AQA Specification focus:

‘Students should understand that excessive inequality is both a cause and consequence of market failure.’

Inequality plays a central role in modern economics, influencing resource allocation, market performance, and social stability. Its relationship with market failure highlights both causes and consequences.

Understanding Market Failure

Market failure occurs when the free market fails to allocate resources efficiently, leading to a loss of economic welfare. Allocative inefficiency and productive inefficiency are common results, where resources are either misallocated or underutilised. Inequality can both trigger these failures and worsen their outcomes.

Market Failure: A situation in which the free market, left to its own devices, results in inefficient allocation of resources, reducing total welfare.

Inequality as a Cause of Market Failure

Excessive inequality can distort incentives, reduce participation in markets, and generate inefficiencies.

Barriers to Human Capital Development

When income and wealth are concentrated, low-income households may struggle to afford education, healthcare, and training. This limits their ability to accumulate human capital, reducing labour productivity and innovation. A lack of widespread skill development can lead to underutilisation of potential resources, weakening long-term growth.

Restricted Access to Credit Markets

Unequal wealth distribution reduces access to financial markets. Without collateral or savings, poorer households and entrepreneurs face credit constraints, preventing investment in education or business. This reduces competition and innovation, both vital for efficient markets.

Social Instability and Negative Externalities

Inequality can generate social unrest, crime, and political instability, which function as negative externalities. These outcomes impose costs on society that markets do not account for, such as higher policing expenditure and reduced investor confidence.

