AQA Specification focus:

‘The types of and reasons for public expenditure.’

Public expenditure plays a central role in shaping economies, influencing demand, supply, and living standards. Understanding its types and underlying reasons is essential.

What Is Public Expenditure?

Public expenditure refers to spending by local, regional, and national governments on goods, services, and transfers. It represents the use of public funds to pursue economic, social, and political objectives.

Public Expenditure: Government spending on goods, services, and transfer payments designed to achieve economic, social, and political objectives.

Public expenditure can be classified into distinct categories depending on its nature and purpose. Each type has implications for aggregate demand (AD), aggregate supply (AS), and wider economic performance.

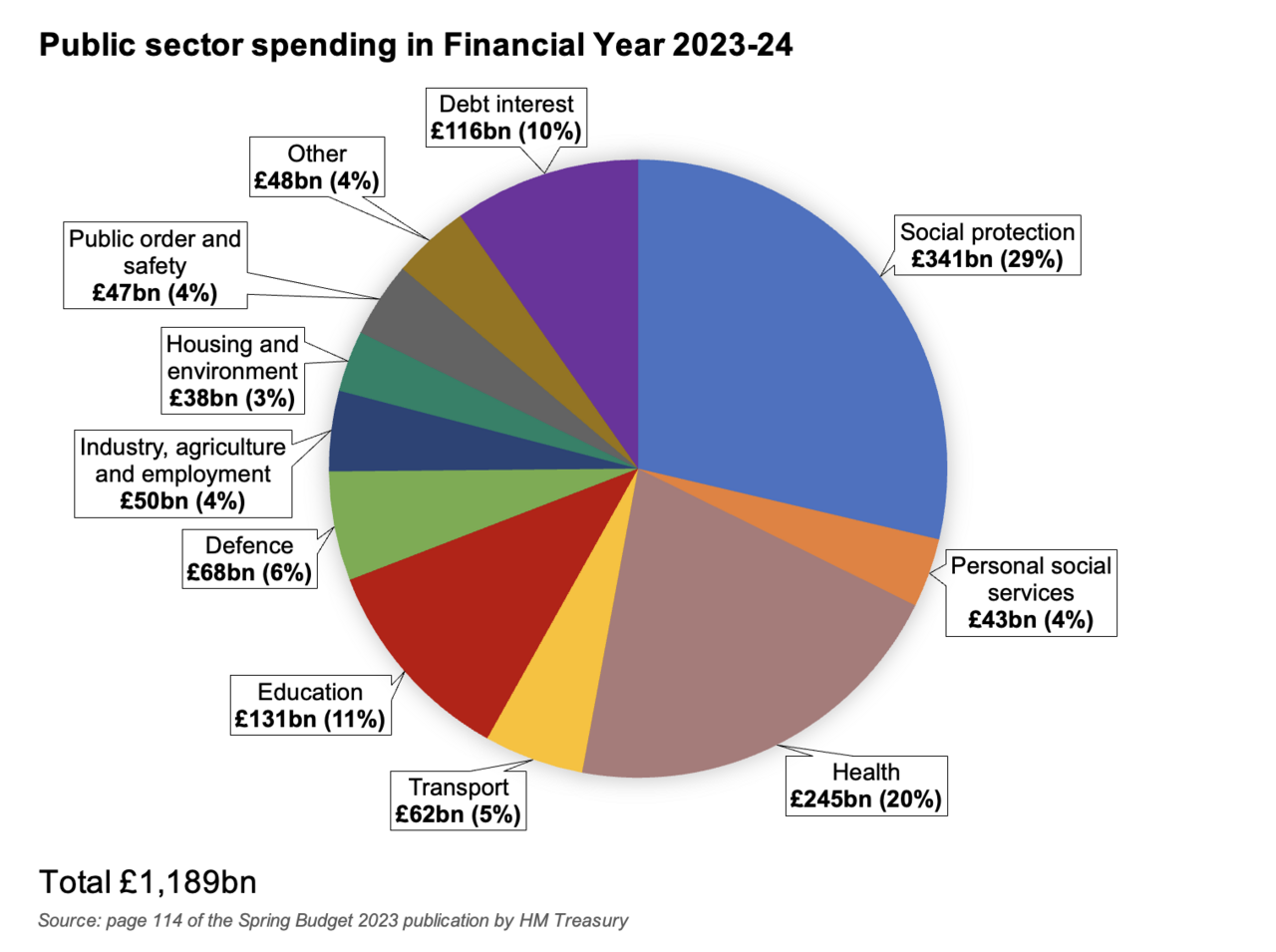

This pie chart displays the distribution of UK government spending for the fiscal year 2023–24, highlighting key areas such as health, education, and debt interest. It serves as a practical example of how public expenditure is allocated across different sectors. Source

Types of Public Expenditure

1. Current Expenditure

This refers to day-to-day spending necessary for running government services.

