AQA Specification focus:

‘How fiscal policy can be used to influence aggregate demand.’

Fiscal policy, through government spending and taxation, is a key tool used to adjust aggregate demand (AD) and stabilise the wider economy during fluctuations.

Fiscal Policy and Aggregate Demand

Fiscal policy directly influences aggregate demand, which represents the total demand for goods and services in an economy at a given price level and time. Adjustments in government expenditure or taxation affect the level of consumption, investment, and government spending, which in turn shift the AD curve.

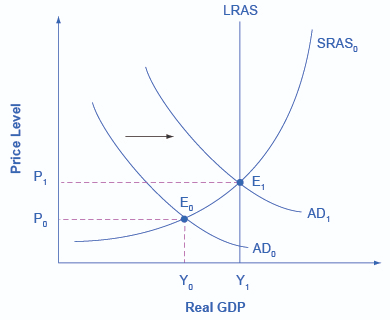

This diagram demonstrates the effect of expansionary fiscal policy on aggregate demand. An increase in government spending or a reduction in taxes shifts the AD curve from AD₀ to AD₁, leading to higher output and potentially higher price levels. Note that the diagram includes additional details on price levels and output which are beyond the scope of the syllabus. Source

Aggregate Demand (AD): The total demand for goods and services in an economy at a given overall price level and in a given time period.

Government fiscal decisions therefore play a crucial role in determining short-run economic outcomes, such as output, employment, and inflation.

Mechanisms of Fiscal Policy on AD

Government Spending

Changes in government spending (G) immediately impact AD, as government expenditure is a direct component of the AD formula:

EQUATION

Aggregate Demand (AD) = C + I + G + (X – M)

C = Consumption

I = Investment

G = Government spending

X = Exports

M = Imports

Increased government spending boosts AD by raising overall demand for goods and services.

Reduced government spending contracts AD, slowing economic activity.

Taxation

Changes in taxation influence disposable income and hence consumer spending.

Lower income tax increases households’ disposable income, raising consumption.

Higher corporate tax can reduce firms’ retained profits, lowering investment.

Indirect taxes (e.g., VAT) raise prices, reducing consumers’ purchasing power.

Budget Balance and AD

The balance between spending and taxation determines the government’s fiscal stance:

Expansionary fiscal policy: Higher spending and/or lower taxes, increasing AD.

Contractionary fiscal policy: Lower spending and/or higher taxes, reducing AD.

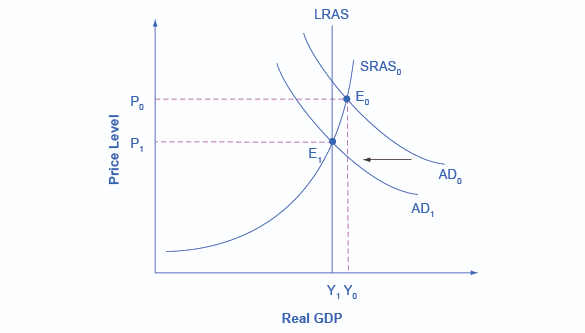

This diagram illustrates the effect of contractionary fiscal policy on aggregate demand. A decrease in government spending or an increase in taxes shifts the AD curve from AD₀ to AD₁, leading to lower output and potentially lower price levels. The diagram includes additional details on price levels and output which are beyond the scope of the syllabus. Source

The Multiplier Effect

Fiscal changes have magnified effects through the multiplier process, where an initial increase in spending generates further rounds of consumption and income growth.

Multiplier Effect: The process by which an initial change in spending leads to a larger overall increase in national income and AD.

This process amplifies the government’s impact on AD, making fiscal policy a powerful tool for managing demand.

Short-Run Objectives of Influencing AD

Fiscal policy is often used to stabilise the economy in the short term:

Reducing unemployment: Expansionary measures create demand for labour.

Controlling inflation: Contractionary policies reduce overheating.

