AQA Specification focus:

‘The significance of interdependence and uncertainty in oligopoly. The advantages and disadvantages of oligopoly. Students should recognise that collusion may allow oligopolists to act as a monopolist and maximise their joint profits.’

Introduction

Oligopolistic markets are characterised by few dominant firms, making interdependence and uncertainty central features. Firms must carefully consider rivals’ behaviour when setting prices, output, or strategic plans.

Interdependence in Oligopoly

In oligopolistic industries, each firm’s decisions directly affect rivals. A firm cannot act independently without anticipating competitor reactions. This is different from perfect competition (many firms, no individual influence) or monopoly (one firm, no rivals).

Features of Interdependence

Price-setting decisions: A price cut by one firm may trigger immediate rival responses, leading to a price war.

Non-price strategies: Firms often focus on advertising, branding, or R&D to win customers, avoiding destructive price competition.

Market share protection: Firms must constantly monitor competitors to prevent losing customers.

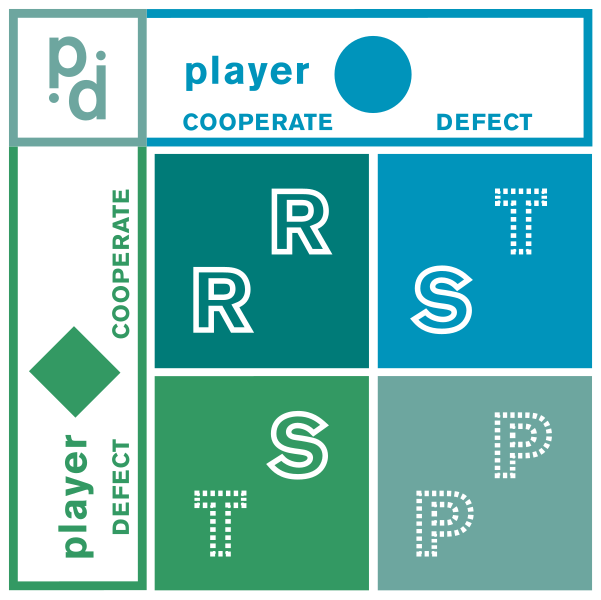

Strategic planning: Game theory illustrates how firms anticipate rivals’ moves, creating complex decision-making.

A two-firm Prisoner’s Dilemma payoff matrix showing how cooperation can yield higher joint profits but remains unstable due to incentives to defect. It illustrates Nash equilibrium at mutual defection, a key concept in oligopolistic interdependence. Source

Uncertainty in Oligopoly

Because firms are interdependent, uncertainty is heightened. Businesses cannot easily predict rivals’ pricing, output, or investment strategies.

Causes of Uncertainty

Rival reactions: Unclear whether competitors will match or ignore price changes.

Entry of new firms: Threat of new competition can destabilise pricing.

Regulatory constraints: Anti-collusion laws create uncertainty about cooperation.

Market shocks: Changes in demand or input costs affect all firms, but responses vary.

Outcomes of Uncertainty

Firms may be cautious, avoiding drastic price changes.

Stability can emerge through price rigidity (prices stay unchanged despite cost shifts).

Alternatively, sudden rival responses can create volatility in market performance.

Advantages of Oligopoly

Despite uncertainty, oligopolies can deliver benefits to both producers and consumers.

Advantages for Producers

Supernormal profits: Firms may sustain high profits due to entry barriers.

R&D investment: Profits finance innovation, improving products and efficiency.

Predictable market shares: In stable collusive arrangements, firms avoid wasteful competition.

Advantages for Consumers

Product variety: Non-price competition often leads to better quality and more choice.

Technological progress: Oligopolists may introduce innovations faster than competitive markets.

Economies of scale: Large firms can reduce costs, sometimes passing savings to consumers.

Disadvantages of Oligopoly

However, oligopolistic structures also raise concerns about efficiency and fairness.

Disadvantages for Producers

Risk of price wars: Competitive retaliation can reduce profits.

