

This can worsen conflicts, as expansionary policies intended to boost employment might instead fuel inflation without long-term gains in output.

Supply-side policies shift LRAS rightwards, allowing sustainable growth without inflationary pressure.

Examples include:

Improving education and skills.

Investing in infrastructure.

Encouraging technological innovation.

These policies reduce conflicts by increasing productive capacity, unlike short-term demand-side measures.

When governments use expansionary fiscal policy, higher public spending can raise interest rates.

This reduces private sector borrowing and investment, shifting AD less than expected. The AD/AS model shows how intended employment gains may be offset by reduced private demand, creating conflict between short-term and long-term growth objectives.

Practice Questions

Using the AD/AS model, explain what is meant by a positive output gap. (2 marks)

1 mark for identifying that actual output is above potential output.

1 mark for explaining that this creates inflationary pressure or overheating in the economy.

Using the AD/AS model, analyse how attempts to reduce unemployment in the short run may create conflicts with other macroeconomic policy objectives. (6 marks)

1 mark for identifying that policies to reduce unemployment increase aggregate demand (AD).

1 mark for recognising that this shifts the AD curve rightwards.

1 mark for explaining that output increases, reducing cyclical unemployment.

1 mark for recognising that higher demand may cause demand-pull inflation.

1 mark for explaining that growth can worsen the current account balance due to increased imports.

1 mark for noting that expansionary policies may increase government borrowing, creating conflict with fiscal sustainability.