AQA Specification focus:

‘They should be able to discuss approaches to reconciling these conflicts and the monetarist/supply-side view that the major macroeconomic objectives are compatible in the long run.’

In macroeconomics, policymakers often face tensions between growth, inflation, employment, and external stability. Monetarist and supply-side perspectives argue these goals can align over time.

The Monetarist and Supply-Side Perspective

Monetarists and supply-side economists maintain that although short-run conflicts exist between macroeconomic objectives, in the long run these conflicts diminish. They argue that market mechanisms, stable monetary policy, and structural reforms allow the economy to achieve non-inflationary growth, low unemployment, and stable prices simultaneously.

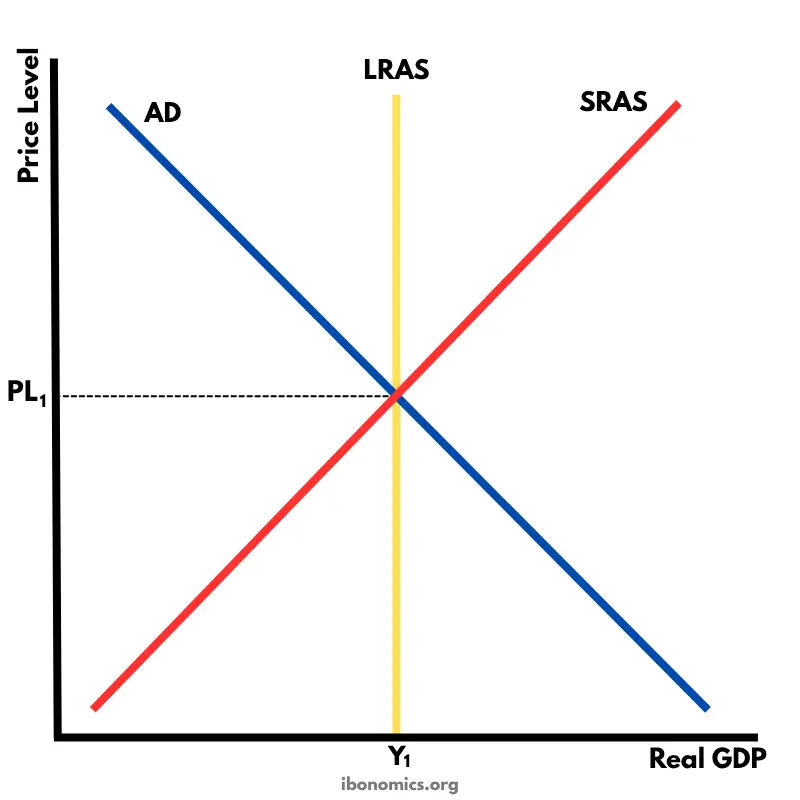

The Classical AD–SRAS–LRAS diagram demonstrates the monetarist perspective that, in the long run, the economy operates at full employment output (Y1), where the LRAS curve is vertical. Shifts in AD or SRAS affect the price level but not real output. Source

Key Principles of Monetarism

Monetarism emphasises the importance of controlling the money supply to maintain price stability. Monetarists believe that inflation is primarily caused by excessive monetary growth.

Monetarism: An economic school of thought which argues that controlling the supply of money is the most effective way to regulate economic activity and achieve stability.

In this view, if monetary growth is controlled, inflationary pressures subside, creating conditions in which other objectives can be pursued without conflict.

Supply-Side Economics

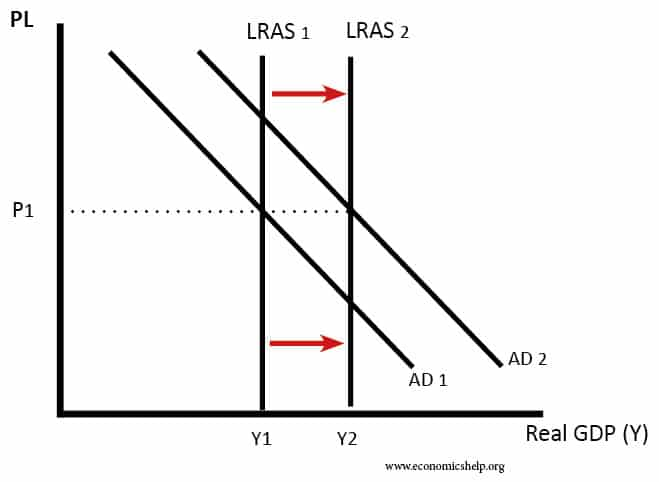

Supply-side policies focus on enhancing the productive capacity of the economy through measures such as deregulation, tax incentives, labour market reforms, and investment in human capital. These aim to shift the long-run aggregate supply (LRAS) to the right.

