AQA Specification focus:

‘How economic policies may be used to try to reconcile possible policy conflicts both in the short run and the long run.’

Economic policymakers often face tensions between stabilising the economy in the short run and securing sustainable growth in the long run. Reconciling these conflicts requires careful strategy.

Understanding Policy Conflicts

Short-run vs Long-run Focus

Short-run policies, such as fiscal stimulus or monetary easing, aim to stabilise output and employment during downturns. Long-run policies, often supply-side reforms, target improvements in productivity and growth potential.

Short-run objective: Reduce cyclical unemployment and stabilise inflation.

Long-run objective: Achieve sustainable growth and maintain stable prices.

Conflicts arise because what stabilises the economy in the short term may generate long-term imbalances. For example, expansionary fiscal policy boosts demand but risks structural deficits if used persistently.

Key Conflicts in the Short and Long Run

Inflation vs Unemployment

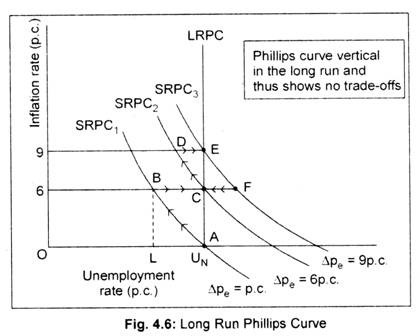

The Phillips curve suggests a trade-off between inflation and unemployment in the short run. Reducing unemployment through demand stimulation may fuel higher inflation.

In the long run, this trade-off disappears as the long-run aggregate supply (LRAS) determines the natural rate of unemployment. Sustained expansionary policy merely raises inflation expectations without reducing unemployment.

This diagram illustrates the long-run Phillips curve (LRPC) as a vertical line at the natural rate of unemployment (NAIRU). It shows that in the long run, there is no trade-off between inflation and unemployment. Source

Natural Rate of Unemployment: The level of unemployment consistent with stable inflation, reflecting structural features of the economy rather than demand fluctuations.

Growth vs Inflation Control

Policies that stimulate growth through increased demand may clash with price stability. For instance:

Expansionary fiscal policy (higher government spending) boosts GDP growth but risks demand-pull inflation.

Tight monetary policy reduces inflation but may slow investment and growth.

Balancing these aims is central to macroeconomic policymaking.

Strategies to Reconcile Conflicts

Supply-side Policies

Supply-side reforms help shift the LRAS curve to the right, reducing inflationary pressures while sustaining growth. Examples include:

Investment in infrastructure.

Reforms to education and training.

Incentives for innovation and productivity growth.

These measures allow policymakers to expand output without fuelling inflation, bridging short- and long-term objectives.

Monetary and Fiscal Coordination

Coordinating policies ensures that short-run stabilisation does not undermine long-run stability.

Monetary policy can target inflation through interest rates.

Fiscal policy can focus on structural investment while maintaining debt sustainability.

Policy mix helps avoid excessive reliance on one instrument.

Rules vs Discretion

Another approach involves balancing policy rules (such as inflation targeting) with discretionary measures to address shocks.

Inflation Targeting: A monetary policy framework where the central bank commits to keeping inflation within a set band, enhancing credibility and long-run stability.

Discretion is useful during unexpected recessions, but strict adherence to rules can anchor expectations, limiting long-term instability.

External and Global Considerations

Exchange Rates and Trade Balances

Policymakers may also face conflicts between domestic stabilisation and external objectives:

Expansionary policy can worsen the current account deficit.

Tight policies may stabilise prices but reduce competitiveness abroad.

Reconciling these requires structural improvements in export performance rather than relying solely on short-term demand management.

Debt and Fiscal Sustainability

Short-run borrowing to stimulate demand can create long-term debt burdens. Rising debt-to-GDP ratios may limit fiscal flexibility and undermine confidence.

To reconcile this, governments often pursue countercyclical fiscal policies:

Deficits during recessions to support demand.

Surpluses during booms to reduce debt.

This allows both stabilisation and sustainability.

Policy Examples of Reconciliation

Short-run Stabilisation with Long-run Vision

Expansionary spending on infrastructure projects creates jobs now while boosting productivity later.

Education reforms expand human capital, reducing unemployment cyclically while raising the trend growth rate.

Green investment policies stimulate demand today and ensure environmental sustainability in the long term.

Monetary Policy Anchors

Central banks raise rates to cool inflation but signal gradual adjustments to avoid damaging growth.

Clear communication of forward guidance reduces uncertainty, balancing short-run expectations with long-term credibility.

Role of Expectations

Expectations are crucial in reconciling short- and long-run objectives. If households and firms trust that inflation will remain stable, policymakers can stimulate demand without triggering runaway prices.

