AQA Specification focus:

‘The difference between collusive and non-collusive oligopoly. The difference between cooperation and collusion.’

In oligopolistic markets, firms’ behaviour can vary widely depending on whether they engage in collusion or act independently. Understanding these distinctions is crucial for evaluating market outcomes.

Collusive Oligopoly

A collusive oligopoly arises when firms in an oligopolistic market agree to cooperate rather than compete, often to maximise joint profits.

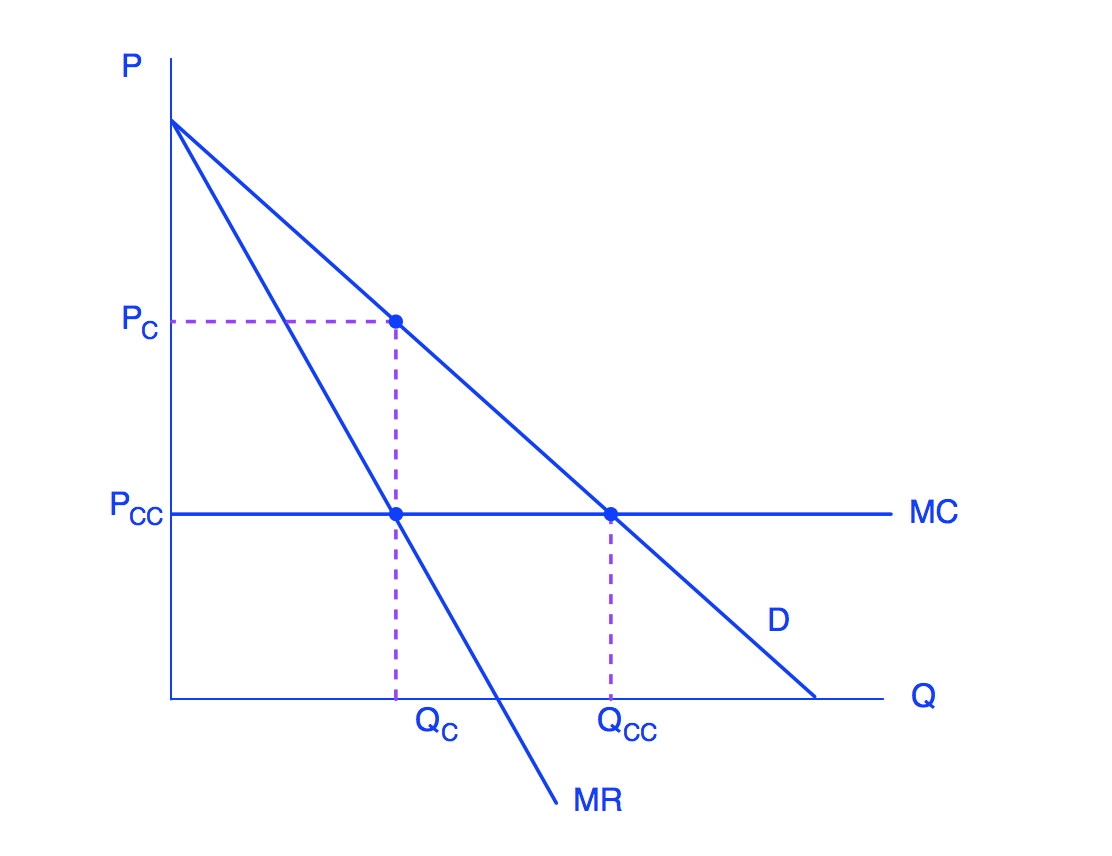

Figure 1 depicts profit maximisation for a colluding oligopoly, which chooses output where MR = MC and charges the corresponding price from the market demand curve. The graphic contrasts the collusive outcome with a lower-price, higher-quantity competitive outcome. This directly illustrates why collusion raises price and restricts output compared with non-collusive behaviour. Source

Forms of Collusion

Overt collusion: Firms make open, formal agreements on prices, output, or market shares.

Tacit collusion: Firms coordinate behaviour without explicit agreements, often through implicit understandings or industry norms.

Collusion: An agreement, either explicit or implicit, between firms to restrict competition, often by fixing prices, limiting output, or dividing markets.

Consequences of Collusion

Higher prices than in competitive markets, raising producer surplus but reducing consumer surplus.

Reduced output compared with allocative efficiency levels.

Potential for cartel formation, such as OPEC in global oil markets.

May be illegal or regulated, as it leads to market inefficiency and consumer harm.

Cartels

A cartel is a specific form of collusion where firms explicitly agree on production quotas or pricing. Cartels are usually unstable due to incentives to cheat for higher individual profits.

