AQA Specification focus:

‘The role of the Office for Budget Responsibility.’

The Office for Budget Responsibility (OBR) plays a central role in the UK’s fiscal framework, ensuring transparency and accountability in government spending, taxation, and borrowing decisions.

Introduction

The OBR provides independent analysis of the UK’s public finances, assessing the sustainability of government policies, forecasting economic outcomes, and monitoring compliance with fiscal targets.

The Purpose of the OBR

The OBR was established in 2010 to enhance credibility in fiscal policy. Before its creation, governments had more scope to present optimistic projections. The OBR aims to reduce political bias by producing objective and evidence-based forecasts.

Office for Budget Responsibility (OBR): An independent public body that provides impartial analysis of the UK’s public finances, including forecasts and evaluations of fiscal policy.

The OBR’s independence is crucial for ensuring that economic projections are not manipulated for short-term political gain.

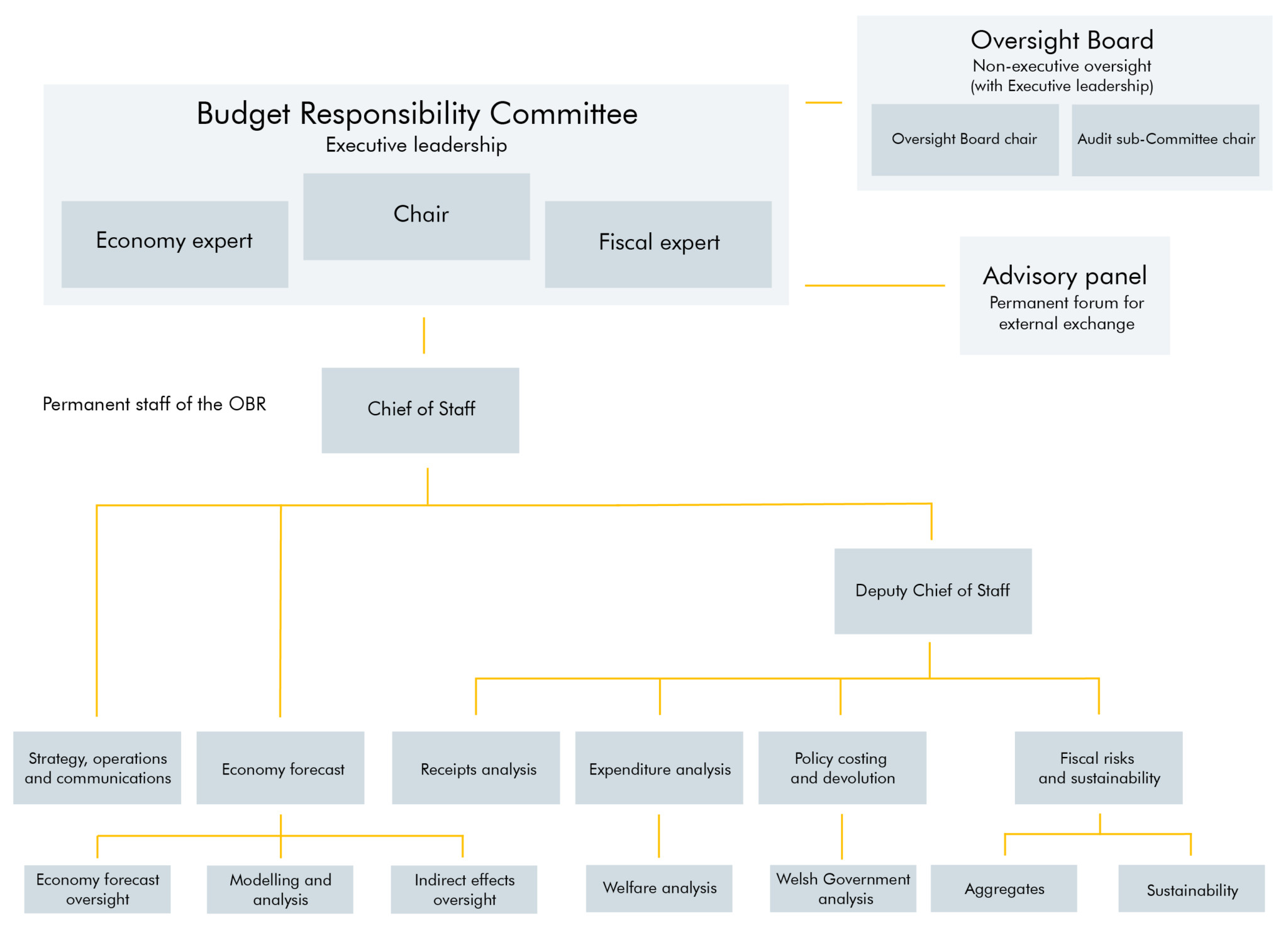

The diagram presents the organisational structure of the Office for Budget Responsibility, highlighting its independent governance and reporting lines, which ensure impartiality in fiscal analysis. Source

Core Functions of the OBR

The OBR has several statutory responsibilities:

Economic forecasting: Produces five-year forecasts for growth, inflation, employment, and other key indicators.

