AQA Specification focus:

‘The various factors which influence the distribution of income and wealth.’

The distribution of income and wealth is shaped by numerous interrelated forces. Labour markets, capital ownership, and institutional frameworks play central roles in determining economic outcomes and disparities.

Labour Markets and Income Distribution

Wages and Employment

The labour market is a key determinant of how income is distributed across society. Wages represent the primary income source for most households, and they vary depending on skill, experience, and demand for specific occupations. High-demand sectors with skill shortages, such as technology or medicine, tend to offer significantly higher wages compared with sectors with surplus labour.

Wage Differentials

Income inequality often arises from wage differentials, where workers in similar roles receive different pay. These differentials can emerge from:

Human capital differences (education, training, skills).

Discrimination (gender, ethnicity, or social background).

Regional disparities (differences in living costs or productivity).

Unionisation and bargaining power (strong trade unions can secure higher wages).

Human Capital: The stock of skills, knowledge, and experience possessed by individuals, which influences their productivity and earning potential.

A workforce with higher human capital typically achieves higher wages, widening income gaps between skilled and unskilled workers.

Labour Market Imperfections

In perfectly competitive markets, wages reflect productivity.

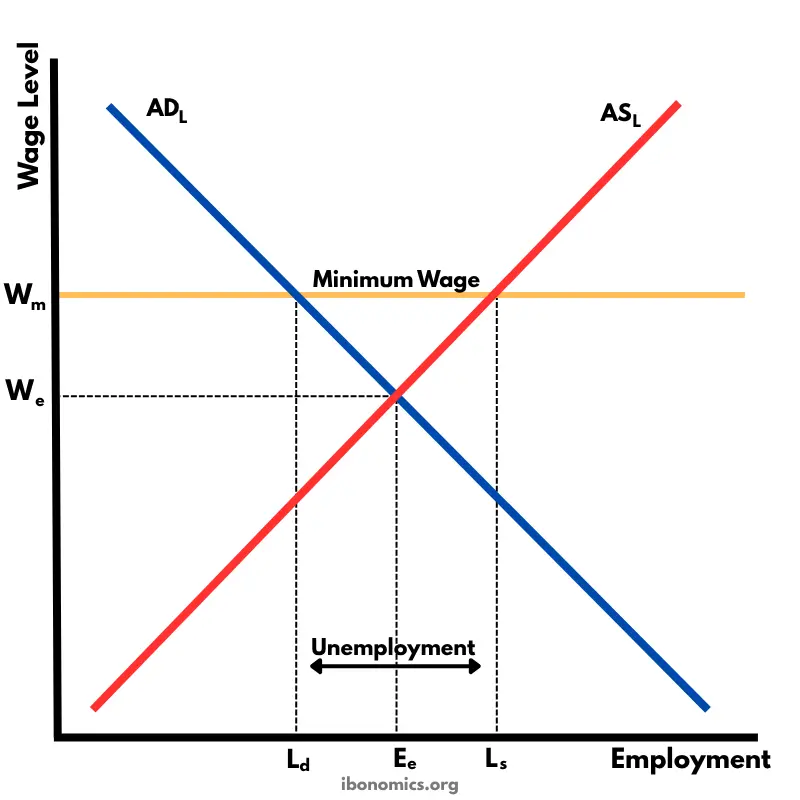

This diagram depicts the equilibrium in the labour market, showing how wages are determined by the intersection of labour demand and supply. It also illustrates the effects of a minimum wage set above the equilibrium wage, leading to unemployment. Source

However, in reality, labour market imperfections—such as monopsony employers, minimum wages, or employment regulations—can distort wage outcomes. These imperfections contribute to persistent inequality.

Capital and Wealth Distribution

Ownership of Capital

Wealth distribution is strongly influenced by capital ownership. Individuals and households that hold assets such as property, shares, or businesses accumulate wealth far more rapidly than those reliant solely on wages.

Wealth: The total market value of all assets owned by an individual, household, or institution, minus any liabilities.

Wealth provides both security and the ability to generate further income through dividends, rent, or interest, reinforcing inequality across generations.