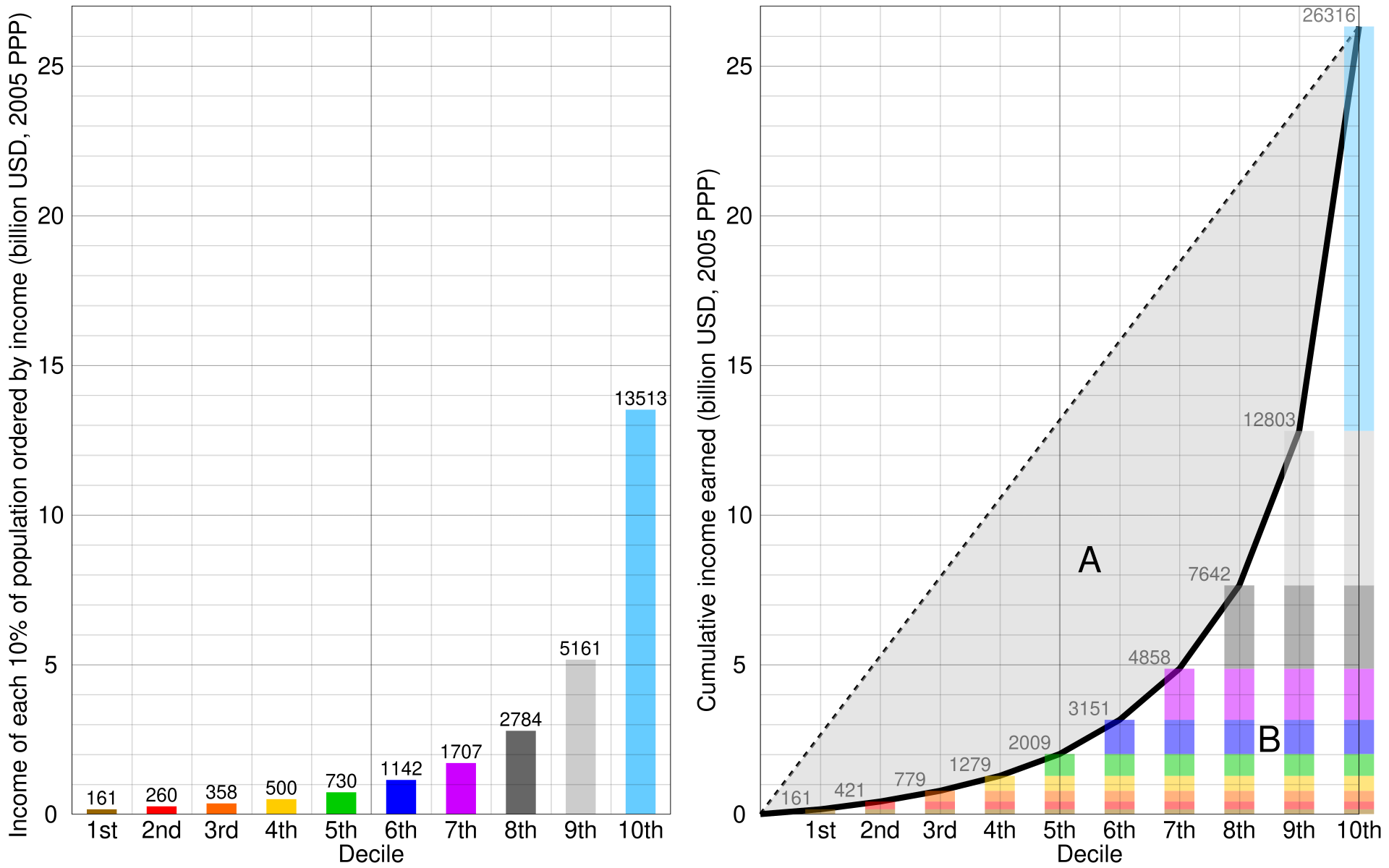

The Lorenz curve demonstrates the cumulative percentage of total income received by the bottom x% of the population. A perfectly equal distribution is represented by the 45-degree line, while the actual Lorenz curve lies below this line, indicating varying degrees of income inequality. Source

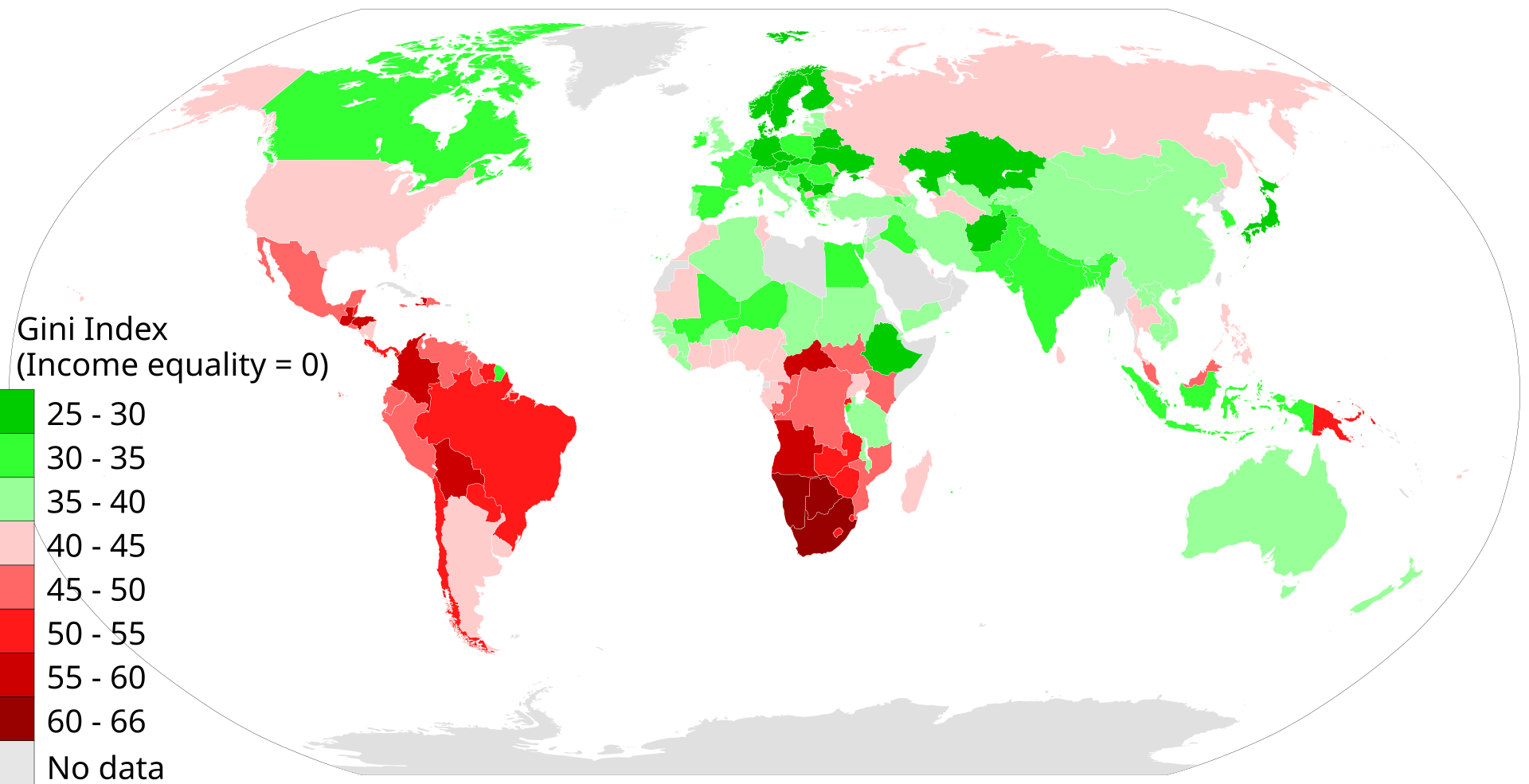

The map illustrates the Gini Index for various countries, with darker shades indicating higher levels of income inequality. This visual representation helps in understanding the global disparities in income distribution and their potential implications on market efficiency. Source

Inefficient Demand

High inequality weakens overall demand. If the majority of income is concentrated among the wealthy, who typically have lower marginal propensity to consume (MPC), aggregate demand becomes subdued. This results in underconsumption and underutilised productive capacity, a form of allocative inefficiency.

