AQA Specification focus:

‘They should be able to discuss the issue of the budget balance and be able to evaluate the possible economic consequences of a government running a budget deficit or budget surplus.’

Government budget balances have significant economic consequences. Evaluating deficits and surpluses requires understanding their impact on growth, stability, debt, and long-term fiscal sustainability.

Understanding Budget Balances

A budget balance is the difference between government revenue and expenditure in a given year. It may be positive (surplus) or negative (deficit).

Budget Deficit: A situation where government expenditure exceeds government revenue in a financial year.

A deficit is usually financed by borrowing, contributing to the national debt.

Budget Surplus: A situation where government revenue exceeds government expenditure in a financial year.

Surpluses can be used to repay debt, fund future spending, or reduce taxation.

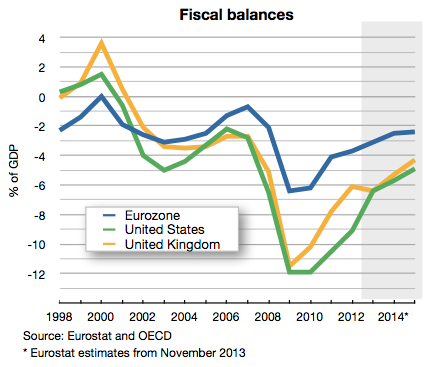

This chart compares the government surplus or deficit as a percentage of GDP among the EU, USA, and UK from 2001 to 2012. It highlights how fiscal policies and economic conditions influence budget balances in these regions. The data indicates that while the EU and UK experienced deficits during the global financial crisis, the USA's deficit was more pronounced, reflecting different fiscal responses. Source

Evaluating Budget Deficits

Short-term Impacts

A budget deficit can stimulate aggregate demand (AD) if financed through higher spending or tax cuts, supporting economic growth during recessions. However, persistent deficits raise concerns:

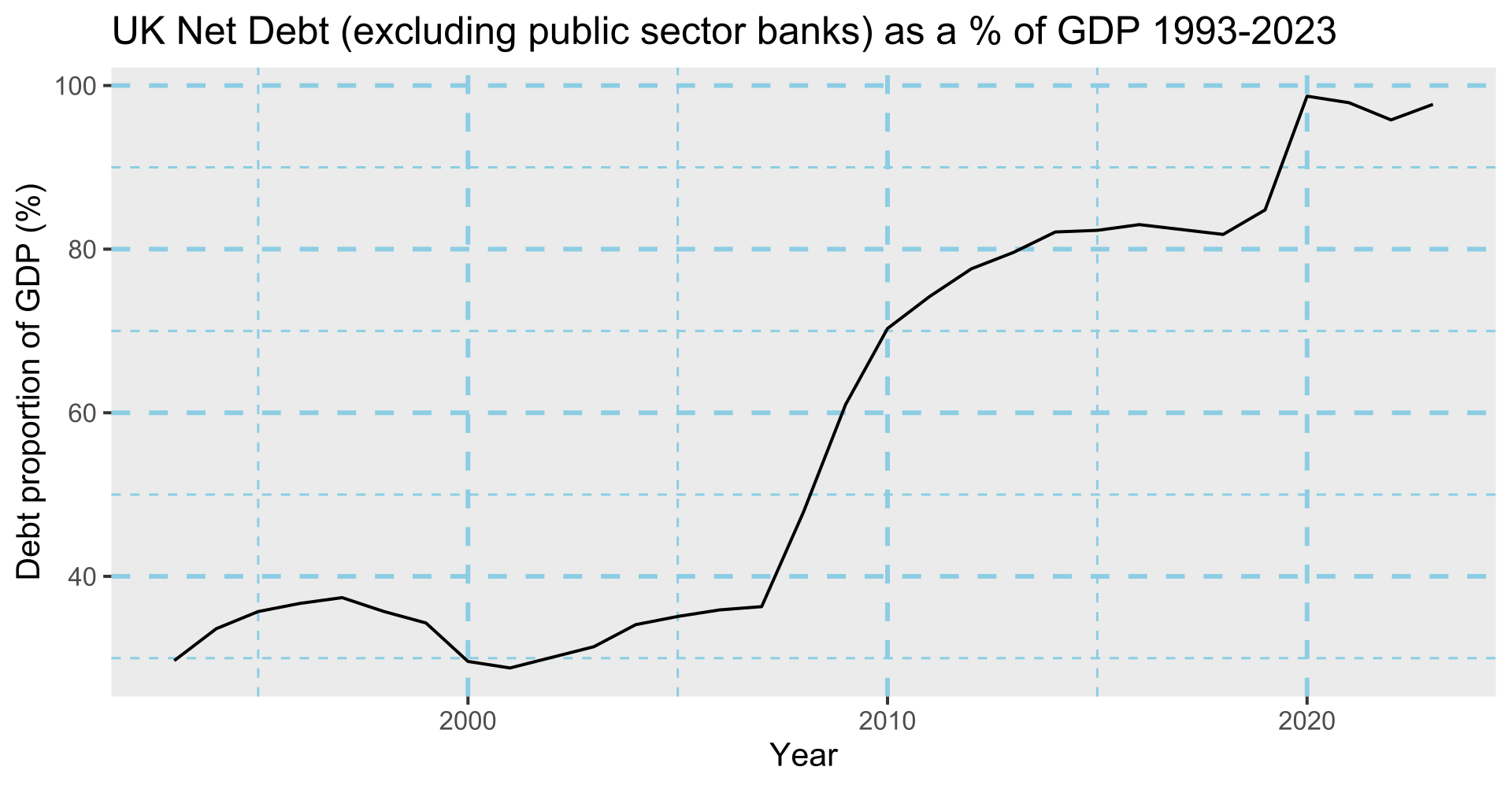

This graph depicts the UK's national debt as a percentage of GDP from 1993 to 2023, reflecting the impact of fiscal policies on debt accumulation. Notably, the data shows significant increases during periods of economic downturns, such as the global financial crisis and the COVID-19 pandemic. Source

Rising national debt: Borrowing increases future interest obligations.