Public finance projections: Forecasts government revenues, spending, borrowing, and debt.

Judging fiscal sustainability: Assesses whether government policies are compatible with long-term fiscal health.

Evaluating performance against fiscal targets: Determines whether the government is meeting rules such as debt reduction or deficit control.

Costing policy changes: Reviews the expected impact of major tax and spending decisions.

Fiscal sustainability: The ability of a government to sustain its current spending, taxation, and borrowing policies without threatening long-term solvency or economic stability.

These functions make the OBR integral to fiscal discipline and policy credibility.

Forecasting and the Budget Process

The OBR produces official forecasts used by the Chancellor when delivering the Budget or Autumn Statement. This means fiscal plans must align with OBR analysis.

Twice a year, the OBR publishes a Economic and Fiscal Outlook (EFO), presenting updated forecasts.

If government policies seem inconsistent with fiscal targets, the OBR highlights these risks publicly.

This transparency increases accountability, as any deviation from commitments such as reducing the deficit becomes visible.

The OBR and Fiscal Rules

Governments often adopt fiscal rules (numerical targets for debt or borrowing). The OBR evaluates whether policies are consistent with these rules.

Fiscal rules: Quantitative limits, usually relating to debt or deficits, designed to guide government fiscal policy over the medium term.

Examples of fiscal rules the OBR monitors include:

Keeping the structural deficit below a set percentage of GDP.

Ensuring debt as a proportion of GDP falls by a specified year.

By reporting when targets are likely to be missed, the OBR discourages irresponsible fiscal behaviour.

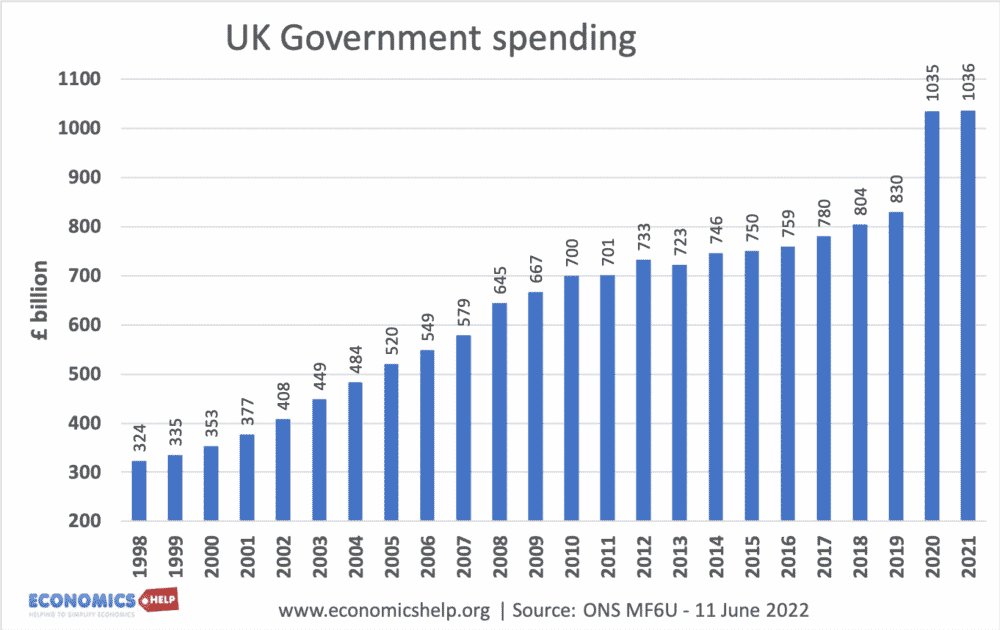

The chart depicts the distribution of UK government spending in 2013, highlighting the allocation of funds across various public services and demonstrating the impact of fiscal policy on economic activity. Source

Impacts on Government Credibility

The OBR increases confidence among:

Financial markets, which rely on credible forecasts for lending decisions.

The public, who gain greater transparency regarding the sustainability of policies.

International institutions (e.g., IMF, credit rating agencies), which monitor fiscal credibility.

This credibility lowers the risk premium on government debt, potentially reducing borrowing costs.

