AQA Specification focus:

‘The difference between direct and indirect taxes.’

Introduction

Taxes are a crucial tool of fiscal policy, shaping government revenue and influencing economic behaviour. Understanding the distinction between direct and indirect taxes is essential.

Defining Direct Taxes

Direct taxes are imposed directly on individuals’ or firms’ income and wealth, with the legal and economic burden falling on the same person or organisation.

Direct Tax: A tax levied directly on income, profits, or wealth, where the taxpayer and bearer of the burden are the same.

Examples of direct taxes include:

Income tax: charged on individuals’ earnings.

Corporation tax: applied to business profits.

Capital gains tax: levied on the increase in value of assets.

The defining feature is that direct taxes are unavoidable unless income or assets are reduced.

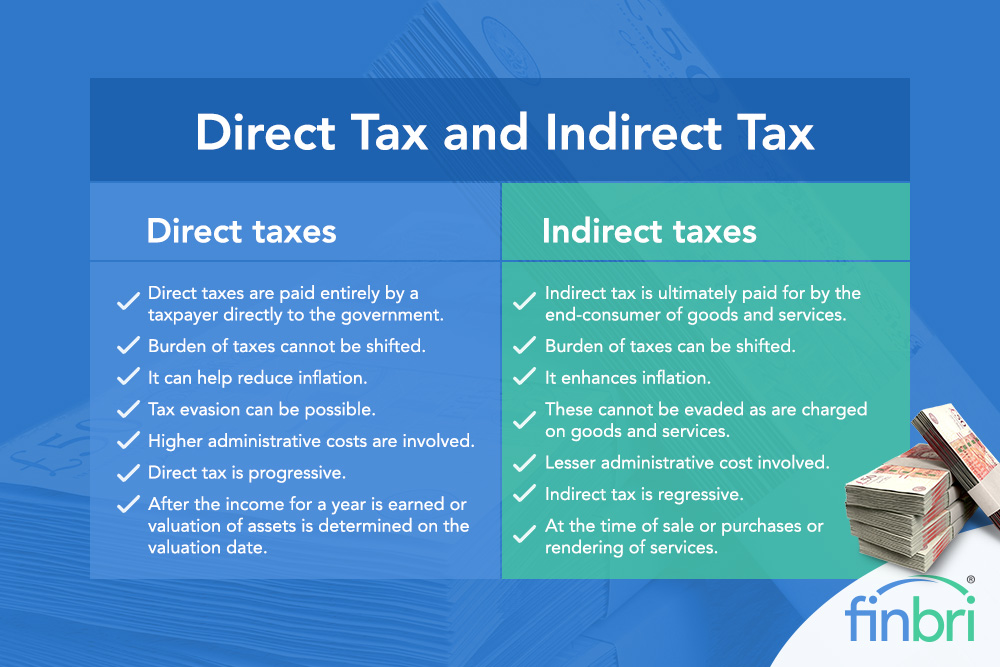

This visual provides a side-by-side comparison of direct and indirect taxes, detailing their definitions, examples, and characteristics, which aligns with the distinctions outlined in the study notes. Source

Defining Indirect Taxes

Indirect taxes are imposed on spending, with the legal incidence on producers or sellers, but the burden often passed on to consumers through higher prices.

Indirect Tax: A tax levied on goods or services, where the legal payer may shift the burden onto others, typically consumers.

Examples of indirect taxes include:

Value Added Tax (VAT): a consumption tax added to most goods and services.

Excise duties: applied to products like fuel, tobacco, and alcohol.

Customs duties: charged on imports.

The key characteristic is the separation of who pays the tax to government and who bears its economic cost.

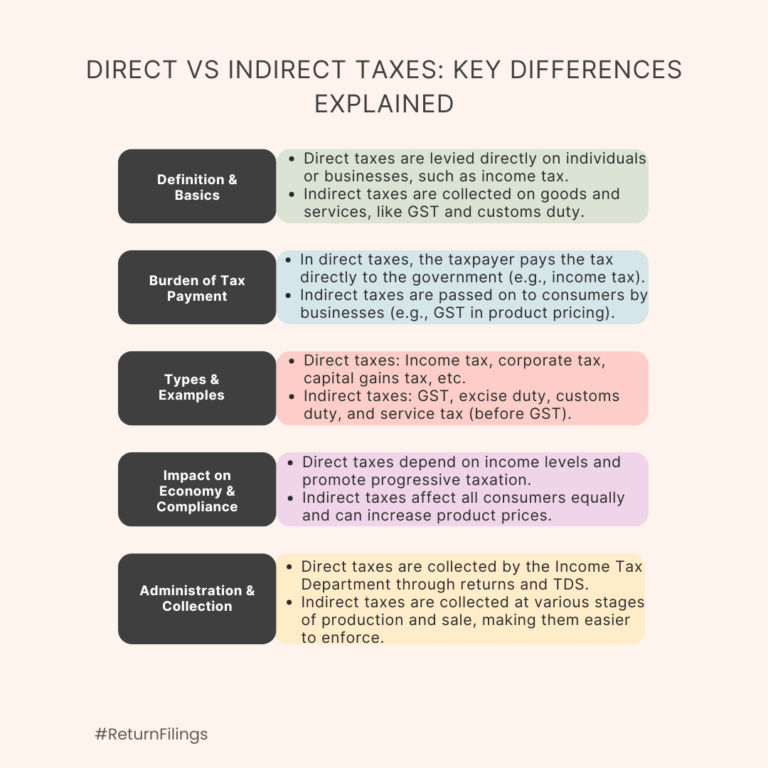

This diagram contrasts direct and indirect taxes, focusing on aspects like tax incidence, collection methods, and examples, thereby reinforcing the distinctions discussed in the study notes. Source

Key Differences between Direct and Indirect Taxes

Incidence of Tax

Direct taxes: burden cannot be shifted; the taxpayer is responsible.