Crowding out: Higher government borrowing can raise interest rates, reducing private sector investment.

Confidence effects: Financial markets may demand higher yields if they fear unsustainable debt.

Long-term Impacts

Deficits may lead to structural imbalances if caused by permanent spending commitments rather than temporary shocks. Students should consider:

Sustainability of public finances.

Risks of higher taxation in the future.

Potential for inflation if excessive demand is created.

Evaluating Budget Surpluses

Short-term Impacts

A budget surplus may reduce AD if it results from higher taxes or reduced spending. This could:

Slow economic growth.

Increase unemployment in the short run.

Improve business and consumer confidence if fiscal discipline is perceived positively.

Long-term Impacts

Surpluses may be beneficial by:

Reducing the national debt and interest payments.

Creating fiscal space for future downturns.

Funding supply-side improvements such as infrastructure or education.

However, surpluses might also represent underutilisation of resources if money is not reinvested in the economy.

Cyclical vs Structural Considerations

Deficits and surpluses can be cyclical (caused by economic conditions) or structural (caused by permanent imbalances). Evaluating them requires identifying which type is present.

A cyclical deficit during recession may be appropriate as tax revenues fall and welfare payments rise.

A structural deficit suggests long-term policy changes are needed.

Students must assess whether the budget balance reflects temporary conditions or persistent fiscal weakness.

The Consequences of Running Deficits

Debt servicing costs: More resources diverted to pay interest.

Generational equity: Future taxpayers may bear the burden.

Reduced flexibility: Limits ability to respond to future crises.

Inflationary pressures: If financed by monetary expansion.

But deficits can also:

Support recovery during downturns.

Fund investment that enhances long-term growth.

The Consequences of Running Surpluses

Debt reduction: Improves fiscal sustainability.

Lower interest rates: As government borrowing falls.

Policy credibility: Enhances confidence in the economy.

Potential drawbacks include:

Lower growth: If surpluses are achieved via spending cuts or tax increases.

Deflationary pressures: Reduced demand may depress prices.

Underinvestment: Failure to fund needed public services.

Assessing Economic Significance

When evaluating budget balances, students should consider:

Size of the balance relative to GDP.

Stage of the economic cycle — surpluses in boom periods are healthier than in recessions.

Opportunity cost of using resources for debt repayment versus investment.

Market perceptions — whether investors see fiscal policy as sustainable.

International comparisons — countries with higher debt tolerance may manage deficits differently.

Economic Theory Perspectives

Keynesian View

Deficits are justified during recessions to boost AD. Surpluses may be harmful if they reduce demand during downturns.

Monetarist/Neoclassical View

Persistent deficits risk inflation and inefficiency. Balanced budgets and surpluses promote stability and private sector growth.

Key Factors for Evaluation

Short-run vs long-run consequences.

Domestic vs international context.

Impact on growth, inflation, unemployment, and external balance.

Credibility of government commitments to fiscal rules.

Students should be able to weigh these factors when discussing whether a deficit or surplus is beneficial or harmful in a given situation.

FAQ

Investor confidence is crucial because it affects the interest rates governments face when borrowing. If investors believe a deficit is unsustainable, they may demand higher returns.

A surplus, on the other hand, can enhance credibility, lowering borrowing costs and signalling fiscal discipline. However, excessive focus on surpluses may reduce growth potential, which could harm long-term investor confidence.

During a recession, a deficit is often necessary to support aggregate demand through higher spending and lower taxation. Without this, unemployment and economic contraction could worsen.

In contrast, during a boom, a surplus may be more appropriate as it helps prevent overheating and inflation. The timing of the balance is therefore key to understanding its economic significance.

A cyclical deficit arises naturally during downturns, when tax revenues fall and welfare spending rises. It usually corrects as the economy recovers.

A structural deficit indicates a persistent imbalance, often from long-term spending commitments or inadequate tax structures.

Cyclical deficits are temporary.

Structural deficits require policy reform, such as tax changes or spending adjustments, to restore sustainability.

Yes. A surplus often means the government is spending less than it collects, which may reduce funding for services like healthcare or education.

If surpluses are prioritised over social investment, long-term growth could suffer due to underfunding in infrastructure and human capital. The challenge is balancing fiscal prudence with essential public service provision.

Persistent deficits increase national debt, leading to higher future interest repayments. This can limit future governments’ fiscal flexibility.

Future generations may face:

Higher taxation to service debt.

Reduced public spending on key areas.

Slower economic growth if borrowing crowds out private investment.

Conversely, if deficit spending today funds long-term productive investment, future generations may benefit from stronger growth and higher living standards.

Practice Questions

Define a budget deficit and explain how it differs from a budget surplus. (2 marks)

1 mark for a correct definition of a budget deficit: government expenditure exceeds government revenue in a financial year.

1 mark for correctly stating how this differs from a surplus: a surplus occurs when government revenue exceeds expenditure.

Discuss the possible economic consequences of a government running a budget surplus. (6 marks)

Up to 2 marks for identifying short-term effects (e.g. reduced aggregate demand, possible slower economic growth, higher unemployment).

Up to 2 marks for identifying long-term effects (e.g. reduced national debt, lower interest payments, increased fiscal space for future downturns).

1 mark for considering potential drawbacks (e.g. underinvestment in public services, deflationary pressures).

1 mark for clear, logical application to the UK economy or use of economic theory (e.g. Keynesian vs Monetarist views).