Limitations of the OBR

Although independent, the OBR faces constraints:

It relies on government-provided data and announced policies.

It cannot compel the government to follow its recommendations.

Forecasts are subject to uncertainty, particularly during periods of global instability.

Despite these limitations, its presence greatly enhances scrutiny of fiscal policy.

Relationship to Fiscal Policy and Aggregate Supply/Demand

The OBR’s assessments influence how fiscal policy is perceived in managing aggregate demand (AD) and aggregate supply (AS).

If the OBR highlights risks of excessive borrowing, the government may adopt more restrictive fiscal policy.

If forecasts suggest fiscal space, the government may increase spending or cut taxes.

In this way, the OBR indirectly shapes both short-term demand management and long-term supply-side planning.

Transparency and Accountability

The OBR ensures fiscal decisions are debated openly by:

Publishing detailed reports accessible to the public.

Presenting alternative scenarios to show risks and uncertainties.

Providing scrutiny of government economic assumptions, such as productivity growth or interest rates.

This accountability makes it harder for governments to pursue unsustainable policies without political cost.

Key Publications of the OBR

The OBR’s main outputs include:

Economic and Fiscal Outlook (EFO) – twice yearly forecasts for the economy and public finances.

Fiscal Risks Report (FRR) – analysis of long-term fiscal pressures and potential shocks.

Fiscal Sustainability Report (FSR) – evaluation of demographic and structural challenges affecting future finances.

Welfare Trends Report – review of welfare spending drivers.

These publications provide evidence for parliamentary debate and public discussion of fiscal priorities.

The Wider Role of the OBR in Policy Evaluation

Beyond forecasts, the OBR also assesses the impact of government tax and spending measures. Each significant policy is costed, and the estimates are published. This discourages the use of unfunded commitments, since unrealistic claims are more easily exposed.

Conclusion of Specification Link

The specification emphasises the role of the OBR because students need to understand how independent oversight supports fiscal responsibility. By producing impartial forecasts and evaluations, the OBR strengthens the link between fiscal policy, credibility, and economic performance.

FAQ

The OBR was established following the financial crisis to increase confidence in UK fiscal management. Before its creation, governments often used overly optimistic forecasts.

Its role was designed to separate economic forecasting from political influence, ensuring that future Budgets were built on transparent, impartial data. This institutional change aimed to restore both market and public trust.

HM Treasury is responsible for designing and implementing fiscal policy. The OBR does not set policy but evaluates it.

Key distinctions include:

HM Treasury: policymaking body.

OBR: independent watchdog.

This separation ensures the government is scrutinised by an impartial organisation, improving accountability in fiscal planning.

The OBR is overseen by a Budget Responsibility Committee, usually three senior economists.

They are appointed by the Chancellor but confirmed by the Treasury Select Committee in Parliament, helping safeguard independence.

Their professional backgrounds typically include significant expertise in economics, forecasting, or fiscal policy.

The OBR regularly reports to Parliament through published documents and evidence sessions.

Twice-yearly Economic and Fiscal Outlook reports form the basis of parliamentary debate on fiscal plans.

Committee hearings allow MPs to question OBR officials directly.

This ensures transparency and parliamentary scrutiny of the government’s fiscal strategy.

Critics argue that while independent, the OBR relies on government-supplied data and announced policies.

Other criticisms include:

Forecasts sometimes being inaccurate due to economic shocks.

Limited power, as it cannot enforce fiscal discipline.

Perceived risk of subtle political pressure, despite formal independence.

These concerns highlight the challenges of relying on forecasting in uncertain economic conditions.

Practice Questions

State two core functions of the Office for Budget Responsibility (OBR). (2 marks)

1 mark for each correct function, up to 2 marks.

Acceptable answers include:

Producing forecasts for the UK economy.

Forecasting government revenues and spending.

Evaluating fiscal sustainability.

Assessing whether the government meets fiscal targets.

Costing the impact of major policy changes.

Explain how the independence of the Office for Budget Responsibility (OBR) can enhance the credibility of government fiscal policy. (6 marks)

1–2 marks: Basic understanding of OBR independence (e.g. “The OBR is not controlled by government so its forecasts are unbiased”).

3–4 marks: Clear explanation of how independence improves credibility (e.g. “Because forecasts are impartial, the public and financial markets can trust the figures”).

5–6 marks: Developed analysis, showing wider effects (e.g. “Credible, independent forecasts reduce the chance of governments overstating growth or understating debt. This increases investor confidence, may reduce the cost of borrowing, and strengthens accountability in fiscal policy”).

Maximum: 6 marks.