Uncertainty in planning: Strategic decisions are difficult, lowering efficiency.

High fixed costs: Maintaining strong brands or R&D requires significant expenditure.

Disadvantages for Consumers

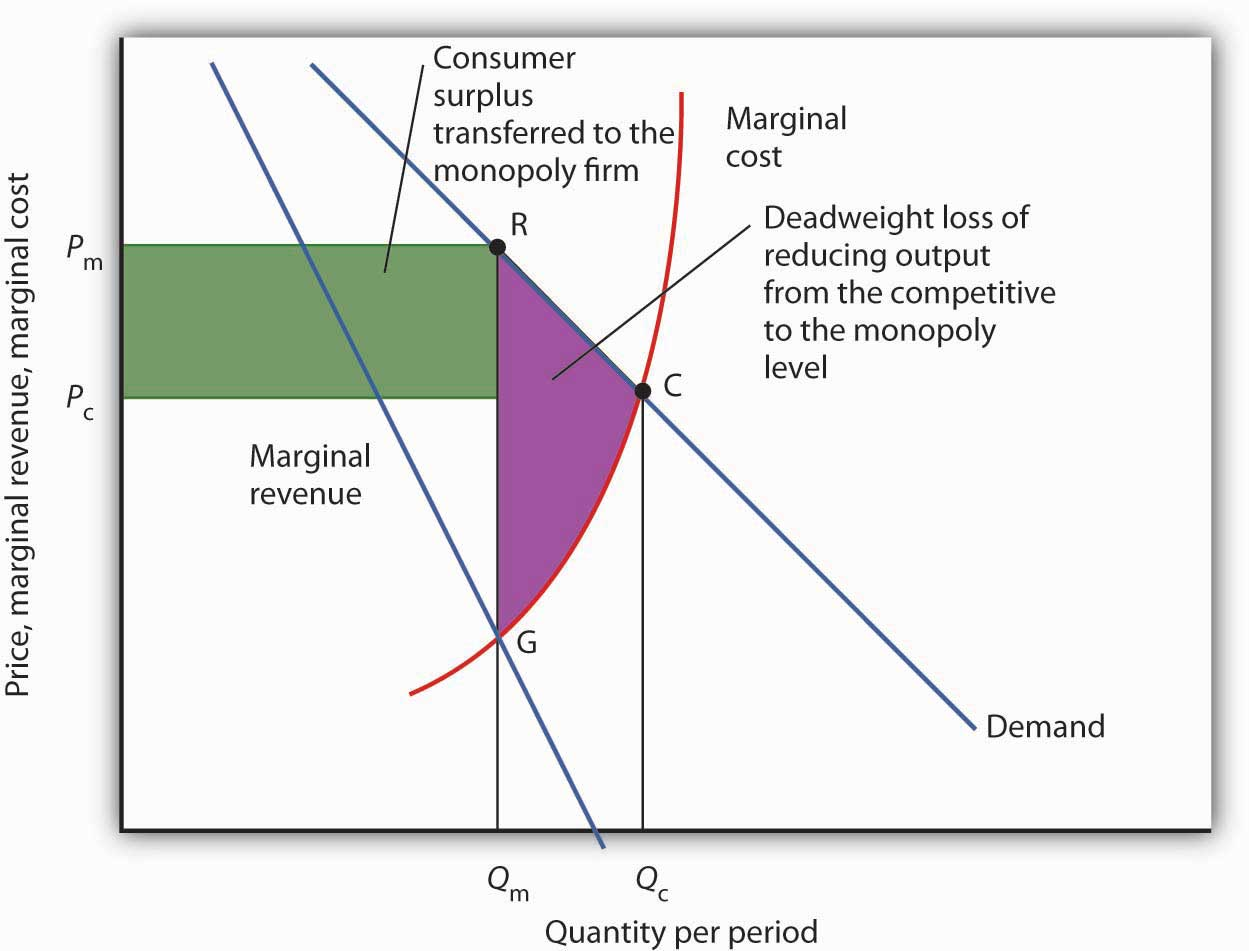

Higher prices: If firms collude, consumers face prices closer to monopoly levels.

