AQA Specification focus:

‘Students should understand that the degree of inequality can be measured but that whether or not a given distribution of income is equitable (fair and just) involves a value judgement.’

Introduction

When analysing income and wealth distribution, economists must consider both measurable inequality and subjective fairness. Deciding whether a distribution is equitable always requires value judgements.

Measuring Inequality vs Assessing Equity

Measuring Inequality

Inequality refers to the degree of variation in income or wealth across individuals or households. It can be objectively measured through tools such as:

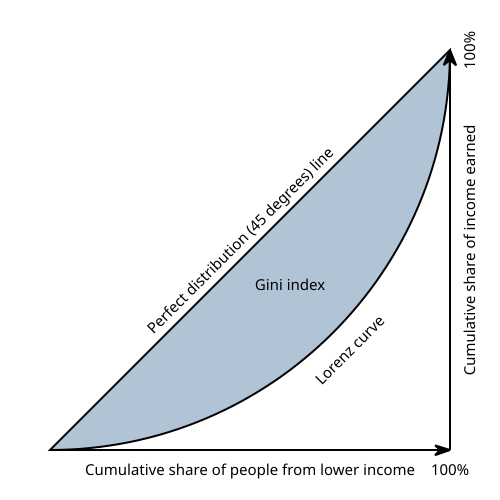

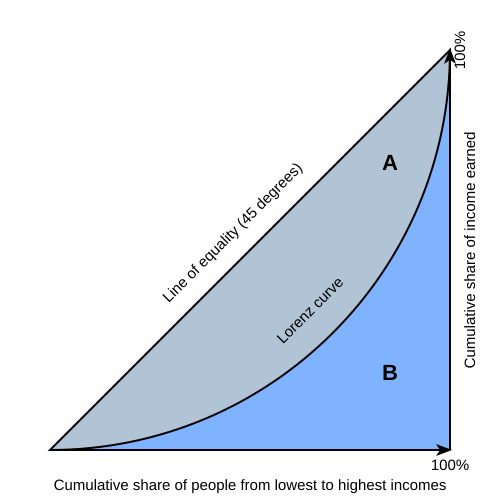

Lorenz curves – graphical representation of cumulative income distribution.

Gini coefficients – a numerical index (0 = perfect equality, 1 = perfect inequality).

These measures provide quantifiable evidence of how income and wealth are spread, but they do not indicate whether the distribution is “fair.”

The Lorenz curve graphically depicts income distribution within a population. The closer the curve is to the line of perfect equality, the more equitable the distribution. Source

The Gini coefficient is derived from the Lorenz curve, representing the area between the line of perfect equality and the Lorenz curve. A value of 0 indicates perfect equality, while 1 represents maximum inequality. Source

Assessing Equity

Equity is linked to fairness and justice in distribution. Unlike inequality, equity cannot be measured directly because it depends on value judgements influenced by personal beliefs, cultural norms, and political ideologies.

Definition of Key Concepts

Inequality: The measurable extent to which income or wealth is unevenly distributed among individuals or households.

A measurable inequality does not automatically imply unfairness. Economists must then ask whether outcomes align with principles of equity.

Equity: A normative concept referring to fairness and justice in the distribution of resources, often debated in relation to economic outcomes.

Sources of Value Judgements in Equity Assessment

Political Ideologies

Left-leaning perspectives often argue that high inequality undermines social justice and economic stability, supporting redistribution policies.

Right-leaning perspectives may see inequality as a natural outcome of differing skills, effort, and productivity, viewing redistribution as harmful to incentives.

Philosophical Principles

Utilitarianism: Fairness achieved if overall welfare is maximised, even if inequality exists.

Rawlsian justice: A distribution is fair only if the position of the least advantaged is maximised.

Libertarianism: Fairness means respecting individual rights and voluntary exchanges, regardless of unequal outcomes.

Social and Cultural Norms

Societies differ in what they consider acceptable inequality. For example:

In some countries, large income gaps are tolerated if social mobility is strong.

In others, even moderate inequality may be seen as unjust if opportunities are perceived as unequal.

