AQA Specification focus:

‘The L-shaped Phillips curve is also known as the vertical long-run Phillips curve.’

Introduction

The long-run Phillips curve (LRPC) illustrates the absence of a long-term trade-off between inflation and unemployment, shaping how economists and policymakers understand macroeconomic stability.

Understanding the Long-Run Phillips Curve

The Concept of the L-Shaped Curve

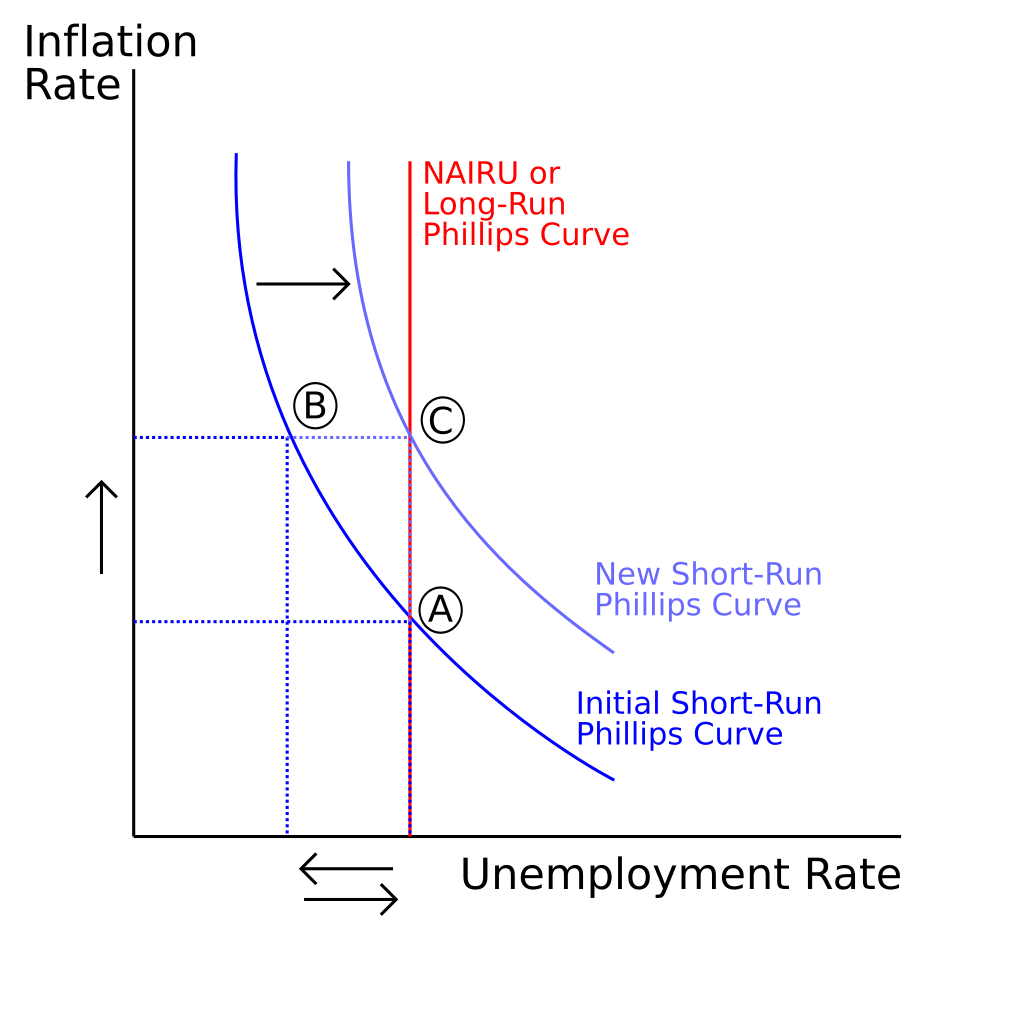

The Phillips curve initially suggested an inverse relationship between inflation and unemployment in the short run. However, in the long run, economists argue this relationship breaks down. The long-run Phillips curve is often described as L-shaped or vertical, emphasising that there is no permanent trade-off between inflation and unemployment once inflationary expectations have adjusted.

Long-Run Phillips Curve (LRPC): A vertical line showing that in the long run, unemployment returns to its natural rate regardless of the inflation rate.

This means attempts to reduce unemployment below the natural rate of unemployment (NRU) by stimulating demand only lead to higher inflation, not lower unemployment in the long run.

The Natural Rate of Unemployment

Importance in the LRPC

At the heart of the LRPC is the natural rate of unemployment. This rate reflects structural and frictional factors in the labour market, which cannot be eliminated through demand-side policy.