Reduced output: Joint profit maximisation can restrict supply.

Misallocation of resources: Collusion reduces allocative efficiency.

Barriers to entry: Innovation may not always reach consumers if dominant firms prevent new entrants.

Collusion and Monopoly Behaviour

Collusion occurs when oligopolists cooperate to reduce competition. This can be formal (cartels) or tacit (implicit agreements).

Collusion: An agreement between firms, explicit or implicit, to limit competition, usually by fixing prices, restricting output, or dividing markets.

When collusion occurs, oligopolists effectively act as a monopolist, maximising joint profits. However, such behaviour is illegal in most economies due to negative impacts on consumers.

Diagram comparing monopoly and perfect competition, showing how collusion in oligopoly can replicate monopoly pricing (Pm) and output (Qm), creating deadweight welfare loss. This highlights the efficiency consequences when firms act collectively as a monopolist. Source

Evaluating Oligopoly

The overall welfare impact depends on the balance between innovation and competition restrictions.

Positive Aspects

Incentives for innovation and investment.

Potential for stable prices and reduced volatility.

Consumer benefit from quality improvements and product differentiation.

Negative Aspects

Risk of collusion leading to higher prices.

Limited choice if a few firms dominate heavily.

Long-term inefficiency if barriers to entry prevent fresh competition.

Key Points to Remember

Oligopolies are defined by interdependence and uncertainty, making them unique compared to other market structures.

Firms may engage in non-price competition and collusion to secure profits.

Consumers can benefit through innovation and product variety, but also risk higher prices and reduced efficiency.

Collusion enables firms to act as a monopolist, maximising joint profits but often harming consumer welfare.

FAQ

Uncertainty discourages firms from taking risks with pricing. A firm that lowers its price risks sparking a price war, while raising its price could result in losing customers to rivals.

This tendency creates a situation of price rigidity, where firms prefer to compete using advertising, branding, or product differentiation instead of constant price shifts.

When firms collude, they agree to fix prices, restrict output, or divide the market.

By fixing a price above the competitive level, firms can share monopoly-style profits.

Output is restricted to ensure demand remains at higher prices.

Each firm gains stability, but consumers face higher prices and reduced choice.

Game theory models how firms anticipate and respond to rivals’ decisions.

The prisoner’s dilemma highlights how, even if collusion is profitable, firms may defect to gain short-term advantage. Mutual defection then becomes the likely outcome.

This shows why uncertainty and interdependence make cooperation fragile in oligopolies.

Non-price competition often delivers:

Improved product quality

Greater variety and differentiation

Stronger brand services such as warranties and after-sales support

Although prices may remain high, consumers enjoy better value through quality improvements and enhanced choice.

Collusion requires trust between firms, but each has an incentive to secretly undercut others to capture more market share.

Regulatory authorities also closely monitor oligopolies, making formal collusion risky.

As markets evolve and new firms enter, sustaining collusion becomes increasingly difficult, often leading back to competition.

Practice Questions

Explain what is meant by interdependence in oligopolistic markets. (3 marks)

1 mark for stating that firms must take account of rivals when making decisions.

1 mark for reference to strategic behaviour, e.g. price-setting or output.

1 mark for a developed example, e.g. a price cut by one firm may trigger retaliation from others.

Discuss two disadvantages for consumers that may arise if firms in an oligopoly collude. (6 marks)

1 mark for identifying higher prices compared to competitive markets.

1 mark for explaining restricted output or reduced consumer choice.

1 mark for reference to misallocation of resources or reduced allocative efficiency.

1 mark for linking collusion to deadweight loss or welfare reduction.

1 mark for analysis of reduced innovation incentives in the long run.

1 mark for clear evaluation or developed reasoning (e.g. short-run stability may benefit consumers despite higher prices).