AQA Specification focus:

‘The implications of the short-run Phillips curve and the long-run, L-shaped Phillips curve for economic policy.’

Economic policymakers often rely on the Phillips curve framework to understand the relationship between unemployment and inflation. The short-run and long-run versions carry very different policy implications.

The Short-Run Phillips Curve and Policy Choices

The short-run Phillips curve (SRPC) shows an inverse relationship between unemployment and inflation: lower unemployment tends to coincide with higher inflation, and vice versa.

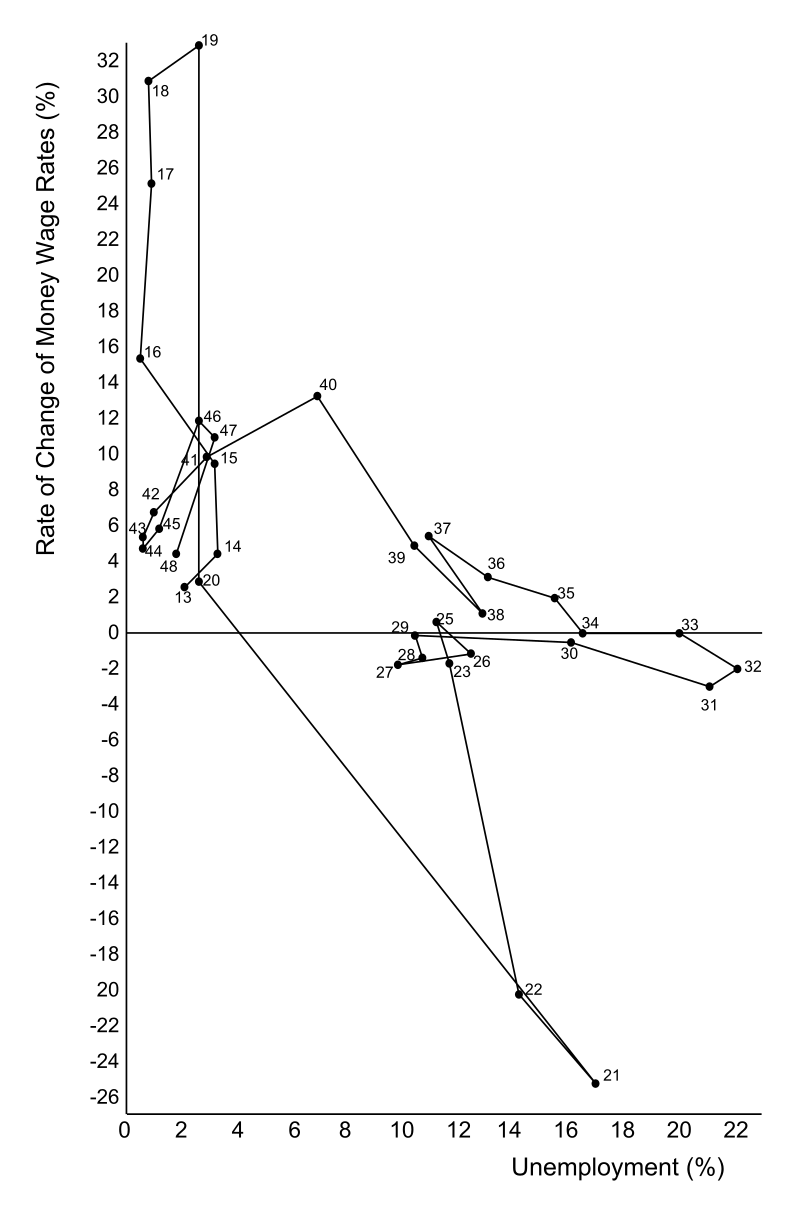

This diagram contrasts the short-run Phillips curve (SRPC), which slopes downward, with the long-run Phillips curve (LRPC), which is vertical at the natural rate of unemployment. It highlights the temporary trade-off between inflation and unemployment in the short run and the absence of such a trade-off in the long run. Source

Policy Trade-offs

Governments and central banks can use demand-management policies to move along the SRPC:

Expansionary policy (higher government spending, lower taxes, or looser monetary policy) reduces unemployment but risks rising inflation.