Examples include:

Wages and salaries of teachers, doctors, and police officers

Maintenance of public buildings and infrastructure

Spending on office supplies or energy bills for public facilities

Key point: Current expenditure is often non-discretionary in the short term, as cutting it may reduce essential services.

2. Capital Expenditure

Capital expenditure involves long-term investment projects. It is designed to create or improve assets that deliver benefits for years to come.

Examples include:

Construction of roads, railways, hospitals, and schools

Defence equipment such as aircraft and ships

Infrastructure supporting renewable energy or technology

Key point: Capital expenditure boosts long-run productive capacity, making it particularly important for aggregate supply.

3. Transfer Payments

Transfer payments are payments made without receiving goods or services in return.

Examples include:

State pensions

Unemployment benefits

Child benefits

Disability allowances

These payments aim to redistribute income and reduce inequality. They directly support household incomes and therefore stimulate aggregate demand.

4. Debt Interest Payments

Governments with outstanding debt must allocate resources to service it. Interest payments on government bonds form a significant share of expenditure in many economies.

Key point: High debt interest can restrict fiscal flexibility, limiting resources available for investment or welfare programmes.

Reasons for Public Expenditure

1. Provision of Public Goods

Certain goods, such as defence, street lighting, and law enforcement, are non-excludable and non-rivalrous. The private sector would underprovide these because they are not profitable.

Therefore, government spending ensures their availability.

Public Goods: Goods that are non-excludable (cannot prevent others from using) and non-rivalrous (one person’s use does not reduce availability to others).

2. Merit Goods and Positive Externalities

Merit goods, such as education and healthcare, generate positive externalities (benefits to society beyond the individual consumer).

Government expenditure ensures wider provision and access, correcting for market underconsumption.

3. Redistributing Income and Wealth

Public expenditure, particularly via transfer payments and welfare services, reduces income inequality. Redistribution supports social cohesion and improves access to basic living standards.

4. Managing Aggregate Demand

Through current spending, capital investment, and welfare transfers, governments influence aggregate demand.

Increasing spending can stimulate economic growth in downturns (expansionary fiscal policy).

Reducing spending can help control inflation in booms (contractionary fiscal policy).

5. Correcting Market Failures

Governments spend to correct market failures such as pollution, underinvestment in education, or inadequate healthcare. Subsidies, regulation, and direct provision address these inefficiencies.

6. Promoting Long-Run Growth

Capital expenditure on infrastructure, research, and technology improves the productive potential of the economy. Education and training investments enhance human capital, boosting productivity.

7. National Defence and Security

Defence spending safeguards national security. It provides insurance against external threats, ensuring political stability, which is essential for sustained economic performance.

8. International Obligations

Public expenditure also arises from commitments to international organisations, aid budgets, and climate change agreements. These reflect diplomatic and strategic considerations as well as economic motives.

Distinguishing Between Recurrent and Capital Spending

A key distinction is between recurrent (ongoing) and capital (long-term) spending:

Recurrent spending sustains existing services.

Capital spending builds capacity for future growth.

Both interact to shape short-run and long-run macroeconomic outcomes.

Economic Significance of Public Expenditure

Public expenditure influences:

Aggregate demand: via transfer payments and government consumption.

