AP Syllabus focus:

‘Mandates are requirements imposed by the national government on states; they shape federal–state responsibilities and influence policy implementation and budgeting.’

State and national governments often share policy goals, but they do not always share the same preferences or resources. Mandates are a major tool the national government uses to direct state action and structure intergovernmental responsibilities.

What Mandates Are

Mandates are most visible when Congress, federal agencies, or federal courts require states (and often local governments) to meet minimum national standards in areas largely administered by states.

This figure uses the Clean Air Act to illustrate an unfunded mandate: the federal government sets nationwide environmental standards, but states are responsible for designing and carrying out implementation plans. It concretely shows how a national requirement can standardize outcomes while leaving day-to-day administration at the state level. Source

Mandate: A requirement imposed by the national government that directs state (or local) governments to take a specific action, comply with a standard, or prohibit certain practices.

Mandates matter in federalism because many programs rely on state implementation, so federal requirements can effectively nationalise outcomes even when delivery remains state-run.

Where Mandates Come From

Mandates typically arise through:

Federal statutes (laws passed by Congress)

Administrative rules (regulations issued by executive agencies under delegated authority)

Judicial decisions (court orders interpreting constitutional or statutory rights)

How Mandates Shape Federal–State Responsibilities

Mandates reallocate responsibility by defining who must do what, by when, and with what accountability. The national government can:

Set uniform rules to reduce variation among states

Shift administrative burdens to states while retaining federal oversight

Expand or clarify rights protections by requiring state compliance procedures

Standardise enforcement in policy areas where states might otherwise under-enforce

Policy Implementation Effects

Because states implement many policies, mandates influence day-to-day governance by requiring states to:

Create or modify agencies, compliance offices, and reporting systems

Train personnel and update procedures to meet federal benchmarks

Collect data and submit documentation to demonstrate compliance

Coordinate across state and local units when responsibilities are fragmented

These requirements can reshape state priorities by elevating federally mandated tasks over optional state initiatives.

Budgeting Effects: Costs, Trade-offs, and Fiscal Stress

Mandates directly affect state budgeting because compliance often carries administrative and programmatic costs (staffing, technology, audits, service delivery).