Inequality as a Consequence of Market Failure

Market structures and failures in competition, information, and provision of public goods can perpetuate inequality.

Monopoly Power and Rent-Seeking

Monopolies and oligopolies restrict output and raise prices above competitive levels, transferring wealth from consumers to producers. This market power contributes to unequal distribution and entrenches wealth in concentrated groups.

Rent-Seeking: Economic behaviour where individuals or firms increase their share of existing wealth without creating new wealth, often through political influence or monopoly power.

Labour Market Failures

Discrimination, unequal bargaining power, and asymmetric information in labour markets create unequal wage distributions. For example, workers may lack full knowledge of their worth, leading to lower wages, or trade unions may lose influence, reducing wages for lower-income groups relative to executives.

Provision of Public Goods and Merit Goods

Markets tend to underprovide merit goods such as healthcare and education. Without government intervention, only those who can afford them benefit, reinforcing inequality across generations.

Capital Market Failures

Wealth inequality is worsened when financial markets allocate investment opportunities unevenly. Those with existing assets gain higher returns, while those without remain excluded. This Matthew effect (‘the rich get richer’) perpetuates inequality.

Interaction Between Cause and Consequence

Inequality and market failure often reinforce one another in a cyclical process.

Cause → Consequence: Limited access to education (cause) lowers productivity, which reduces wages, leading to wider income inequality (consequence).

Consequence → Cause: Monopolistic practices (cause of inequality) transfer wealth upwards, which then further distorts market efficiency (consequence).

This cycle illustrates how excessive inequality and market failure are not isolated problems but interconnected, deepening inefficiencies and welfare losses in the economy.

Key Points of Analysis

Excessive inequality is both a cause and consequence of market failure.

Causes include barriers to human capital, credit restrictions, weak demand, and social instability.

Consequences arise from monopoly power, labour market imperfections, underprovision of merit goods, and capital market biases.

The interaction between cause and consequence creates a self-reinforcing cycle.

Government intervention may be necessary to break the cycle and restore efficiency.

FAQ

Persistent inequality reduces access to education, healthcare, and training, limiting human capital accumulation. This lowers productivity and innovation, restricting an economy’s growth potential.

High inequality can also dampen aggregate demand. Wealthy households save a larger proportion of their income, while poorer households spend more. When income is heavily concentrated, overall consumption falls, creating underutilised capacity and slower growth.

Information failure occurs when consumers or workers lack access to accurate or complete information.

Poorer households may be unaware of opportunities in higher education or employment due to limited guidance.

Employers may discriminate based on incomplete or biased information.

Lack of transparency in credit markets may exclude low-income households.

These failures reinforce inequality, while simultaneously causing inefficient allocation of resources.

High inequality can lead to greater crime, unrest, and social division. These impose external costs on society, such as policing, healthcare, and reduced investor confidence.

Since markets fail to price in these costs, resources are misallocated. Inequality thereby generates negative externalities, both reducing welfare and discouraging investment in affected areas.

Monopolies restrict output and raise prices, transferring income from consumers to producers. This process disproportionately affects poorer households, who spend a larger share of their income on essential goods.

Firms with monopoly power can also use rent-seeking behaviour to protect profits. This entrenches wealth in specific groups and prevents competitive entry, reinforcing inequality across the economy.

Allocative efficiency requires that resources are used where they generate the most welfare. Inequality disrupts this process in several ways:

Limited access to credit prevents investment in high-return opportunities by poorer households.

Underconsumption reduces demand for essential goods and services.

Barriers to human capital restrict productivity growth.

As a result, the distribution of resources is skewed, and the economy operates below its welfare-maximising potential.

Practice Questions

Explain one way in which excessive income inequality can act as a cause of market failure. (3 marks)

1 mark for identifying a relevant way (e.g., restricted access to education, healthcare, or credit).

1 mark for explaining how this limits efficiency (e.g., reduces human capital or productivity).

1 mark for linking to market failure (e.g., misallocation of resources, underutilisation of potential labour force).

(Max 3 marks)

Examine how excessive inequality can be both a cause and a consequence of market failure. (6 marks)

Up to 2 marks for explaining inequality as a cause of market failure (e.g., weak demand due to low marginal propensity to consume, restricted access to credit/education).

Up to 2 marks for explaining inequality as a consequence of market failure (e.g., monopoly power transferring wealth, labour market discrimination, underprovision of merit goods).

Up to 2 marks for clear analysis of the cyclical relationship, showing how inequality and market failure reinforce one another.

(Max 6 marks)