AQA Specification focus:

‘The factors which influence prices, output, investment, expenditure on research and advertising in oligopolistic industries.’

Introduction

In oligopolistic markets, firms face strategic interdependence, meaning decisions on pricing, output, investment, and research & development (R&D) are heavily influenced by rivals’ actions.

Pricing Decisions in Oligopoly

Interdependence and Uncertainty

Oligopolists are highly interdependent, so a single firm’s pricing decision can trigger strong competitive responses. This creates uncertainty, making stable pricing strategies attractive.

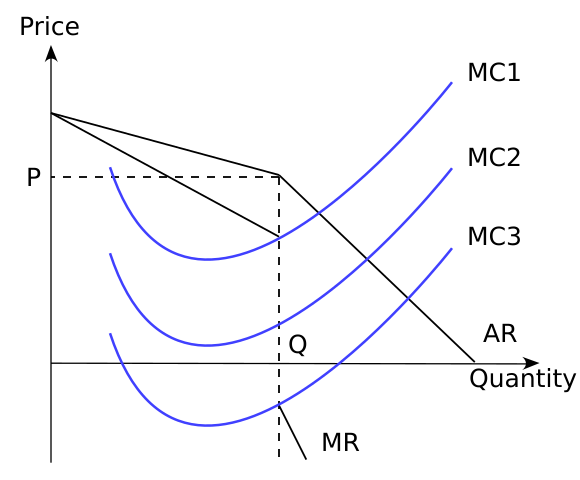

A labelled diagram of the kinked demand curve shows why price and output remain stable despite small cost changes, illustrating interdependence in oligopoly pricing. Source

Firms may avoid frequent price changes to prevent price wars.

Tacit collusion may occur, where firms keep prices aligned without formal agreements.

Price leadership can emerge when one dominant firm sets the price and others follow.

Price Leadership: A market situation where one firm, often the largest or most efficient, sets the price that other competitors adopt.

This behaviour helps maintain higher prices and avoids destabilising competition.

Pricing Strategies

Cost-plus pricing: Setting prices by adding a mark-up to costs, ensuring profitability.

Predatory pricing: Setting very low prices to drive out rivals, though illegal under competition law.

Limit pricing: Keeping prices low enough to deter new entrants but still earning profits.

Non-price competition: When firms keep prices stable but compete through advertising, branding, and service quality.

Output Decisions

Profit Maximisation vs Strategic Considerations

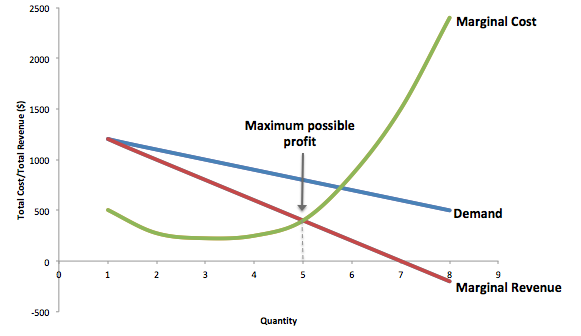

In theory, profit maximisation occurs at MC = MR, but oligopolists often modify output choices to reflect competitive pressures.

The diagram shows profit maximisation where MR = MC, with the corresponding price found on the demand curve. While illustrated for monopoly, the same rule applies to oligopolistic price makers. Source

If rivals expand output, a firm may restrict its own to avoid oversupply.

Firms often match industry-wide output levels to sustain higher prices.

Profit Maximisation: The process where a firm produces the level of output where marginal cost (MC) = marginal revenue (MR) to maximise profit.

Output decisions therefore balance theoretical efficiency with practical rivalry management.

Investment Decisions

Importance of Long-Term Strategy

Investment choices in oligopolies are shaped by the need to maintain or gain market dominance. Heavy investment may act as a barrier to entry, discouraging potential competitors.

Key investment areas include:

Capital equipment to improve efficiency.

Distribution networks to secure supply chains and access to markets.

Sustainable practices, as firms respond to consumer and regulatory pressure.

Firms that fail to invest risk losing market share in the long term.

Barriers to Entry Through Investment

By committing to large-scale, irreversible investments, firms can raise entry barriers. For example, investing in high-capacity production plants may signal an ability to sustain low-cost, high-output production, deterring new competitors.

Research and Development (R&D) Decisions

Incentives for R&D

Oligopolists frequently spend heavily on R&D because:

High profits provide funding capacity.

