AQA Specification focus:

‘The principles of taxation, such as that taxes should be equitable.’

Introduction

Taxation is a crucial government tool for raising revenue and shaping behaviour. Its design must follow established principles of taxation to ensure fairness, efficiency, and economic stability.

The Role of Principles in Taxation

The principles of taxation guide how governments should design and levy taxes. They help balance equity, efficiency, certainty, convenience, and administrative simplicity while ensuring governments meet revenue needs.

Adam Smith’s Canons of Taxation

Adam Smith’s classical framework, known as the Four Canons of Taxation, remains influential in evaluating tax systems.

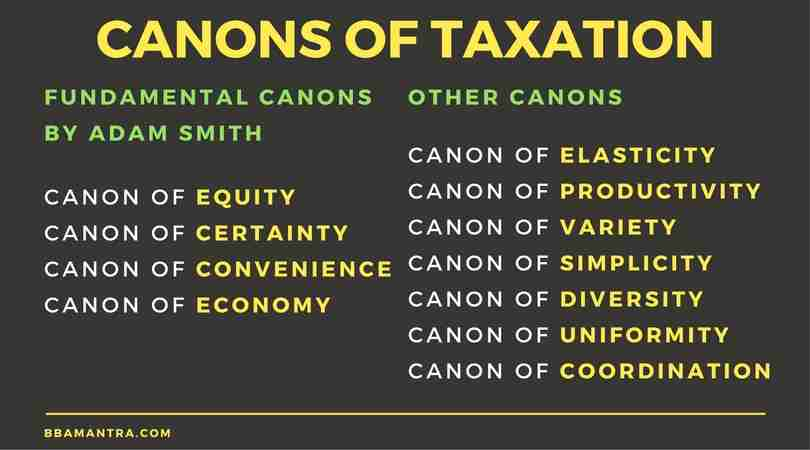

This diagram illustrates Adam Smith's Four Canons of Taxation: equity, certainty, convenience, and economy. These principles serve as foundational guidelines for evaluating tax systems. Source

Equity (Fairness) – taxes should be just and proportionate to ability to pay.

Certainty – the taxpayer should clearly know when, how, and how much tax to pay.

Convenience – tax collection should be convenient for taxpayers.

Economy (Efficiency) – the cost of tax collection should be minimal relative to revenue raised.

Equity in Taxation

Equity is often seen as the most important principle because it underpins the perceived legitimacy of a tax system.

Equity in Taxation: The principle that taxation should be fair, with individuals contributing according to their ability to pay.

Horizontal and Vertical Equity

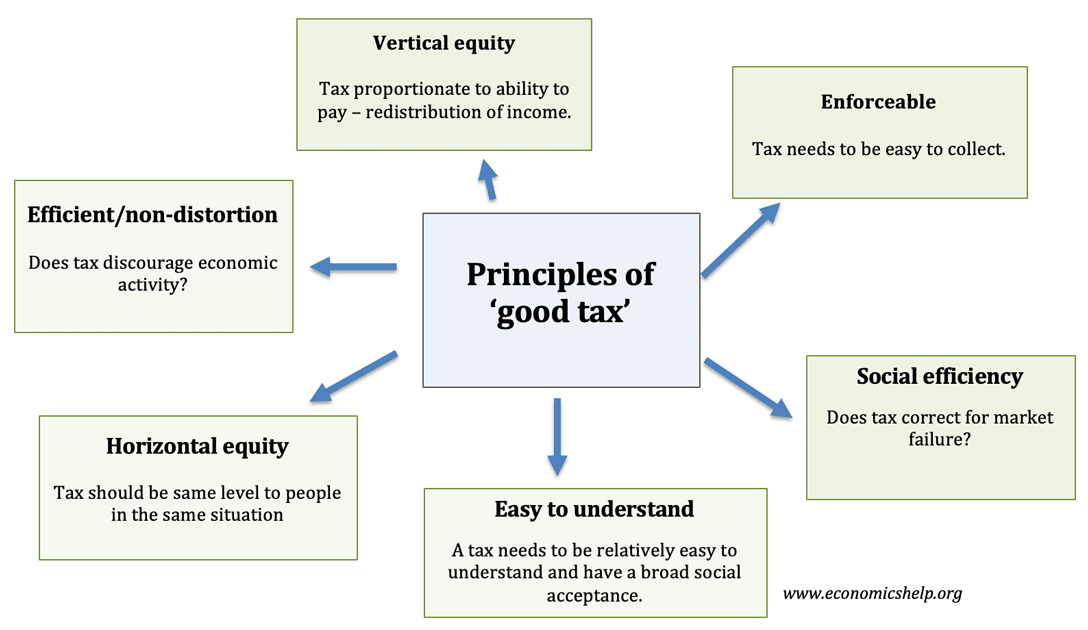

Horizontal equity: People with the same ability to pay should contribute equally. For example, two individuals earning the same income should face the same tax burden.

Vertical equity: Those with greater ability to pay should contribute proportionately more. This supports progressive taxation, where higher earners face higher average tax rates.