Why Value Judgements Matter

Policy Implications

Whether inequality is seen as fair or unfair influences economic policies. For instance:

Supporters of progressive taxation see redistribution as necessary to correct unfair outcomes.

Opponents may argue such policies reduce incentives and damage efficiency.

Determining Acceptable Trade-offs

Policies often involve balancing equity vs efficiency:

Greater redistribution may enhance fairness but reduce productivity.

Lower redistribution may improve incentives but create social tensions.

Different Views of Fairness

Equality of Outcome vs Equality of Opportunity

Equality of outcome: Everyone should have similar levels of income and wealth.

Equality of opportunity: Everyone should have a fair chance, even if outcomes differ.

Equality of opportunity: A fairness principle stating that all individuals should have the same initial chances to succeed, regardless of background.

This distinction is central to debates over the equity of income distribution.

Horizontal vs Vertical Equity

Horizontal equity: People in similar circumstances should be treated equally (e.g., equal incomes taxed equally).

Vertical equity: Those with greater ability to pay should contribute more (e.g., progressive taxation).

Case Study Relevance for Students

While the specification does not require calculation, students should understand that measured inequality does not equate to unfairness. Whether a given distribution is equitable depends on:

The lens through which fairness is assessed.

The role of political, social, and ethical frameworks.

The willingness of society to trade efficiency for equity.

Key Takeaways for AQA Economics

Inequality can be measured using statistical tools like the Gini coefficient.

Equity cannot be measured in the same way because it depends on value judgements.

Whether a distribution is equitable depends on ideologies, cultural context, and views of fairness.

Policymaking is strongly shaped by these value judgements, making equity a contested and normative concept.

FAQ

Cultural values strongly influence whether a distribution is seen as fair. In collectivist societies, equity may be linked to community wellbeing, whereas individualist cultures often prioritise merit and personal achievement.

Public tolerance of inequality can differ: some societies accept wide income gaps if opportunities exist for upward mobility, while others demand narrower outcomes regardless of opportunity.

Positive analysis describes measurable outcomes, such as the Gini coefficient or Lorenz curve. These show inequality levels but do not judge whether they are fair.

Value judgements enter when deciding if a measured level of inequality is acceptable. Economists must therefore distinguish between objective evidence and normative conclusions influenced by ideology or ethics.

Policymakers bring different political and philosophical frameworks.

A progressive policymaker may see high inequality as unfair and propose redistribution.

A market-oriented policymaker may argue inequality reflects effort and skill, therefore fair.

The same data can thus support opposing policies depending on underlying value judgements.

Equality of outcome views fairness as similar incomes and wealth across society, regardless of differences in ability or effort.

Equality of opportunity focuses on ensuring equal starting conditions, such as access to education or healthcare. Here, unequal outcomes are acceptable if the competition was fair.

Complete agreement is unlikely, as fairness is inherently subjective. Different groups emphasise efficiency, social justice, or individual freedom.

Consensus may occur only on extreme cases, such as condemning poverty that denies basic needs. Beyond that, debates reflect deep value judgements and cannot be resolved purely by economic measurement.

Practice Questions

Explain the difference between inequality and equity in the distribution of income and wealth. (2 marks)

1 mark for identifying that inequality can be measured objectively, e.g., by tools such as the Lorenz curve or Gini coefficient.

1 mark for explaining that equity is about fairness or justice in distribution, which is a value judgement and cannot be measured in the same way.

Discuss how value judgements influence whether a given distribution of income and wealth is considered equitable. (6 marks)

1–2 marks: Basic reference to value judgements being subjective and shaped by personal, cultural, or political views.

1–2 marks: Application of different perspectives (e.g., left-wing vs right-wing, equality of opportunity vs equality of outcome, or philosophical approaches such as Rawlsian justice or utilitarianism).

1–2 marks: Clear explanation of how these views lead to different conclusions on fairness (e.g., some see redistribution as necessary for equity, others see it as damaging to incentives).

Maximum 6 marks awarded for well-structured, relevant discussion with clear economic reasoning.