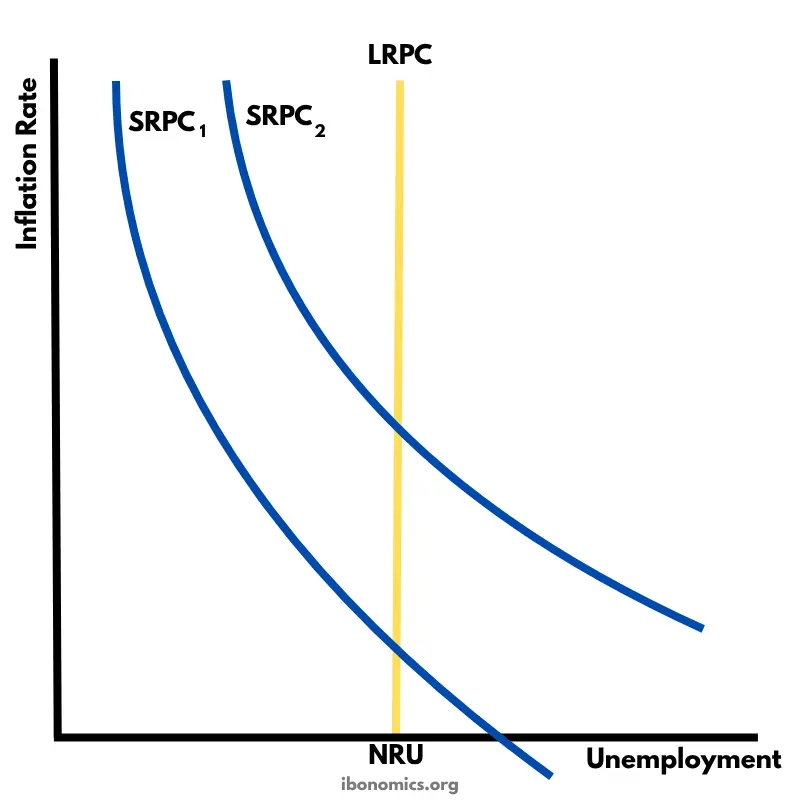

This diagram shows shifts in the short-run Phillips curve (SRPC) caused by rising or falling inflation expectations. It highlights how anticipated inflation alters the inflation–unemployment relationship in the short run. Source

Rational Expectations: The idea that economic agents use all available information to predict future variables, limiting the effectiveness of systematic policy manipulation.

Anchored expectations reduce the conflict between short-term growth and long-term stability.

Conclusion of Reconciliation Approaches

Although conflicts between short-run and long-run macroeconomic objectives are inevitable, a combination of supply-side reforms, policy coordination, and expectation management enables policymakers to reduce trade-offs. By carefully designing strategies, governments and central banks can achieve stabilisation today without undermining sustainable growth tomorrow.

FAQ

Short-run policies such as expansionary fiscal spending or sharp interest rate cuts can stabilise output and employment during recessions.

However, if maintained for too long, these may:

Create structural budget deficits.

Increase public debt levels.

Fuel higher inflation expectations.

This can make it harder to sustain long-term growth without major corrections.

Fiscal sustainability ensures governments can meet long-term spending commitments without excessive borrowing.

If governments rely too heavily on short-run fiscal stimulus, debt servicing costs may rise, reducing funds available for productive investment. This can crowd out future growth opportunities and erode confidence in economic policy.

If households and firms believe inflation will rise, they demand higher wages and adjust prices accordingly. This reduces the effectiveness of short-run stimulus policies.

Anchored expectations allow policymakers to expand demand without creating runaway inflation. Managing expectations through credible central bank targets is therefore key to balancing short- and long-run goals.

Investment in education and training has both short-run and long-run benefits.

Short run: Increases employment by creating jobs in training and education sectors.

Long run: Enhances productivity and shifts the LRAS curve outward, allowing higher growth without inflationary pressure.

Such policies reduce the trade-off between stabilisation and sustainability.

Countercyclical policy means governments act against the economic cycle.

During recessions: Increase spending or cut taxes to boost demand.

During booms: Reduce spending or raise taxes to cool the economy.

This approach ensures stability in the short run while preserving fiscal space and debt sustainability for the long run.

Practice Questions

Explain what is meant by a conflict between short-run and long-run macroeconomic policy objectives. (2 marks)

1 mark for identifying a short-run objective (e.g. reducing unemployment or stimulating growth).

1 mark for identifying a long-run objective that may conflict (e.g. maintaining low inflation or fiscal sustainability).

(Max 2 marks)

Discuss how supply-side policies can help reconcile short-run and long-run conflicts in macroeconomic objectives. (6 marks)

1–2 marks: Basic definition or description of supply-side policies (e.g. policies that increase productive capacity/LRAS).

1–2 marks: Explanation of how supply-side policies impact the short run (e.g. can create immediate employment or demand stimulus if government invests in infrastructure).

1–2 marks: Explanation of how they benefit the long run (e.g. higher productivity, sustainable growth without inflationary pressure).

Up to 1 mark for use of relevant terminology (e.g. LRAS, trend growth).

Up to 1 mark for analysis of reconciliation (e.g. policies allow output to rise while limiting inflationary pressure).

(Max 6 marks)