Efficiency and Incentives

Taxes should avoid distorting economic behaviour excessively. For example:

High income taxes might discourage work or entrepreneurship.

High corporate taxes could deter investment.

Excessive consumption taxes could reduce spending and harm demand.

Tax Efficiency: A principle that taxation should raise necessary revenue with minimal distortion of economic decisions and incentives.

Certainty and Predictability

A good tax system must be predictable. If individuals and firms cannot anticipate tax liabilities, investment and spending decisions may be disrupted. Certainty also reduces opportunities for avoidance and evasion.

Convenience in Payment

Taxes should be easy for citizens to pay. Examples include:

PAYE (Pay As You Earn) systems that automatically deduct income tax from wages.

VAT collection at point of sale, reducing administrative effort for individuals.

Convenience supports compliance and reduces resistance to taxation.

Administrative Simplicity

The costs of assessing, collecting, and enforcing taxes should be low relative to the revenue generated. Complex systems raise compliance costs for businesses and administrative burdens for government.

Administrative Simplicity: The principle that a tax system should be straightforward and inexpensive to administer.

Additional Modern Principles

Beyond Smith’s framework, modern economies recognise additional taxation principles:

Flexibility

Tax systems should be adaptable to changing economic conditions.

For example, temporary surcharges may be introduced during crises.

Revenue Adequacy

Taxes must provide sufficient revenue to finance government spending commitments.

Under-collection risks budget deficits; over-collection may reduce private sector efficiency.

Neutrality

Taxes should not give undue advantage to one activity or group over another.

For example, consistent VAT treatment across goods avoids distortions in consumer choices.

This diagram highlights essential principles of a good tax system, such as equity, efficiency, and simplicity, aligning with the study notes' emphasis on these qualities. Source

Equity vs. Efficiency Trade-Off

Tax policy often faces a tension between equity and efficiency:

Progressive taxation supports fairness but may reduce incentives to work or invest.

Lower tax rates encourage growth but may increase inequality.

Governments must balance these competing aims when designing fiscal systems.

Applying Principles to UK Taxation

The UK system provides examples of these principles in practice:

Equity: Progressive income tax ensures vertical equity, while personal allowances reflect horizontal fairness.

Certainty: Standardised tax codes provide predictability, though frequent changes can undermine this.

Convenience: PAYE system simplifies collection.

Economy: HMRC uses digital systems to reduce costs, though tax avoidance schemes highlight weaknesses.

Neutrality: Efforts are made to reduce distortions, but policies such as VAT exemptions complicate neutrality.

Evaluation of Principles in Practice

While the principles of taxation provide strong guidelines, real-world systems face challenges:

Equity disputes: Debates over whether taxation should prioritise redistribution (equity) or growth (efficiency).

Administrative complexity: UK’s tax code is among the world’s longest, undermining simplicity.

Certainty issues: Regular budget announcements alter tax liabilities, creating uncertainty for firms and households.

Global pressures: Tax competition between countries limits governments’ ability to impose high rates on mobile capital.

FAQ

Equity can be interpreted differently. Some argue fairness means everyone pays the same rate, while others believe those with higher incomes should pay proportionally more.

This controversy often reflects political ideology. For instance, progressive taxation supports redistribution, whereas flat taxes emphasise simplicity and neutrality.

Horizontal equity means individuals with equal incomes pay the same amount of tax. Vertical equity requires those with higher incomes to pay a greater share.

In practice, vertical equity is reflected in progressive income tax systems, while horizontal equity is supported by uniform tax treatment across individuals in similar circumstances.

Simpler tax systems reduce administrative costs but can limit fairness.

Flat taxes are simple but often criticised for lacking vertical equity.

Progressive systems enhance equity but introduce complexity through bands, exemptions, and reliefs.

Governments aim for a balance by combining basic allowances with progressive structures.

Certainty reduces taxpayer anxiety and prevents economic decisions being distorted by unpredictable tax burdens.

Without clear rules, individuals may over-save to cover potential liabilities, while businesses might delay investment. Predictability builds trust in the system and encourages compliance.

When systems are easy to understand and pay into, compliance rates improve.

Complex codes increase errors and avoidance opportunities, particularly for firms with access to tax specialists. Online filing systems, automated deductions, and digital reporting are examples of measures that promote simplicity and compliance.

Practice Questions

Define the principle of equity in taxation. (2 marks)

1 mark for stating that equity refers to fairness in taxation.

1 mark for mentioning that it relates to individuals contributing according to their ability to pay (e.g., horizontal or vertical equity).

Explain how Adam Smith’s principles of taxation can be applied to evaluate the effectiveness of a country’s tax system. (6 marks)

1 mark for identifying equity (fairness and ability to pay).

1 mark for identifying certainty (clarity and predictability of tax liability).

1 mark for identifying convenience (ease of payment for taxpayers).

1 mark for identifying economy/efficiency (low administrative costs).

Up to 2 additional marks for application and explanation:

Linking principles to real-world tax systems (e.g., PAYE system supporting convenience).

Explaining how adherence to these principles strengthens compliance and revenue collection.