Natural Rate of Unemployment (NRU): The lowest sustainable unemployment rate in the long run, accounting for frictional, seasonal, and structural unemployment but excluding cyclical unemployment.

The vertical nature of the LRPC shows that this rate of unemployment remains constant regardless of inflation, provided that expectations are fully adjusted.

This diagram contrasts the short-run Phillips curve (SRPC) with the long-run Phillips curve (LRPC), demonstrating that in the long run, the economy returns to the natural rate of unemployment (NAIRU), regardless of the inflation rate. Source

Expectations and Inflation in the Long Run

Adaptive and Rational Expectations

The role of expectations is critical in explaining the shift from the short-run Phillips curve to the long-run.

Adaptive expectations suggest workers and firms adjust their behaviour gradually in response to past inflation, leading to short-run trade-offs.

Rational expectations assume economic agents anticipate policy effects immediately, limiting even short-run trade-offs.

The alignment of inflation expectations with actual inflation ultimately ensures that unemployment returns to the NRU, leaving the long-run Phillips curve vertical.

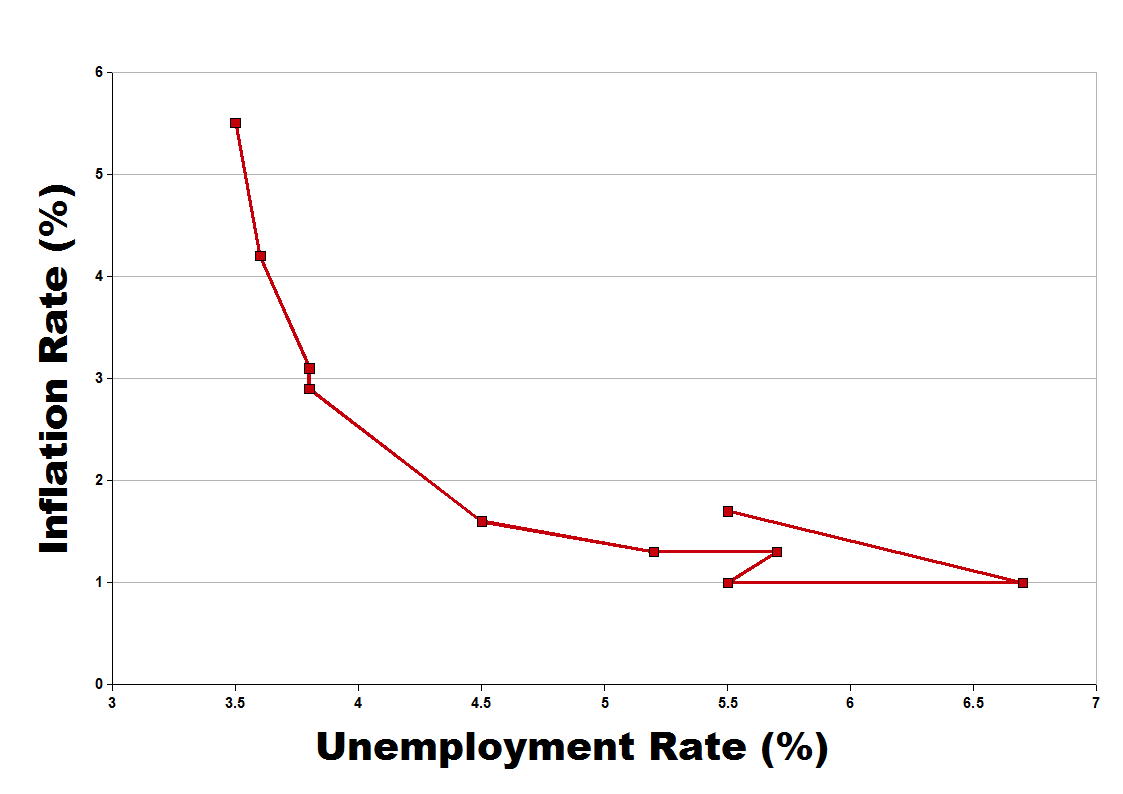

This chart from the 1960s depicts the inverse relationship between inflation and unemployment, reflecting the short-run Phillips curve. It serves as a historical reference point before the recognition of the long-run vertical Phillips curve. Source

Policy Implications of the LRPC

Limits of Demand-Side Policies

Policymakers face clear restrictions:

Attempts to use demand-side policies (such as fiscal or monetary expansion) to reduce unemployment below the NRU only generate higher inflation in the long term.

The economy self-corrects as expectations adjust, forcing unemployment back to the NRU while inflation stabilises at a higher level.

