AP Syllabus focus:

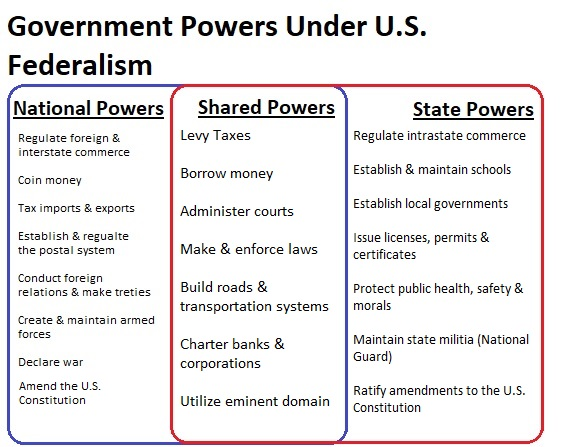

‘Concurrent powers are shared by both levels of government, including collecting taxes, making and enforcing laws, and building infrastructure such as roads.’

Concurrent powers show how American federalism works day to day: state and national governments often act in the same policy space. This overlap expands governing capacity but also creates coordination problems and political conflict.

Core idea: shared authority in a federal system

Venn diagram of U.S. federalism showing powers reserved to the states, powers delegated to the national government, and the shared (concurrent) powers in the overlap. This helps you visualize why concurrent powers create both expanded governing capacity and potential intergovernmental conflict. Use it as a quick “map” for categorizing examples like taxation, law enforcement, and infrastructure. Source

What “concurrent” means

Concurrent powers: Powers exercised by both the national and state governments at the same time within the same territory.

Concurrent powers are a practical necessity because governing a large, diverse country requires both national capacity and state-level responsiveness. They also ensure that neither level is the only provider of key public functions.

Why the Constitution permits overlap

Concurrent powers are implied by the structure of federalism (divided sovereignty) and by the fact that many essential government tasks are not exclusive by nature. The same activity—like taxing or law enforcement—can be carried out by different governments for different purposes.

Concurrent powers in practice (AP-required examples)

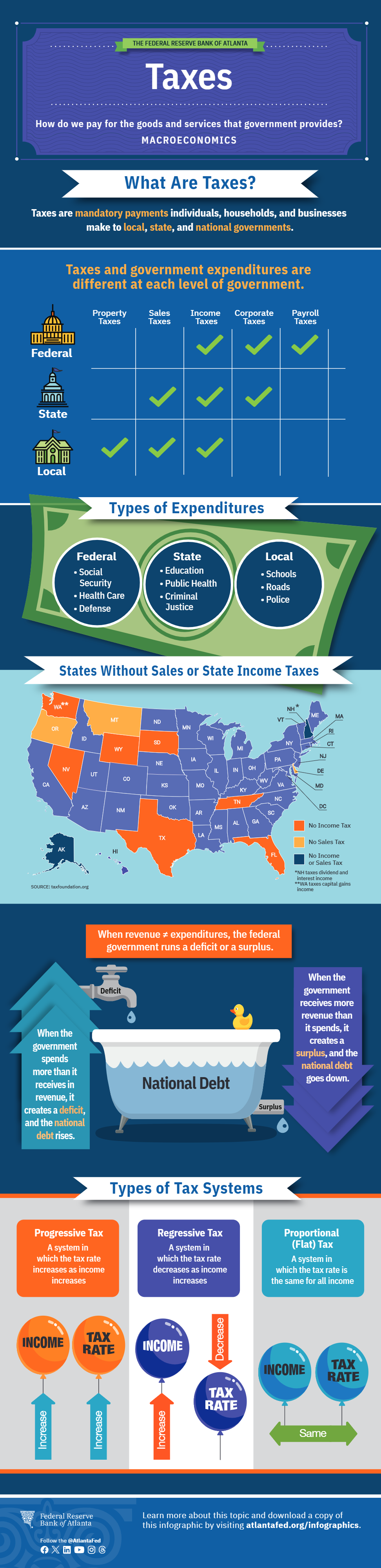

Collecting taxes

Both the federal government and states can collect taxes to raise revenue for public programs.

Infographic explaining what taxes are and how different levels of government (federal, state, local) raise revenue through different tax types (e.g., income, sales, property, payroll). It visually reinforces the idea of concurrent taxing power by showing how multiple tax systems operate at the same time over the same people and territory. The labeled layout also helps connect revenue collection to public programs and services. Source

Key practical features:

Different tax bases and rates can coexist (e.g., federal income taxes alongside state income and sales taxes).

Each level uses taxation to pursue its own budget priorities and policy goals.

Overlap increases total revenue capacity but can create political debate about tax burden and fairness.