Innovation is a key method of differentiation.

Continuous product development sustains consumer loyalty.

Product Differentiation: The process of distinguishing a product from competitors’ offerings through quality, features, branding, or service.

Types of R&D Expenditure

Process innovation: Improving production efficiency to cut costs.

Product innovation: Developing new products or improving existing ones.

Advertising and branding: Aimed at increasing consumer recognition and demand.

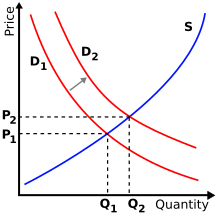

This diagram illustrates how successful advertising shifts the demand curve outward, supporting higher equilibrium price and output in oligopolistic industries. Source

R&D and advertising spending are closely linked, as both reinforce brand loyalty and make demand more price inelastic.

The Link Between Pricing, Output, Investment, and R&D

Strategic Interconnections

Decisions in each area cannot be made in isolation. For example:

Pricing strategies affect the level of funds available for investment and R&D.

Heavy R&D expenditure may necessitate higher prices to recoup costs.

Investment in efficiency may allow firms to lower prices without reducing profitability.

Short-Run vs Long-Run Choices

Short run: Firms may keep prices stable and output aligned to avoid conflict.

Long run: Firms pursue growth through sustained investment and innovation.

Risk and Reward Balance

Excessive investment may harm profitability if demand falls.

Too little investment risks being outcompeted by rivals with superior products or production.

Advertising and Non-Price Rivalry

The Role of Advertising

Advertising expenditure is a central component of oligopolistic behaviour. It reinforces brand power, differentiates products, and maintains customer loyalty.

High advertising spending can act as a sunk cost, further deterring market entry.

Collective advertising raises industry demand, but firms often try to outspend rivals.

Sunk Costs: Expenditures that cannot be recovered if a firm exits a market, such as advertising or specialised machinery.

Benefits and Drawbacks

Benefit: Increased demand stability.

Drawback: May escalate into advertising “wars” with diminishing returns.

Efficiency Implications

Heavy R&D and investment can promote dynamic efficiency, improving innovation and consumer choice.

High advertising and brand loyalty may reduce allocative efficiency, as prices are higher than in competitive markets.

Output restriction strategies can reduce productive efficiency, as firms operate below optimal capacity to sustain high prices.

Thus, pricing, output, investment, and R&D decisions in oligopolistic markets reflect the balance between competitive rivalry, profit maximisation, and long-term strategic positioning.

FAQ

Firms in oligopolies often view downturns as opportunities to strengthen long-term market position. Those with financial reserves may invest when rivals cut back, gaining a cost or innovation edge.

However, risk increases if demand remains weak, so firms balance expected recovery benefits with potential short-run losses.

In oligopolies, products are often similar in function, so advertising becomes vital to build brand loyalty and create artificial differentiation.

This makes demand less price elastic, allowing firms to sustain higher prices without losing significant market share.

The most effective investments include:

Large-scale production facilities that lower long-run average costs.

Exclusive distribution channels or retail contracts.

Advanced technology systems that competitors struggle to replicate.

These commitments discourage new entrants by raising required start-up costs.

Uncertainty about rivals’ strategies can push firms into a “race to innovate.”

Some invest aggressively to avoid falling behind, while others delay investment until competitors reveal their direction. This behaviour highlights the interdependence that defines oligopoly.

Yes. Aggressive price competition reduces profit margins, leaving less internal funding available for R&D.

Firms in price wars may cut innovation budgets, while those in stable pricing environments often have more consistent profits to reinvest in research.

Practice Questions

Explain what is meant by non-price competition in oligopolistic markets. (2 marks)

1 mark for a basic definition: competition based on factors other than price.

1 mark for a relevant example such as advertising, branding, product differentiation, or customer service.

Discuss how investment and research & development (R&D) decisions influence long-run outcomes for firms in oligopolistic markets. (6 marks)

1–2 marks: Identifying that investment and R&D can provide competitive advantage, product differentiation, or efficiency gains.

1–2 marks: Explaining how such expenditure can act as a barrier to entry by raising sunk costs or signalling long-term commitment.

1 mark: Recognition of the link between R&D, innovation, and dynamic efficiency.

1 mark: Recognition of potential drawbacks, e.g. high costs, risk of failure, or reduced short-run profitability.

(Answers must show clear economic reasoning. Maximum 6 marks.)