The diagram illustrates how effective supply-side policies can shift the LRAS curve outward, representing an increase in the economy’s full employment level of output. This shift enables the economy to accommodate higher levels of aggregate demand without increasing the price level. Source

Supply-side policies: Measures intended to improve the efficiency, productivity, and flexibility of the economy, thereby increasing its potential output.

By increasing LRAS, the economy can grow without generating inflationary pressure, making sustainable growth compatible with stable prices.

Reconciling Policy Conflicts in the Long Run

Growth and Inflation

In the short run, faster growth often leads to inflation as demand outpaces capacity. However, the monetarist/supply-side view argues that long-run growth comes from improvements in productivity, technology, and efficiency. Since LRAS expands, real output rises without persistent inflation.

Unemployment and Inflation

Monetarists reject the idea of a permanent trade-off between unemployment and inflation, as suggested by the short-run Phillips curve. Instead, they argue that in the long run the economy settles at the natural rate of unemployment (sometimes referred to as the non-accelerating inflation rate of unemployment, NAIRU).

Natural rate of unemployment: The level of unemployment consistent with stable inflation, where labour markets are in equilibrium and there is no cyclical unemployment.

This implies that attempts to reduce unemployment below its natural rate will only fuel inflation. Hence, monetary stability and supply-side reforms are the sustainable route to low unemployment.

Balance of Payments Stability

By improving competitiveness through supply-side measures, such as innovation and productivity growth, economies can increase exports and reduce reliance on imports. This supports a more balanced external position, aligning growth and external stability.

Policy Tools Supporting Compatibility

To achieve long-run compatibility, the following policies are emphasised:

Monetary discipline: Central banks controlling money supply growth to keep inflation low.

Labour market reforms: Reducing rigidities to improve efficiency and match workers to jobs.

Tax reform: Incentivising investment and work by lowering distortionary taxes.

Education and training: Enhancing human capital to increase productivity.

Competition policies: Encouraging innovation and efficiency in markets.

Infrastructure investment: Supporting long-term capacity expansion.

These measures raise potential output, reduce structural unemployment, and enable sustainable, non-inflationary growth.

The Monetarist/Supply-Side Model of Compatibility

The model assumes that:

Inflation is a monetary phenomenon controlled through disciplined monetary policy.

Unemployment cannot be reduced below the natural rate without triggering inflation.

Supply-side reforms shift LRAS, allowing growth without inflationary pressure.

Over time, all major macroeconomic objectives—growth, low unemployment, low inflation, and external stability—are compatible.

Critiques of the Approach

While influential, the monetarist/supply-side perspective faces criticism:

Time lags: Supply-side policies may take decades to impact productivity.

Equity concerns: Deregulation and labour market reforms can increase inequality.

Overemphasis on money supply: Critics argue inflation is influenced by multiple factors, not just monetary growth.

Rigid assumptions: The natural rate of unemployment may not be stable and can vary over time.

Despite these criticisms, the AQA specification requires students to appreciate the core belief that long-run compatibility is achievable under this framework.

FAQ

Monetarists believe that although conflicts may exist in the short run, in the long run, the economy returns to its natural equilibrium.

By controlling the money supply, inflation stabilises. Combined with supply-side improvements, this allows output, employment, and external stability to be achieved simultaneously without trade-offs.

Supply-side reforms expand the economy’s productive capacity, shifting LRAS to the right.

This ensures that increases in aggregate demand do not immediately translate into higher prices. Instead, real output grows, creating conditions for non-inflationary growth.

The natural rate is not fixed; it can be influenced by labour market flexibility, demographic shifts, and education standards.

If structural conditions improve, the natural rate can fall, making objectives even more compatible. Conversely, rigidities or technological changes may raise it.

Monetarists argue that independent central banks can credibly commit to low inflation targets.

This avoids political pressures for excessive stimulus and maintains confidence in long-run price stability.

While supply-side policies increase long-term growth, they face limitations:

They take many years to deliver results.

Some reforms may increase inequality, e.g. weakening labour protections.

High investment costs in education or infrastructure can strain government budgets.

Practice Questions

Explain why monetarists argue that inflation is primarily a monetary phenomenon. (3 marks)

1 mark: Reference to inflation being linked to excessive growth in the money supply.

1 mark: Explanation that if money supply grows faster than real output, prices rise.

1 mark: Recognition that controlling monetary growth is central to achieving price stability.

Discuss how supply-side policies can help reconcile economic growth with low inflation in the long run. (6 marks)

1 mark: Identification that supply-side policies increase the productive capacity of the economy (shift LRAS to the right).

1 mark: Reference to specific supply-side policies (e.g. education and training, deregulation, tax incentives, infrastructure investment).

1 mark: Explanation that a rightward shift in LRAS allows higher output without upward pressure on prices.

1 mark: Reference to compatibility of objectives (sustained growth with price stability).

1 mark: Understanding that policies reduce structural unemployment, aiding growth and stability.

1 mark: Balanced point/criticism such as long time lags, uneven effectiveness, or equity concerns.