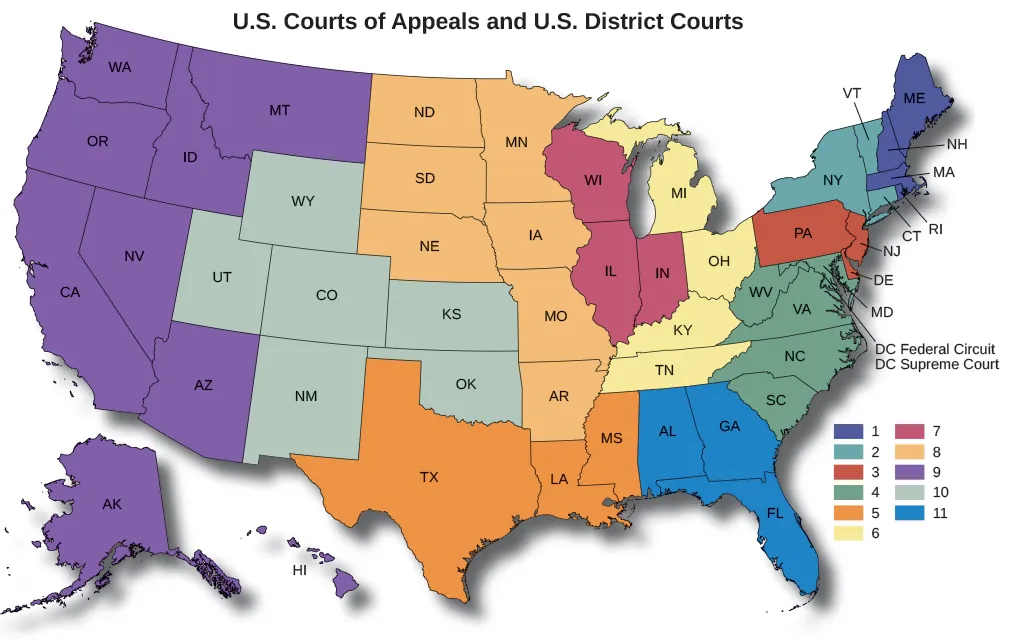

Making and enforcing laws

Both levels can make and enforce laws, meaning they can legislate and use executive agencies (and state/local law enforcement) to implement rules.

How overlap typically looks:

States pass statutes covering issues within their jurisdictions, while Congress passes national laws within federal authority.

Enforcement can involve parallel institutions (state police and courts; federal agencies and federal courts).

Map of U.S. judicial circuits (Courts of Appeals) and district court regions, illustrating how federal legal authority is organized geographically. This is useful for understanding how federal enforcement and litigation are routed through federal institutions alongside state courts and law enforcement. It also helps clarify what “jurisdiction” means in practice when laws are made and enforced concurrently. Source

Policy differences among states can persist even when the federal government also regulates in the same broad area.

Common consequences of shared lawmaking and enforcement:

Multiple “venues” for political action: groups can lobby state legislatures, Congress, governors, or federal agencies depending on where they expect success.

Variation in enforcement capacity: states may differ in funding, staffing, and administrative competence, affecting how consistently laws are applied.

Building infrastructure such as roads

Both levels help build infrastructure such as roads, reflecting shared responsibility for commerce, safety, and economic development.

In practice, infrastructure concurrency often involves:

Joint planning across jurisdictions when roads connect regions and states.

Separate but complementary systems (state highways, federally supported interstate routes, local streets).

Layered funding and administration, where different governments contribute resources and set standards relevant to their responsibilities.

Benefits and tensions created by concurrent powers

Benefits: capacity, redundancy, and responsiveness

Concurrent powers can:

Increase governing capacity by allowing multiple governments to address public needs.

Provide redundancy if one level lacks resources or political will.

Support experimentation, as states can adopt different approaches while the federal government also acts within its domain.

Tensions: duplication, inconsistency, and conflict

Because both levels operate simultaneously, concurrent powers can produce:

Duplication of administrative effort (multiple bureaucracies addressing similar problems).

Inconsistent rules across jurisdictions that complicate compliance for individuals and businesses.

Disputes over which level should act, especially when policy goals diverge.

When conflict occurs, resolution often depends on political negotiation, administrative coordination, and court interpretation of whether a government acted within its lawful authority.

Key vocabulary to use precisely

Concurrent powers: shared powers (taxing, lawmaking/enforcement, infrastructure).

Jurisdiction: the legal authority of a government to act in a particular area.

Implementation: turning laws into practice through agencies, rules, and enforcement.

FAQ

Yes, both can tax the same taxpayer or activity under separate legal authority.

“Double taxation” is often a political complaint rather than a constitutional rule.

Some conduct can violate both state and federal law.

This can permit separate prosecutions by different sovereigns, depending on the offence and jurisdiction.

All can be involved.

Federal role often focuses on nationwide networks and standards

States manage major state routes

Local governments handle most streets and maintenance

No. Shared authority allows variation.

States may adopt different legal rules or enforcement priorities even when the national government also legislates in the same broad area.

They use administrative agreements, shared planning processes, and joint task forces.

Coordination is often driven by practical needs like interoperable systems, staffing, and consistent enforcement expectations.

Practice Questions

Question 1 (2 marks) Define concurrent powers and identify two examples.

1 mark: Defines concurrent powers as powers shared by both national and state governments.

1 mark: Identifies two valid examples (any two of: collecting taxes; making laws; enforcing laws; building infrastructure such as roads).

Question 2 (6 marks) Explain how concurrent powers shape policymaking in the United States. In your answer, describe one benefit and one tension created by shared authority, using an example for each.

1 mark: Accurate explanation that concurrent powers create overlapping national and state roles in policymaking.

1 mark: Describes a benefit (e.g., greater governing capacity, redundancy, responsiveness).

1 mark: Provides a relevant benefit example linked to a concurrent power (e.g., both levels raising revenue through taxes to fund services).

1 mark: Describes a tension (e.g., duplication, inconsistency, intergovernmental conflict).

1 mark: Provides a relevant tension example linked to a concurrent power (e.g., overlapping law enforcement creating conflicting rules or uneven enforcement).

1 mark: Clear linkage between the example(s) and how shared authority affects real policymaking outcomes.