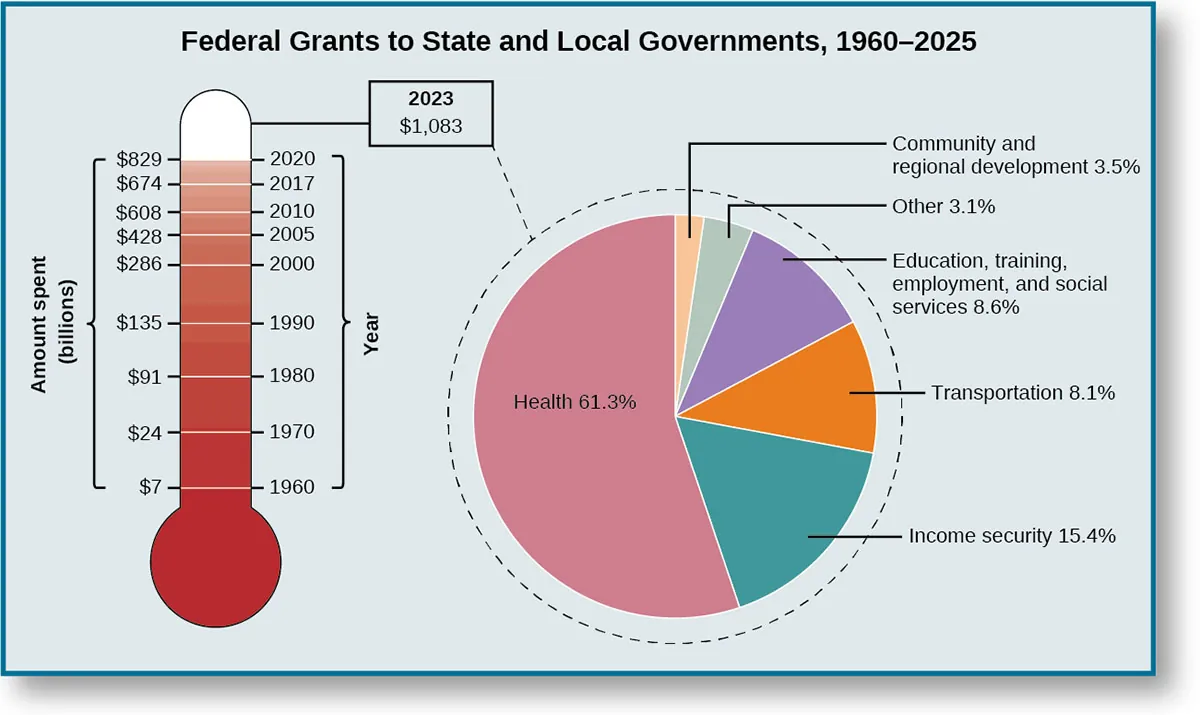

This figure visualizes the long-run rise in federal grants to state and local governments and shows how grant dollars are distributed across major policy areas. It provides budgeting context for why states may experience fiscal pressure when federal requirements increase—especially in areas where intergovernmental funding is central to service delivery. Source

When costs rise, state governments may respond by:

Reallocating funds away from other state programs

Increasing state or local revenues (where politically feasible)

Reducing service levels in non-mandated areas

Lobbying Congress or agencies for flexibility, waivers, or funding

Unfunded mandate: A federal requirement that state or local governments must meet without sufficient federal funding to cover compliance costs.

Unfunded mandates are especially contentious because they can create a gap between federal policy ambition and state fiscal capacity.

Conditionality and Leverage

Even without directly ordering states to act, the national government can encourage compliance by linking requirements to participation in federal programs or to receiving funds. This can blur the line between a “choice” and a practical necessity for states that rely on federal support.

Types of Mandates Students Should Recognise

Mandates vary by what they demand and how they are enforced:

Procedural mandates: require specific processes (reporting, hearings, recordkeeping)

Substantive mandates: require meeting outcome standards (service levels, protections)

Funded mandates: include federal resources to support compliance

Unfunded mandates: shift costs primarily to states/localities

Mandates can also differ in flexibility:

One-size-fits-all requirements limit state discretion

Performance-based requirements allow states to choose methods if they meet standards

Accountability and Federalism Tensions

Mandates create recurring tensions about democratic accountability:

Voters may blame state officials for unpopular policies that are federally required

State leaders may argue mandates weaken state autonomy

National officials may argue mandates protect rights and ensure fair, consistent treatment across states

Enforcement mechanisms (audits, penalties, litigation risk, or loss of program eligibility) strengthen federal influence, but also increase administrative complexity and conflict over who should pay and who should decide.

FAQ

States often build compliance units, set internal performance metrics, and create reporting pipelines.

Common tools include:

scheduled audits and internal reviews

data dashboards and standardised forms

interagency memoranda to clarify responsibility

States may consolidate programmes, centralise purchasing, or standardise training.

They may also:

automate reporting to reduce staff time

renegotiate contracts with local providers

prioritise the least-cost methods that still meet federal thresholds

Yes. States frequently “pass through” requirements to counties, cities, and school districts because they deliver services.

This can create:

local budget strain

uneven capacity across communities

disputes over who pays for compliance

Variation can persist due to differences in administrative capacity, geography, and baseline infrastructure.

Enforcement intensity may also differ because of:

staffing levels in oversight agencies

political willingness to prioritise compliance

litigation risk and settlement choices

Waivers can temporarily relax or modify requirements to give states flexibility.

They are often used to:

test alternative approaches

accommodate capacity limits

reduce short-term fiscal pressure while maintaining core federal goals

Practice Questions

(2 marks) Define a federal mandate and explain one way it can affect state budgeting.

1 mark: Accurate definition of a mandate (federal requirement imposed on states/localities).

1 mark: Explains a budgeting effect (e.g., compliance costs force spending shifts, new administrative expenses, or revenue pressures).

(6 marks) Explain how federal mandates shape federal–state responsibilities and create tension within American federalism. In your answer, refer to policy implementation and budgeting.

1 mark: Describes how mandates assign duties/standards to states (responsibility-shaping).

1 mark: Links mandates to implementation changes (procedures, reporting, enforcement, administration).

1 mark: Explains budgeting impacts (direct compliance costs, opportunity costs).

1 mark: Identifies a federalism tension (state autonomy vs national standards/rights).

1 mark: Explains accountability tension (blame/credit mismatch between federal and state officials).

1 mark: Notes enforcement/leverage (penalties, oversight, conditions) as a driver of tension.