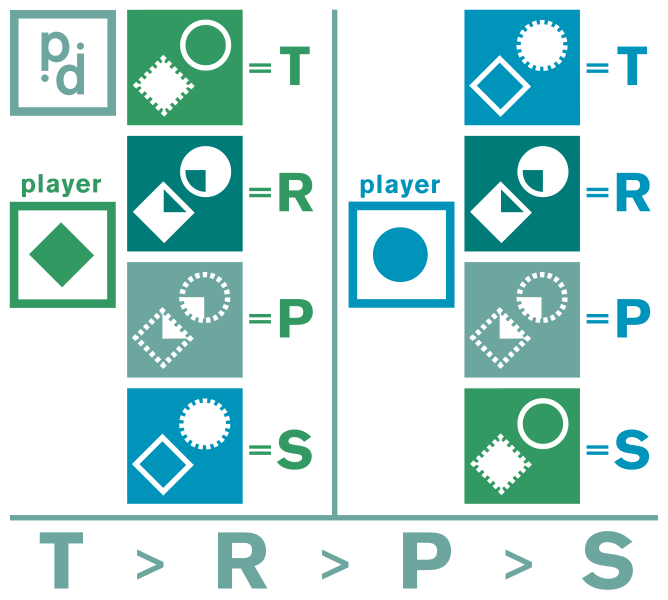

This 2×2 payoff matrix contrasts outcomes when each firm cooperates (colludes) or defects (cheats). Although joint profits are highest when both cooperate, each firm has a dominant incentive to defect, undermining cartel stability. This clarifies why non-collusive outcomes often emerge despite the gains from collusion. Source

Cartel: A formal agreement between firms in an oligopoly to fix prices, restrict output, or coordinate other competitive behaviours to increase collective profits.

Non-Collusive Oligopoly

In contrast, a non-collusive oligopoly exists when firms do not cooperate and instead act independently, while still being interdependent in decision-making.

Key Features

Firms anticipate rivals’ reactions before making decisions.

Prices often remain stable due to mutual interdependence, as aggressive price changes may trigger price wars.

Competition often shifts towards non-price competition such as branding, advertising, and product innovation.

Outcomes of Non-Collusion

Prices may not always be as high as under collusion, but price rigidity is common.

Greater consumer benefits in terms of product variety and quality.

Potential for dynamic efficiency, as firms invest in research and development to attract customers.

Cooperation vs Collusion

While related, cooperation and collusion differ in important ways.

Cooperation

Refers to firms aligning behaviour for mutual advantage without necessarily engaging in illegal or anti-competitive practices.

Can include sharing research or setting industry standards.

May enhance efficiency and benefit consumers through better technology and improved quality.

Collusion

Aims explicitly to reduce competition and often involves anti-competitive agreements.

Tends to harm consumer welfare by raising prices and limiting choice.

Is usually subject to legal restrictions and monitored by competition authorities.

Interdependence and Strategic Behaviour

Oligopolistic firms, whether collusive or non-collusive, are characterised by interdependence. Each firm’s strategy affects and is affected by rivals’ actions.

Strategic Choices in Collusion

Whether to maintain agreements or cheat to gain market share.

Decisions often shaped by monitoring costs, number of firms, and demand elasticity.

Strategic Choices in Non-Collusion

Whether to compete on price (risking a price war) or focus on non-price competition.

Use of strategies like limit pricing (setting prices low enough to deter new entrants).

Regulatory Perspectives

Competition authorities closely monitor markets for evidence of collusion.

Penalties for cartels include heavy fines and reputational damage.

Non-collusive behaviour is generally legal, but regulators may intervene if firms’ conduct still harms consumer welfare.

Summary of Key Distinctions

Collusive oligopoly: Firms cooperate (formally or informally) to limit competition, usually leading to higher prices and restricted output.

Non-collusive oligopoly: Firms act independently but remain strategically interdependent, often relying on non-price competition.

Cooperation may be legal and beneficial, whereas collusion is generally illegal and anti-competitive.

FAQ

Collusion is more likely when the market has a small number of firms, making agreements easier to monitor and enforce.

It is also strengthened by high barriers to entry, similar cost structures across firms, and stable demand conditions.

Repeated interaction between firms in the same market also builds trust, reducing the temptation to cheat.

Tacit collusion does not involve formal agreements but occurs when firms signal intentions indirectly. Examples include price leadership, where one firm sets prices and others follow.

Unlike explicit collusion, which is illegal and easier to detect, tacit collusion is harder for regulators to prove because no written or spoken agreement exists.

Collusion raises prices, restricts output, and reduces consumer welfare, mirroring monopoly outcomes.

Regulators intervene to preserve market efficiency, prevent misallocation of resources, and encourage innovation.

Evidence of collusion may be sought through suspicious pricing patterns, communication records, or unusual stability in prices across competitors.

While typically harmful, some argue collusion can create stability.

For example:

Price agreements may prevent destructive price wars that destabilise industries.

Coordination on safety or quality standards can raise overall product reliability.

However, such benefits are usually outweighed by higher prices and reduced consumer choice.

Cooperation in technology sharing may involve joint research ventures or patent pooling to accelerate innovation.

This can reduce costs, improve products, and enhance efficiency, benefitting both firms and consumers.

Collusion, by contrast, would use agreements to restrict competition, such as limiting access to innovations or controlling output levels.

Practice Questions

Define the term collusion in the context of an oligopolistic market. (2 marks)

1 mark for recognising that collusion involves firms agreeing to cooperate (e.g., fixing prices, limiting output, or dividing markets).

1 mark for stating the purpose, e.g., to reduce competition and increase joint profits.

Explain why cartels are often unstable in oligopolistic markets. (6 marks)

1 mark: Recognition that cartels involve formal collusion.

1 mark: Explanation that members agree on price/output quotas to maximise joint profits.

1 mark: Recognition of incentives to cheat (e.g., undercutting price to increase individual market share).

1 mark: Use of the concept of game theory/interdependence to explain why cheating is attractive.

1 mark: Explanation of the consequence of cheating, e.g., price wars, collapse of collusion, lower profits.

1 mark: Overall understanding that collusion requires trust and monitoring, making it inherently unstable.