AQA Specification focus:

‘The main characteristics of oligopolistic markets. Oligopolistic markets can be very different in relation to, for example, the number of firms, the degree of product differentiation and ease of entry.’

Introduction

Oligopoly represents a market structure where a few large firms dominate, yet these markets differ widely in size, concentration, behaviour, and competitive strategies, influencing consumer outcomes.

Characteristics of Oligopolistic Markets

Oligopoly is distinct from other market structures due to its interdependence of firms, barriers to entry, and strategic behaviour. Unlike perfect competition or monopoly, it falls between extremes and can vary significantly across industries.

Number of Firms

Oligopolies typically consist of a few large firms dominating most of the market share.

The number may range from as few as two or three in highly concentrated sectors (e.g., commercial aircraft manufacturing) to many firms in fragmented industries (e.g., supermarkets).

Despite this diversity, each firm’s actions are highly interdependent on rivals’ behaviour.

Market Concentration

Measured by concentration ratios, which calculate the percentage of total industry sales controlled by the largest firms.

A high concentration ratio (e.g., four-firm ratio above 70%) signals strong oligopolistic power, though not all oligopolies are equally concentrated.

Some oligopolies show moderate ratios but still demonstrate oligopolistic traits like interdependence and non-price competition.

Product Differentiation

Homogeneous products: Found in industries like steel or oil, where products are essentially identical.

Differentiated products: More common, as firms compete using branding, quality, design, or marketing. For example, in the soft drinks industry, products are highly differentiated by brand identity.

Product Differentiation: The process by which firms make their products distinct from rivals’ offerings through branding, features, quality, or marketing.

Differentiation affects the level of price-making power a firm can exercise and the extent of non-price competition.

Barriers to Entry

Oligopolistic markets are usually characterised by significant barriers:

Structural barriers such as high fixed costs or economies of scale.

Strategic barriers such as aggressive advertising, predatory pricing, or patents.

However, the degree of difficulty varies. In some industries, barriers are very high (e.g., pharmaceuticals), while in others, they are lower (e.g., local restaurants).

Oligopolistic markets can be very different in relation to, for example, the number of firms, the degree of product differentiation and ease of entry.

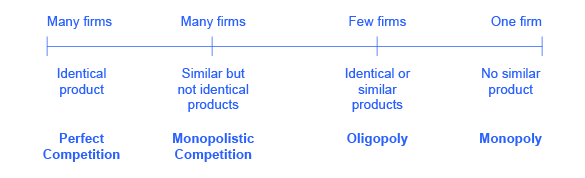

Figure 6.2 illustrates the spectrum of market structures, with oligopoly between perfect competition and monopoly. It shows diversity in the number of firms, product differentiation, and entry conditions. Source

Diversity Across Oligopolies

Oligopolies are not uniform and differ widely across industries. The differences stem from structure, conduct, and performance.

Types of Oligopoly Structures

Concentrated oligopoly: A few firms dominate (e.g., energy providers).

Loose oligopoly: A larger number of firms exist, but competition is still interdependent (e.g., retail grocery).

Duopoly: A special case with only two major firms, often seen in high-tech or aerospace sectors.

Some oligopolies are very tight—duopolies—such as large commercial aircraft manufacturing.

Air France Boeing 777 and Lufthansa Airbus A380 photographed together, exemplifying a real-world duopoly. This illustrates the dominance of two producers in large commercial aircraft manufacturing. Source

Behaviour and Conduct

In some oligopolies, firms may collude, formally or tacitly, to act like a monopoly and maximise joint profits.

In others, firms may adopt non-collusive competition, focusing on innovation and aggressive marketing.

Conduct depends heavily on the degree of regulation, the culture of competition, and the ease of monitoring rivals.

Pricing Behaviour

Prices may remain rigid in certain oligopolies due to fear of price wars.

Alternatively, firms may engage in price leadership, where one dominant firm sets prices and others follow.

In industries with high product differentiation, pricing strategies can be more flexible and less coordinated.

Non-Price Competition and Strategic Behaviour

Because direct price competition can be destructive, oligopolists often rely on non-price competition, which varies across industries:

Heavy investment in advertising and branding.

Product development and innovation.

Enhancements in customer service, loyalty schemes, or after-sales support.

This strategic behaviour underscores the interdependence of firms, as each anticipates rivals’ reactions.