Contractionary policy (higher interest rates, reduced spending, or higher taxes) lowers inflation but risks rising unemployment.

This trade-off gives policymakers apparent control over short-term economic outcomes. However, such a relationship is not stable over time.

Short-run Phillips Curve: The downward-sloping relationship between inflation and unemployment, suggesting a temporary trade-off between the two variables.

Policies based on the SRPC may deliver temporary results but can create long-term instability if inflation expectations change.

The Long-Run Phillips Curve and Policy Ineffectiveness

The long-run Phillips curve (LRPC) is vertical (L-shaped in some AQA diagrams), reflecting that in the long run there is no trade-off between unemployment and inflation.

Implications for Long-run Policy

Attempts to maintain unemployment below the natural rate of unemployment (also known as the NAIRU — non-accelerating inflation rate of unemployment) will only cause accelerating inflation.

Monetary and fiscal policy cannot permanently lower unemployment below the natural rate.

Sustainable growth in output and employment requires supply-side policies, not demand stimulation.

Natural Rate of Unemployment (NAIRU): The unemployment rate consistent with stable inflation in the long run.

This perspective suggests that demand-management policies are ineffective for influencing unemployment in the long run.

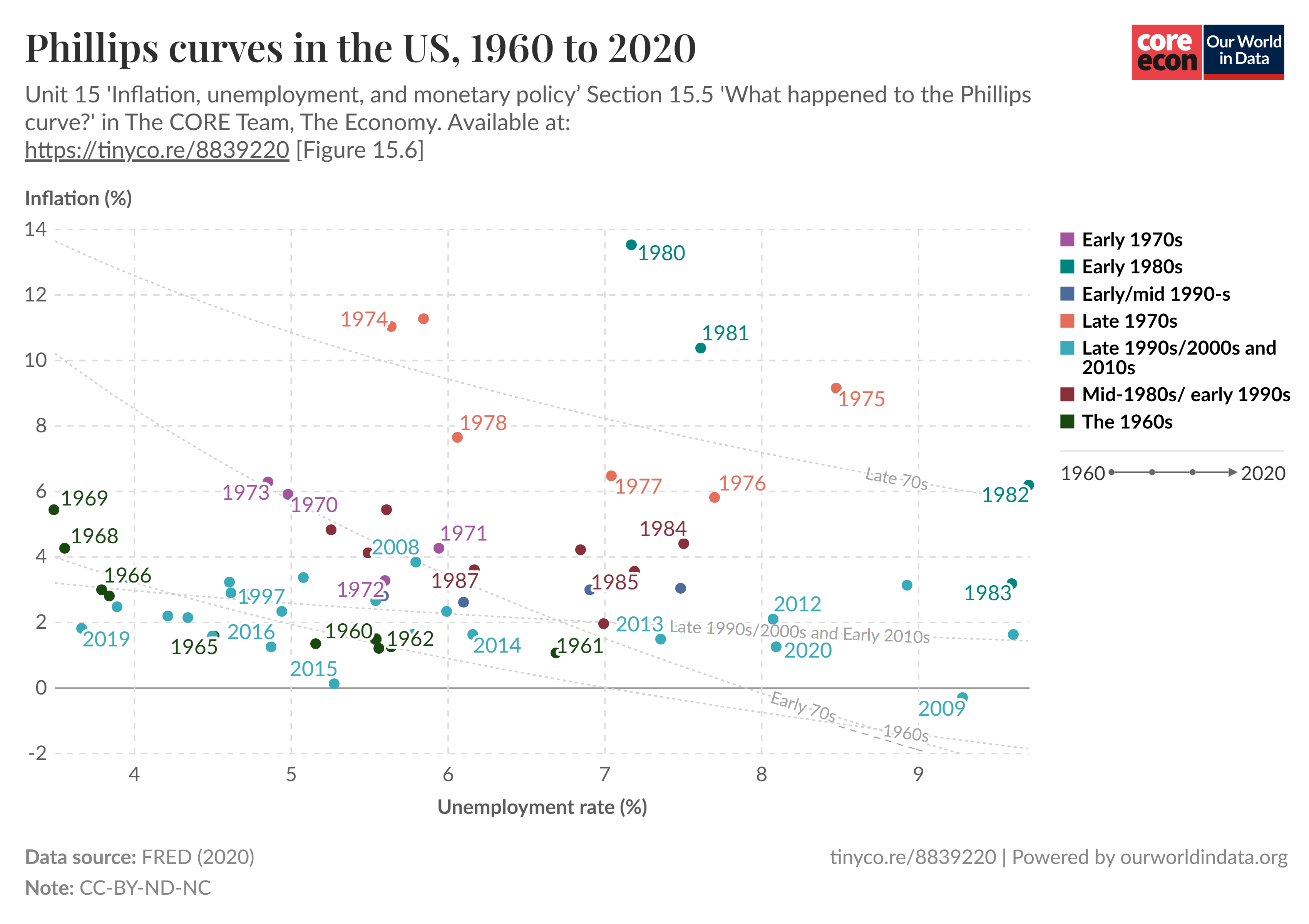

This chart displays the observed relationship between unemployment and inflation in the United States from 2000 to 2013, illustrating the complexities and variations in the Phillips curve over time. It provides empirical evidence of the trade-off between unemployment and inflation and the challenges in applying the Phillips curve to real-world policy. Source

Role of Expectations in Policy Implications

Expectations play a crucial role in shifting Phillips curves:

If workers and firms anticipate higher inflation, they will adjust wages and prices upwards, shifting the SRPC outward.

This means that expansionary policies only produce higher inflation, not lower unemployment, in the long run.

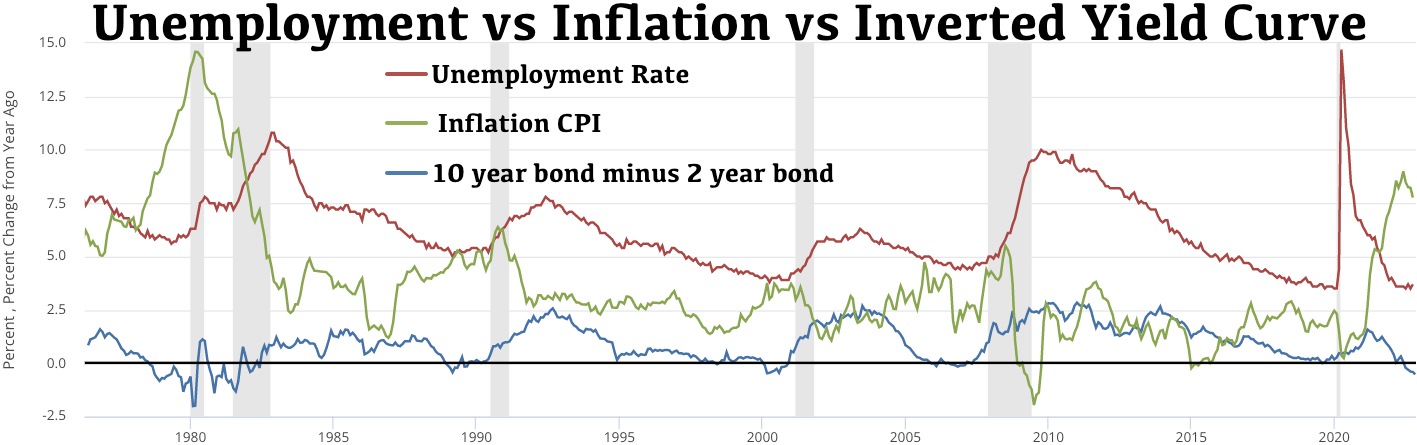

This diagram illustrates how an increase in expected inflation shifts the short-run Phillips curve upward, leading to higher inflation at each level of unemployment. It emphasizes the role of inflation expectations in influencing the short-run trade-off between inflation and unemployment. Source

Policy Considerations

Policymakers must account for adaptive or rational expectations.

Repeated use of demand-management leads to inflationary spirals without reducing unemployment.