Smoothing the business cycle: Fiscal adjustments dampen recessions or cool booms.

Limitations in Using Fiscal Policy

Time Lags

Recognition lag: Time needed to identify economic problems.

Implementation lag: Time to pass and enact policy.

Effectiveness lag: Time for measures to impact AD.

Crowding Out

Expansionary fiscal policy may raise interest rates, discouraging private investment.

Crowding Out: A situation where increased government spending leads to reduced private sector investment due to higher interest rates.

Government Finances

Persistent fiscal expansion can lead to budget deficits and growing national debt, constraining future policy flexibility.

Evaluating Fiscal Policy for AD

When assessing the effectiveness of fiscal policy in influencing AD, economists consider:

Size of the multiplier: Larger multipliers make fiscal changes more powerful.

Spare capacity: If the economy is near full employment, AD increases may lead mainly to inflation.

Consumer and business confidence: If confidence is low, tax cuts may not translate into higher spending.

Globalisation: Increased imports may leak demand abroad, reducing the domestic impact.

Types of Fiscal Policy Used to Influence AD

Expansionary Fiscal Policy

Increased public spending on infrastructure, education, or healthcare.

Reductions in income or corporation tax.

Aim: Stimulate growth, reduce unemployment, prevent deflationary pressures.

Contractionary Fiscal Policy

Reduced public expenditure or subsidy removal.

Increases in direct or indirect taxes.

Aim: Control inflation, reduce excessive demand, and stabilise the balance of payments.

Interaction with Monetary Policy

Fiscal policy’s effectiveness depends on coordination with monetary policy:

If interest rates remain low, fiscal expansion is more effective.

If monetary policy is contractionary, fiscal expansion may be offset.

Case for Fiscal Policy in AD Management

Ultimately, the use of fiscal policy to influence AD is central to government economic management. It allows adjustment of output, employment, and price levels, but its success relies on timing, size, and context.

FAQ

The MPC determines how much of any additional income households spend rather than save. A higher MPC increases the effectiveness of fiscal policy because more of the tax cut or government spending circulates back into the economy.

A lower MPC means more income is saved, reducing the multiplier effect and weakening the impact of fiscal policy on aggregate demand.

A tax cut may not boost aggregate demand if households choose to save the extra income rather than spend it.

Other reasons include:

High levels of household debt encouraging repayment instead of spending.

Low consumer confidence, making people cautious about spending.

Leakages from imports, where extra spending benefits foreign economies rather than domestic demand.

If the economy is already operating close to full employment, extra government spending may simply cause inflation rather than increase real output.

Additionally, when private investment is crowded out due to higher interest rates, the overall effect on aggregate demand may be limited.

Discretionary fiscal policy involves deliberate government decisions, such as new tax cuts or additional spending on infrastructure.

Automatic stabilisers, like income tax and unemployment benefits, adjust automatically with the business cycle. They help stabilise aggregate demand without requiring new government action.

Expansionary fiscal policy may raise interest rates, leading to currency appreciation and reduced net exports, partially offsetting the increase in aggregate demand.

Alternatively, if expansionary policy reduces interest rates, the currency may depreciate, boosting exports and amplifying the effect on aggregate demand.

Practice Questions

Explain how a reduction in income tax can influence aggregate demand in the short run. (3 marks)

1 mark for identifying that a reduction in income tax increases disposable income.

1 mark for explaining that higher disposable income leads to greater consumption.

1 mark for linking increased consumption to a rightward shift in the aggregate demand curve.

Discuss how government spending on infrastructure projects can be used to influence aggregate demand. (6 marks)

Up to 2 marks for identifying government spending as a component of aggregate demand.

Up to 2 marks for explaining that increased government spending directly increases AD (with AD = C + I + G + (X – M)).

1 mark for explaining the multiplier effect, where initial government spending generates further rounds of spending and income.

1 mark for considering limitations, e.g., time lags, crowding out, or whether the economy has spare capacity.