Indirect taxes: burden often passed onto consumers through price increases.

Certainty vs Uncertainty

Direct taxes are usually predictable, tied to income or profits.

Indirect taxes may be less predictable, as they rely on consumer spending.

Visibility

Direct taxes are highly visible; taxpayers know their contribution.

Indirect taxes are often less visible, embedded within prices.

Equity Considerations

Direct taxes can be progressive, proportional, or regressive depending on structure.

Indirect taxes are generally regressive, as they take a larger share of income from lower earners.

The Role of Direct Taxes in Fiscal Policy

Direct taxation plays a macroeconomic and microeconomic role in government policy:

Provides a stable revenue base linked to ability to pay.

Enables redistribution of income through progressive taxation.

Influences incentives, e.g., high income tax may discourage work or investment.

Governments often adjust rates to influence economic behaviour, such as reducing corporation tax to encourage investment.

The Role of Indirect Taxes in Fiscal Policy

Indirect taxation is important for both revenue raising and behavioural change:

Revenue generation from broad-based consumption taxes like VAT.

Used to discourage demerit goods, such as tobacco or alcohol, through excise duties.

Affects international trade patterns through tariffs and customs duties.

Indirect taxes are flexible tools, as governments can adjust them quickly in response to economic needs.

Economic Effects of Direct and Indirect Taxes

Aggregate Demand and Aggregate Supply

Direct taxes influence disposable income and therefore consumer spending, shifting aggregate demand (AD).

Indirect taxes affect production costs, influencing aggregate supply (AS) by altering firms’ pricing decisions.

Inflationary Impact

Higher indirect taxes often feed into inflation, as prices of taxed goods and services rise.

Direct taxes typically affect demand more than supply, with less direct impact on inflation.

Labour Market Effects

Direct income tax affects labour supply decisions, as higher marginal rates may reduce incentives to work.

Indirect taxes influence real wages, as higher consumption prices erode purchasing power.

Advantages and Disadvantages of Direct Taxes

Advantages

Equitable, as progressive taxation ensures higher earners contribute more.

Provide certainty for government planning.

Help redistribute wealth, reducing inequality.

Disadvantages

High rates can create disincentives to work or invest.

Encourages tax evasion and avoidance.

May reduce overall efficiency if poorly structured.

Advantages and Disadvantages of Indirect Taxes

Advantages

Broad-based and difficult to evade, collected at point of sale.

Encourage behavioural change by discouraging harmful goods.

Provide flexibility, as rates can be adjusted relatively quickly.

Disadvantages

Tend to be regressive, impacting low-income households more severely.

Can contribute to inflation.

Revenue is less stable, depending on levels of consumption.

Interaction of Direct and Indirect Taxes in the UK

In practice, most governments use a mix of direct and indirect taxes to balance objectives:

UK fiscal policy combines progressive income tax with regressive VAT, achieving both redistribution and revenue generation.

Shifts in emphasis between the two types of taxation reflect political priorities, economic conditions, and social goals.

Evaluation of the Balance between Direct and Indirect Taxes

The ideal balance between direct and indirect taxation is debated:

Too much reliance on direct taxes may harm incentives and economic growth.

Excessive reliance on indirect taxes risks worsening inequality and fuelling inflation.

Policymakers seek a balanced system that ensures sufficient revenue, fairness, and efficiency while supporting broader economic objectives.

FAQ

Governments often prefer indirect taxes because they can be implemented quickly and generate immediate revenue.

They also allow governments to target specific goods, such as alcohol or fuel, to influence behaviour. Unlike changes to income tax, adjustments to indirect taxes usually require less administrative change.

Indirect taxes can change relative prices, influencing consumer decisions.

Higher taxes on demerit goods may reduce consumption.

Subsidised or lower-taxed goods may become more attractive.

If demand for a taxed good is inelastic, consumers may continue to buy it, but with less disposable income for other goods.

Yes, direct taxes can be regressive in practice.

For example, a flat-rate income tax would take a larger percentage of income from low earners than from high earners. Similarly, local council tax may disproportionately affect households with lower income, even though it is technically a direct tax.

With direct taxes, the person or business legally responsible also bears the economic burden.

With indirect taxes, the seller may shift part or all of the tax onto consumers through higher prices, depending on price elasticity of demand and supply.

Indirect taxes such as tariffs and customs duties are key tools in trade policy.

They can:

Protect domestic industries by making imports more expensive.

Generate government revenue from imported goods.

Sometimes trigger retaliation from trading partners, affecting global trade relations.

Practice Questions

Define an indirect tax and give one example. (2 marks)

1 mark for correct definition: a tax levied on goods or services where the legal incidence is on the seller but the burden can be shifted to consumers.

1 mark for a valid example such as VAT, excise duty on alcohol, tobacco duty, or customs duty.

Explain two key differences between direct and indirect taxes. (6 marks)

Up to 3 marks for each difference explained, to a maximum of 6 marks.

Award 1 mark for identification of a valid difference.

Award up to 2 further marks for clear explanation, including reference to economic impact or incidence.

Indicative content:

Incidence of tax: Direct taxes cannot be shifted, whereas indirect taxes are often passed onto consumers.

Visibility: Direct taxes are transparent (e.g. income tax deductions), while indirect taxes are less visible, included in prices.

Equity: Direct taxes can be progressive, indirect taxes are generally regressive.

Certainty: Direct taxes are predictable, indirect taxes vary with spending levels.