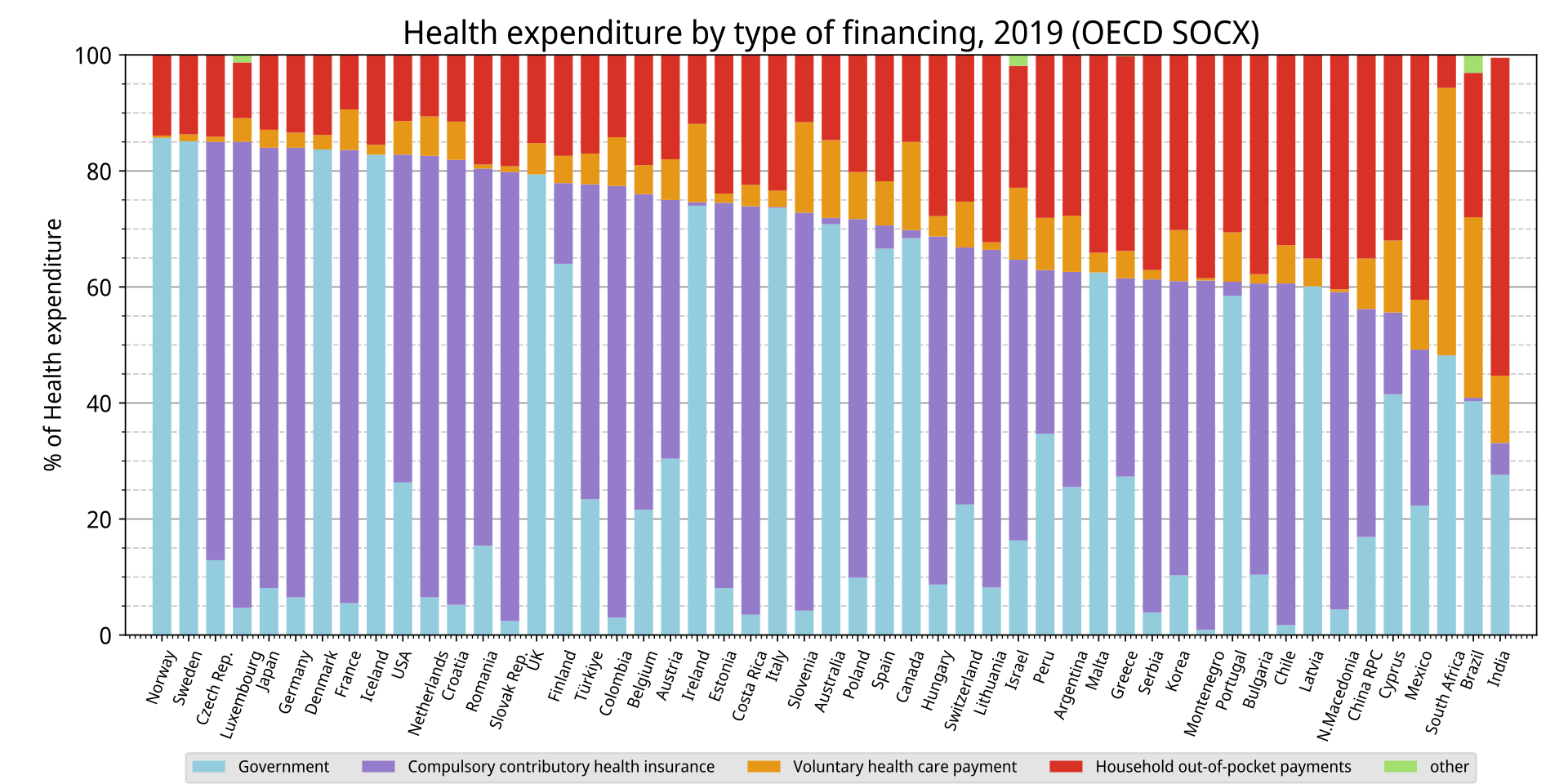

This bar chart compares public and private health expenditure across various countries, illustrating the proportion of healthcare funding sourced from public versus private means. It highlights the variability in public spending on health services globally. Source

Aggregate supply: via education, infrastructure, and healthcare investment.

Distribution of income: through welfare and progressive spending.

Fiscal sustainability: as debt interest grows, choices about tax and borrowing become more pressing.

Ultimately, the balance and purpose of public expenditure reflect political priorities as much as economic necessities.

FAQ

Recurrent expenditure refers to spending on the regular, day-to-day operation of public services, such as wages, maintenance, and supplies. It ensures continuity of services.

Capital expenditure, on the other hand, funds long-term investment projects like new hospitals, transport infrastructure, or schools. These projects aim to enhance the economy’s productive capacity over time.

Debt interest is a mandatory payment on money the government has previously borrowed. It does not create new services or infrastructure but is necessary to maintain credibility with lenders.

Failure to meet debt interest obligations could increase borrowing costs, reduce investor confidence, and limit resources for other types of spending.

Transfer payments, such as pensions or unemployment benefits, directly support households without requiring them to produce goods or services.

They reduce income inequality by redistributing wealth from taxpayers to vulnerable groups. This promotes social stability and ensures access to basic living standards.

Increased taxation may reduce incentives for work and investment.

Excessive borrowing can raise national debt and interest payments.

Misallocation of resources may occur if spending is politically rather than economically motivated.

High expenditure can also crowd out private sector activity if government borrowing drives up interest rates.

Merit goods like education and healthcare produce positive externalities that benefit society beyond the individual consumer.

For example, investment in education raises productivity and innovation, while healthcare spending improves workforce participation.

By prioritising merit goods, governments address underconsumption caused by imperfect information and affordability barriers.

Practice Questions

Define the term public goods and explain why governments provide them. (2 marks)

1 mark for defining public goods as both non-excludable and non-rivalrous.

1 mark for explaining that governments provide them because the private sector would underprovide or not provide them at all due to lack of profit incentive.

Explain two reasons why governments spend on transfer payments such as pensions and unemployment benefits. (6 marks)

Up to 3 marks for each reason explained (2 marks for clear identification, 1 mark for development).

Possible reasons include:

To redistribute income and reduce inequality (2 marks identification and explanation, 1 mark for linking to equity/social cohesion).

To maintain aggregate demand by sustaining household incomes (2 marks identification and explanation, 1 mark for linking to stabilising economic activity).

Maximum 6 marks.