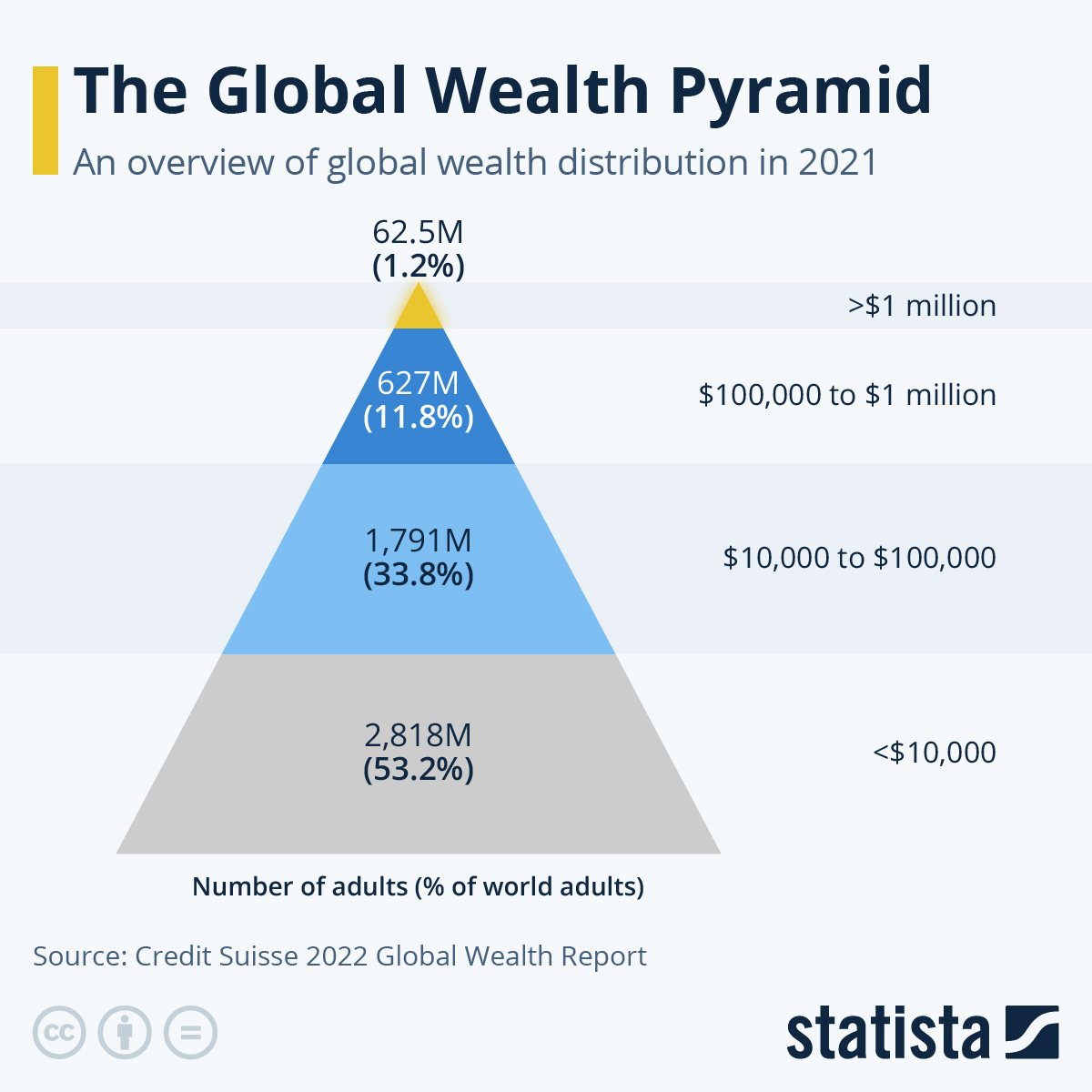

This chart illustrates the global distribution of wealth, highlighting the disparity between the wealthiest individuals and the majority of the population. It underscores the significant role of capital ownership in wealth accumulation and inequality. Source

Unearned Income

Income derived from capital ownership—such as rents, dividends, and interest payments—is often termed unearned income, as it is not directly linked to labour. Since wealth is unequally distributed, unearned income contributes disproportionately to widening income inequality.

Intergenerational Wealth Transfer

Wealth is frequently transferred across generations through inheritance and gifts, further entrenching inequality. Families with existing wealth can pass on advantages in housing, education, and investment, making wealth distribution less equal over time.

Institutional Influences

Role of Institutions

Institutions—including governments, legal systems, and cultural norms—play a vital role in shaping the distribution of income and wealth. They establish rules regarding taxation, property rights, social security, and labour protections. Institutional strength or weakness determines whether inequality is moderated or exacerbated.