Central banks often adopt inflation targets to anchor expectations and maintain credibility.

Policy Strategies Derived from Phillips Curve Analysis

Demand-Side Policies

Effective in the short run for stabilising the economy during recessions or booms.

Risky if used repeatedly, as they can fuel inflation without long-term unemployment gains.

Supply-Side Policies

Aim to lower the natural rate of unemployment by improving labour market flexibility, education, and training.

Encourage productivity growth and shift the long-run aggregate supply (LRAS) outward, allowing growth without inflationary pressure.

Inflation Control

Independent central banks often prioritise price stability, recognising the LRPC’s verticality.

Monetary policy rules, such as inflation targeting, are designed to prevent governments from exploiting the short-run trade-off.

Key Implications Summarised for Policymakers

In the short run, governments face a trade-off between inflation and unemployment, allowing some choice between stabilisation goals.

In the long run, unemployment gravitates to the natural rate, meaning policymakers cannot permanently manipulate it through demand.

Overuse of demand management risks stagflation (high unemployment and high inflation simultaneously), as experienced in the 1970s.

Long-term stability depends on credibility, expectations management, and structural reforms rather than cyclical demand policies.

Main Takeaways for Economic Policy

Short-run: Demand-side policies can reduce unemployment temporarily, but only at the cost of higher inflation.

Long-run: Inflation expectations erode the trade-off; unemployment remains at the natural rate.

Effective policy mix: Prioritise inflation control and employ supply-side reforms to improve labour market outcomes.

FAQ

Stagflation in the 1970s challenged the idea of a stable trade-off between unemployment and inflation suggested by the short-run Phillips curve. Economies experienced both high unemployment and high inflation simultaneously, which could not be explained by the original model.

This led economists to focus on the importance of expectations and the concept of the natural rate of unemployment, reinforcing the long-run Phillips curve as vertical.

The NAIRU limits how far policymakers can push unemployment down without causing rising inflation.

If unemployment is above the NAIRU, expansionary policies may reduce unemployment without fuelling inflation.

If unemployment is already at or below the NAIRU, further demand stimulation only drives inflation upwards, without sustainable job gains.

Governments therefore consider NAIRU when setting long-term policy targets.

Independent central banks can resist political pressure to exploit the short-run trade-off between unemployment and inflation.

By maintaining credibility, they anchor inflation expectations. This prevents the repeated outward shifting of the short-run Phillips curve, which occurs when workers and firms anticipate continual inflation.

Independence supports long-term price stability, aligning policy with the vertical long-run Phillips curve.

The expectations-augmented Phillips curve incorporates the effect of inflation expectations.

The original model assumed a stable trade-off.

The augmented version shows that if inflation expectations rise, the short-run Phillips curve shifts upward.

This means unemployment will always return to the natural rate, but at progressively higher levels of inflation if demand policies are misused.

While the LRPC is vertical, its position depends on the natural rate of unemployment.

Supply-side policies that can reduce the NAIRU include:

Improved education and training to enhance worker skills.

Labour market reforms that increase flexibility, such as reducing barriers to hiring and firing.

Incentives for innovation and productivity growth.

These policies shift the LRPC leftward, allowing lower unemployment without accelerating inflation.

Practice Questions

Explain the difference between the short-run Phillips curve and the long-run Phillips curve. (2 marks)

1 mark for stating that the short-run Phillips curve shows a temporary inverse relationship between inflation and unemployment.

1 mark for stating that the long-run Phillips curve is vertical, showing no trade-off between inflation and unemployment.

Using the Phillips curve framework, analyse the implications for economic policy of attempting to reduce unemployment below the natural rate in the long run. (6 marks)

1–2 marks: Identification of the natural rate of unemployment (NAIRU) and recognition that the long-run Phillips curve is vertical.

1–2 marks: Explanation that attempts to reduce unemployment below the natural rate in the long run will only lead to accelerating inflation.

1–2 marks: Application to policy — recognising that demand-side policies are ineffective in the long run and that supply-side measures are needed to reduce the natural rate sustainably.

Full 6 marks require clear and coherent analysis showing understanding of both theory and policy implications.