AP Syllabus focus:

‘Power distribution is reflected in funding tools: revenue sharing has few restrictions and is least used, block grants have minimal restrictions and are preferred by states, and categorical grants are restricted, preferred by the national government, and most commonly used.’

Intergovernmental grants are a major way the national government shapes state and local policy. Understanding revenue sharing, block grants, and categorical grants clarifies how federalism operates through money, rules, and administrative leverage.

Intergovernmental Grants and Federalism

Intergovernmental grants are transfers of funds from the national government to state or local governments to support public purposes.

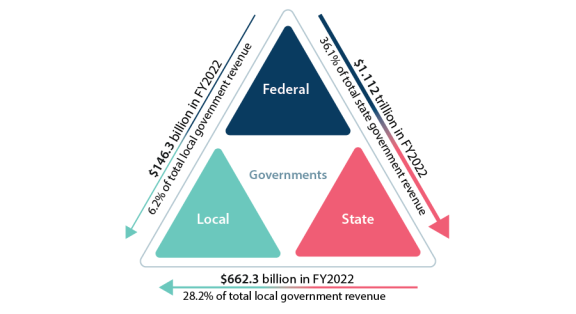

Figure: Federal funds flowing to state and local governments. This chart visualizes the distribution of federal funds across levels of government, helping students connect grant programs to real fiscal pathways. It reinforces why grants are such a powerful federalism tool: the national government can influence subnational policy by structuring where and how money enters state and local budgets. Source

Grants are policy tools: they can encourage state cooperation, standardise programmes nationally, or allow local flexibility.

Intergovernmental grants: Federal funds provided to state and local governments, often with conditions that shape how the money is spent.

Because the Constitution limits direct federal control over many state functions, grants allow influence through spending power rather than direct command. The key differences across grant types are the degree of restriction (rules and conditions) and the political preferences they create between national and state officials.

Categorical Grants (Most Common; Most Restricted)

Categorical grants provide money for a specific, narrowly defined purpose and typically come with detailed federal rules. The syllabus emphasises that categorical grants are restricted, are preferred by the national government, and are most commonly used.

Categorical grants: Federal grants targeted to specific programmes, usually accompanied by detailed requirements on eligibility, spending, reporting, and outcomes.

Categorical grants increase national influence because they:

Define allowable uses (e.g., only certain services, populations, or activities)

Require administrative compliance (applications, reporting, audits)

Sometimes include penalties for noncompliance (loss of funds)

From the federal perspective, categorical grants help ensure money supports national priorities and reduces variation among states. From the state perspective, they can create administrative burdens and reduce flexibility, even when states want the funding.

Block Grants (Minimal Restrictions; Preferred by States)

Block grants provide funding for a broader policy area with fewer federal constraints than categorical grants.

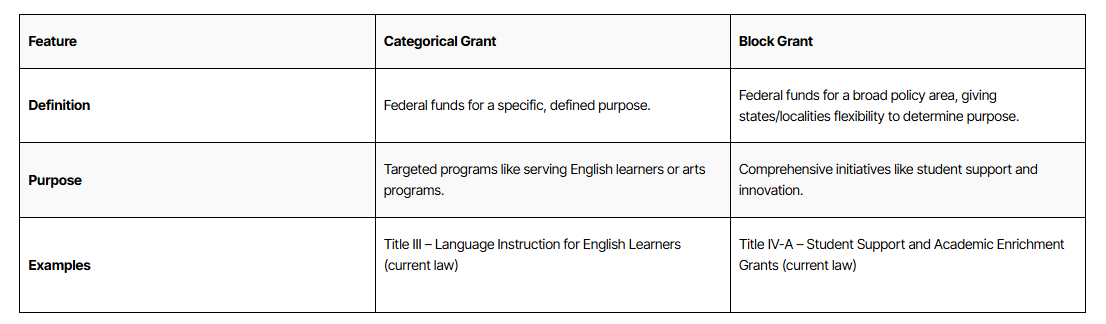

Table: How block grants differ from categorical grants. The table contrasts each grant type’s defining purpose and the typical level of flexibility granted to states/localities. It visually reinforces the key AP Gov takeaway: categorical grants are more targeted and rule-bound, while block grants bundle funding into broader areas with more state discretion. Source

The syllabus emphasises that block grants have minimal restrictions and are preferred by states.

Block grants: Federal grants for broad policy areas (such as health or community development) that give states discretion to design and administer specific programmes.

Block grants appeal to state and local governments because they:

Allow adaptation to local conditions and priorities

Reduce detailed federal micromanagement

Increase state policymaking discretion within the funded area

However, “minimal restrictions” does not mean “no restrictions.” Block grants still generally require states to spend within the named policy area and meet baseline federal standards, but they offer more room for state innovation and variation.

Revenue Sharing (Few Restrictions; Least Used)

Revenue sharing gives federal money to state and local governments with few restrictions, leaving spending choices largely to recipient governments. The syllabus emphasises revenue sharing has few restrictions and is least used.

Revenue sharing: Broad federal transfers to state and local governments with few or no programme-specific conditions, allowing recipients wide discretion in how to spend the funds.

Revenue sharing is least used because it offers the national government limited control over policy outcomes. When Congress and the president want measurable national results, they tend to choose categorical grants over broad, flexible transfers.

Comparing the Three Grant Types (What to Remember)

The syllabus comparison is primarily about restrictions, usage, and political preference:

Revenue sharing: few restrictions, least used

Block grants: minimal restrictions, preferred by states

Categorical grants: restricted, preferred by the national government, most commonly used

In federalism terms, these grant types function as different “dials” of national influence:

More restrictions (categorical) increase federal control and standardisation.

Fewer restrictions (block and revenue sharing) increase state discretion and policy diversity.

FAQ

To gain state buy-in when federal goals are broad or politically contested.

It can also reduce administrative oversight costs and allow faster distribution when uniform outcomes are not required.

Common restrictions include:

Eligibility rules (who can be served)

Maintenance-of-effort requirements (states must keep their own spending level)

Reporting, auditing, and performance benchmarks

They typically increase variation.

States can prioritise different subprogrammes, set different eligibility thresholds, and choose distinct implementation strategies within the same broad funding category.

Critics argue it:

Weakens accountability for federal tax dollars

Funds state priorities that may conflict with national goals

Makes it harder to evaluate whether federal spending achieved specific results

Yes.

Congress can rewrite authorising statutes to add or remove conditions, change allowable uses, or restructure programmes, effectively moving a programme along the spectrum from flexible to restrictive (or vice versa).

Practice Questions

(2 marks) Identify two differences between categorical grants and block grants.

1 mark: Categorical grants are more restricted/specific; block grants are broader.

1 mark: Categorical grants are preferred by the national government / block grants are preferred by states (or block grants have fewer restrictions than categorical).

(6 marks) Explain how revenue sharing, block grants, and categorical grants reflect different distributions of power between the national government and the states.

1 mark: Revenue sharing has few restrictions and gives states/localities wide discretion.

1 mark: Revenue sharing is least used because it provides limited federal control over outcomes.

1 mark: Block grants have minimal restrictions and allow states flexibility within a broad policy area.

1 mark: Block grants are preferred by states because they preserve state discretion.

1 mark: Categorical grants are restricted and target specific purposes with federal requirements.

1 mark: Categorical grants are preferred by the national government and are most commonly used to shape state policy implementation.