Taxation and Redistribution

Progressive taxation and welfare programmes can reduce inequality by redistributing income from higher earners to lower-income households. Conversely, regressive taxation or limited social safety nets may worsen inequality. The structure of a country’s fiscal policy reflects both economic choices and political values.

Labour Market Institutions

Institutions such as trade unions, minimum wage laws, and employment protections influence how income is shared between workers and employers. Strong institutions often reduce wage inequality, while weak or absent institutions allow employers greater control over wage-setting.

Financial Institutions

Access to financial services—such as credit, mortgages, and savings accounts—also impacts wealth accumulation. When financial institutions are inclusive, they enable wider participation in asset ownership. In contrast, exclusion from credit markets prevents low-income households from building wealth.

Interactions Between Drivers

Labour and Capital

The distribution of income is influenced by the interaction between labour and capital. For example, workers with significant wealth are less dependent on wages, while those without assets rely solely on employment income. This interaction can widen disparities when returns to capital grow faster than wages.

Globalisation and Technological Change

Globalisation and technological progress have reshaped labour markets and capital returns. Outsourcing and automation reduce demand for low-skilled labour, suppressing wages. Simultaneously, high-skilled workers and capital owners benefit from increased productivity and investment returns, reinforcing inequality.

Policy and Institutional Context

The extent to which inequality develops depends heavily on institutional frameworks. Countries with robust welfare systems and strong labour protections often experience lower inequality than those with weaker institutions. Cultural norms surrounding fairness and equity also influence policy responses.

Key Factors Summarised

The distribution of income and wealth is driven by three interlinked forces:

Labour markets: Wages, employment opportunities, human capital, discrimination, and labour market imperfections.

Capital: Ownership of assets, unearned income, and inheritance.

Institutions: Taxation, welfare systems, legal structures, and labour market regulations.

Together, these drivers explain why some societies experience higher levels of inequality than others, and why income and wealth distribution remain central concerns in economics.

FAQ

Financial crises often reduce employment and wages, hitting low-income households hardest. Falling asset prices, however, primarily affect the wealthy who hold shares or property.

The recovery phase usually benefits capital owners more quickly than wage earners, widening inequality. Policies such as quantitative easing can also disproportionately boost asset values, further enriching those with existing wealth.

Inheritance allows wealth to pass across generations without requiring labour or effort from recipients. This entrenches advantages such as home ownership and access to elite education.

Large inheritances amplify inequality because they are concentrated among high-wealth families, while lower-income households rarely pass on significant assets.

Education systems affect human capital, which influences wage levels. High-quality education raises skills, productivity, and earnings.

Inequalities arise because access to elite schools or universities is often linked to family wealth, meaning institutional structures reinforce income differences.

Discrimination leads to wage differentials unrelated to productivity. Groups facing barriers may receive lower pay, limited promotions, or reduced job opportunities.

Key forms include:

Gender discrimination (gender pay gap).

Ethnic or racial discrimination.

Regional discrimination (urban vs rural job access).

Such inequalities persist even with equal qualifications, deepening overall income disparity.

Unions negotiate higher wages, better working conditions, and job security, narrowing gaps between workers and employers.

By raising pay for lower and middle earners, they reduce wage dispersion. However, their influence depends on institutional strength—weak unionisation often leads to wider wage inequality.

Practice Questions

Explain one way in which ownership of capital can influence the distribution of wealth. (3 marks)

1 mark for identifying that ownership of capital generates unearned income (e.g., rent, dividends, interest).

1 mark for explaining that this income increases the wealth of asset holders.

1 mark for explaining how unequal ownership of capital widens wealth inequality (e.g., those without assets cannot benefit from such returns).

Discuss how labour market imperfections can contribute to income inequality. (6 marks)

1 mark for identifying what labour market imperfections are (e.g., monopsony employers, trade unions, minimum wage laws, discrimination).

1 mark for explaining how monopsony employers can set wages below competitive equilibrium, reducing worker income.

1 mark for explaining how strong trade unions can raise wages for certain groups, creating wage differentials.

1 mark for discussing how minimum wages may reduce inequality at the bottom end but could cause unemployment.

1 mark for application to the UK or a relevant context (e.g., regional wage disparities, gender pay gap).

1 mark for evaluative comment (e.g., the impact depends on the strength of institutions, extent of government intervention, or the balance between different imperfections).