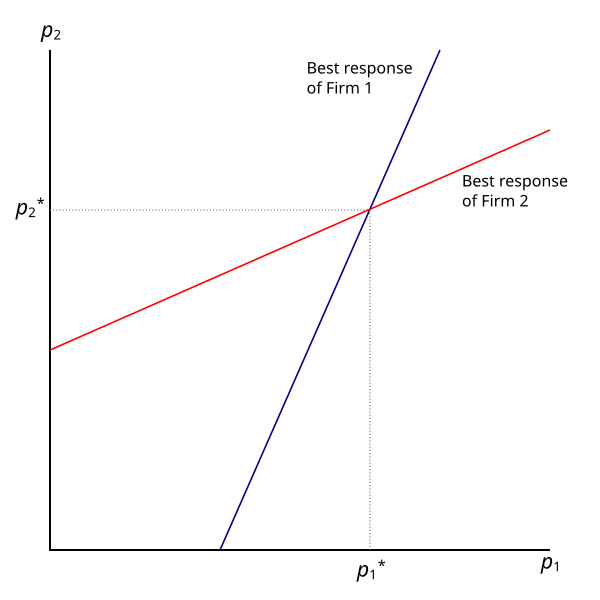

Firms in oligopoly are interdependent.

Reaction functions for two firms in a differentiated oligopoly. Their intersection shows a Nash equilibrium where each firm’s decision is optimal given the other’s, demonstrating interdependence. Source

The Role of Entry Conditions

Entry conditions shape diversity within oligopolies:

In industries with high sunk costs (irrecoverable costs such as R&D in pharmaceuticals), oligopolies tend to be highly stable and concentrated.

In contrast, industries with low sunk costs may experience frequent entry and exit, making the oligopoly more contestable and diverse in structure.

Sunk Costs: Expenditures that cannot be recovered if a firm leaves the market, such as advertising expenditure or specialised machinery investment.

The role of sunk costs explains why some oligopolies are more open to competition while others remain entrenched.

Conclusion on Diversity

The key insight from the specification is that oligopolistic markets can be very different. While they share core features—few firms, interdependence, and barriers to entry—the exact nature of the market depends on:

The number and size distribution of firms.

The extent of product differentiation.

The level and type of entry barriers.

This explains why industries like supermarkets, oil, airlines, and mobile phone providers all exhibit oligopoly but operate in very distinct ways.

FAQ

Interdependence means that in an oligopoly, firms cannot act in isolation — each pricing or output decision depends on expected reactions from competitors.

This contrasts with perfect competition, where firms are price takers, and monopoly, where one firm sets conditions without concern for rivals. Interdependence explains why oligopolies often engage in strategic behaviour such as collusion, price leadership, or heavy non-price competition.

In homogeneous oligopolies (e.g., steel), consumers choose mainly based on price, as products are virtually identical.

In differentiated oligopolies (e.g., smartphones), non-price factors become central, including branding, product features, and after-sales support. This increases firms’ ability to exercise monopoly power and reduce direct price competition.

Concentration ratios measure the market share held by the largest firms, helping to identify how dominant a few firms are.

A high ratio suggests a tightly concentrated oligopoly, often with more collusion risk.

A lower ratio may still indicate oligopolistic behaviour if firms are interdependent, even where competition appears wider.

Thus, concentration ratios highlight both the structure and intensity of competition within different oligopolies.

Barriers depend on industry characteristics:

Structural barriers: economies of scale, capital requirements, access to technology.

Strategic barriers: branding, advertising intensity, predatory pricing.

Regulatory barriers: patents, licences, government restrictions.

High barriers reinforce firm dominance, while lower barriers make markets more contestable, creating diversity across oligopolies.

In tightly concentrated oligopolies, firms often keep prices stable to avoid destructive price wars, sometimes following a price leader.

In more fragmented oligopolies, particularly with differentiated products, firms may adopt flexible pricing, offering promotions or tiered products to capture different market segments.

The degree of diversity explains why pricing in oligopolies ranges from rigid and collusive to highly dynamic and competitive.

Practice Questions

Outline two characteristics of an oligopolistic market structure. (3 marks)

1 mark for identifying each valid characteristic (maximum 2 marks).

Examples: few large firms dominate, interdependence between firms, barriers to entry, product differentiation.1 additional mark for brief development/explanation of one characteristic.

Example: “Firms are interdependent, meaning each firm’s decisions are influenced by the expected reactions of rivals.”

Explain why oligopolistic markets can be very different from one another, despite sharing core features. (6 marks)

1 mark for stating oligopolies share core features (few firms, barriers to entry, interdependence).

Up to 2 marks for explaining variation in number of firms and concentration (e.g., tight duopoly vs loose oligopoly).

Up to 2 marks for explaining variation in product differentiation (homogeneous vs branded/differentiated products).

1 mark for explaining variation in entry barriers or sunk costs across industries.

Maximum 6 marks: responses must show awareness that oligopolies are not uniform but diverse in structure and conduct.