Supply-Side Importance

The LRPC highlights the importance of supply-side policies to influence the natural rate of unemployment. By addressing structural rigidities, training gaps, or labour market inefficiencies, governments may shift the NRU lower, thereby improving long-term employment outcomes without triggering inflation.

The Shape and Position of the Curve

Why Vertical?

The L-shaped or vertical representation emphasises:

Inflation and unemployment are unrelated in the long run.

Unemployment gravitates towards the NRU, unaffected by persistent demand changes.

Shifts in the Curve

Although the LRPC is vertical, its position can change if the NRU changes. Influences include:

Labour market flexibility: Greater flexibility reduces structural unemployment, shifting the LRPC left.

Education and training: Better skills lower structural mismatches.

Globalisation and technology: These can both create and reduce structural unemployment, altering the natural rate.

Comparing Short-Run and Long-Run Phillips Curves

Short-Run Phillips Curve (SRPC)

Downward sloping, showing a temporary trade-off between inflation and unemployment.

Arises due to sticky wages and imperfect adjustment of expectations.

Long-Run Phillips Curve (LRPC)

Vertical at the NRU.

Shows that inflation does not reduce unemployment once expectations adjust.

Short-Run Phillips Curve (SRPC): A downward sloping curve showing a temporary inverse relationship between inflation and unemployment due to unadjusted expectations.

Unlike the SRPC, the LRPC illustrates that long-run unemployment depends only on supply-side factors, not inflation.

Cyclical Instability and Phillips Curve Limitations

Critiques of the LRPC

While widely accepted, some economists question whether the LRPC is always perfectly vertical:

Hysteresis: Prolonged high unemployment can increase the NRU by eroding skills, suggesting the LRPC may shift outward after recessions.

Behavioural economics: Psychological and institutional factors can make adjustment slower or less predictable than theory suggests.

Despite these criticisms, the AQA specification emphasises the L-shaped, vertical curve to reinforce the orthodox view that inflation and unemployment are unrelated in the long run.

Key Points for Students

The long-run Phillips curve is vertical at the natural rate of unemployment.

There is no trade-off between inflation and unemployment in the long run.

Demand-side policies cannot permanently reduce unemployment below the NRU.

Supply-side reforms are the only way to shift the long-run curve and improve long-term employment outcomes.

Expectations play a crucial role in the transition from short-run trade-offs to the long-run vertical curve.

FAQ

It is vertical because in the long run unemployment always gravitates back to the natural rate of unemployment (NRU) or Non-Accelerating Inflation Rate of Unemployment (NAIRU).

This point reflects the lowest sustainable unemployment level consistent with stable inflation. Attempts to move below this rate only accelerate inflation without reducing unemployment.

Hysteresis suggests that prolonged high unemployment can push the natural rate upwards.

Workers may lose skills if unemployed for long periods.

Employers may become reluctant to hire those with long unemployment gaps.

This can mean the curve shifts rightwards, indicating a permanently higher NRU after a recession.

Some argue expectations may not adjust fully or immediately, meaning a limited trade-off could persist even in the long run.

Others highlight that institutional and behavioural factors, such as wage bargaining, can create imperfections.

As a result, while many models show a vertical line, in practice the curve may have a slight slope.

Inflation expectations ensure the curve’s verticality.

If workers and firms anticipate higher inflation, they demand higher wages and set higher prices.

This erodes the short-term employment gains from expansionary policies.

Once expectations match reality, unemployment stabilises at the NRU.

Governments cannot alter the vertical nature but can influence its position by reducing the NRU.

Effective measures include:

Investing in education and training to reduce structural unemployment.

Encouraging labour market flexibility, e.g., reforming employment laws.

Supporting mobility programmes to match workers with jobs.

These supply-side reforms reduce mismatches, shifting the LRPC left.

Practice Questions

Explain why the long-run Phillips curve is shown as vertical. (2 marks)

1 mark for stating that unemployment always returns to the natural rate of unemployment (NRU) in the long run.

1 mark for recognising that inflation has no long-term effect on unemployment once expectations adjust.

Discuss why supply-side policies, rather than demand-side policies, are considered more effective in reducing the natural rate of unemployment in the long run. (6 marks)

1 mark for identifying that demand-side policies can only reduce unemployment temporarily.

1 mark for stating that attempts to push unemployment below the NRU lead to higher inflation.

Up to 2 marks for explaining that supply-side policies (e.g., improving education/training, labour market flexibility) can lower structural or frictional unemployment.

Up to 2 marks for analysis of how this shifts the long-run Phillips curve leftwards, enabling a lower NRU without causing inflation.

Evaluation (optional but creditworthy): up to 1 mark for noting time lags, costs, or uncertainty in effectiveness of supply-side policies.

Total: 6 marks.