AQA Specification focus:

‘Fiscal policy can have both macroeconomic and microeconomic functions.’

Introduction

Fiscal policy, through government spending, taxation, and budgetary choices, serves both broad macroeconomic objectives and more focused microeconomic aims, shaping growth, stability, and individual economic behaviour.

Macroeconomic Functions of Fiscal Policy

Stabilising Aggregate Demand (AD)

Fiscal policy plays a key role in managing aggregate demand, which is the total spending in the economy at a given price level. By adjusting taxation and government spending, policymakers can influence the level of output, employment, and inflation.

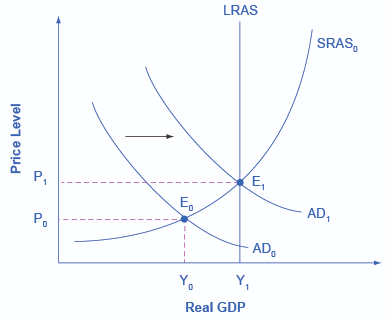

This diagram demonstrates the effect of expansionary fiscal policy on the economy. An increase in government spending or a reduction in taxes shifts the aggregate demand curve from AD0 to AD1, leading to higher real GDP (Y1) and a higher price level (P1). Note: The diagram focuses on the short-run effects and does not depict potential long-run adjustments. Source

Expansionary fiscal policy: Increasing government spending or reducing taxes to boost AD, typically used in times of recession or high unemployment.

Contractionary fiscal policy: Reducing spending or increasing taxes to decrease AD, usually applied to control inflation and unsustainable economic growth.

Aggregate Demand (AD): The total expenditure on an economy’s goods and services at a given price level and time period.

Managing Economic Growth

Fiscal policy helps stimulate or moderate growth in line with economic goals. Sustained government investment in infrastructure or public services can contribute to long-term productivity and rising potential output.

Controlling Inflation

By reducing AD through tax rises or spending cuts, governments can mitigate demand-pull inflation, where excessive demand causes general price levels to rise.

Employment Levels

Fiscal policy supports employment creation through direct job programmes or indirect effects of higher demand stimulating business investment and hiring. During downturns, expansionary measures can reduce cyclical unemployment.

Balancing External Accounts

By influencing national income and import demand, fiscal policy indirectly affects the balance of payments. Higher AD can lead to increased imports, worsening the current account deficit, while contractionary policy may ease external imbalances.

Microeconomic Functions of Fiscal Policy

Influencing Allocation of Resources

Fiscal policy is used to redirect resources within the economy, ensuring more efficient or socially desirable outcomes. This involves targeted spending and taxation to correct market failures.

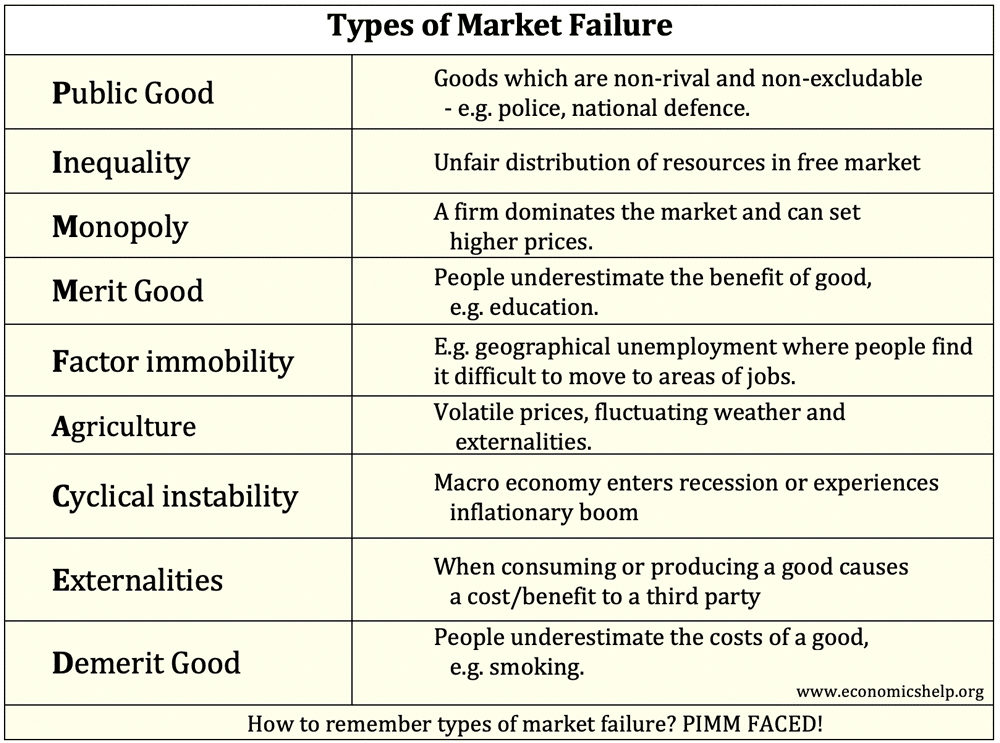

This diagram categorizes various types of market failures, including public goods, externalities, and information asymmetries. It highlights areas where government intervention, such as taxation, subsidies, or regulation, can correct inefficiencies and promote a more equitable allocation of resources. Note: The diagram includes examples beyond those covered in the syllabus, such as information failures. Source

Subsidies for renewable energy encourage sustainable production.

Indirect taxes on tobacco or alcohol (de-merit goods) discourage consumption.

Public spending on healthcare or education ensures access to essential services.

Market Failure: A situation in which the free market fails to allocate resources efficiently, leading to a loss of economic and social welfare.

Redistribution of Income and Wealth

Through progressive taxation and welfare spending, governments attempt to reduce inequality. Wealthy individuals pay a higher proportion of income in tax, funding benefits and public services that support lower-income groups.

Correcting Externalities

Fiscal instruments help address external costs and benefits:

Pollution taxes (internalising negative externalities).

Subsidies for public transport or education (promoting positive externalities).

Providing Public Goods

The government funds public goods such as national defence, street lighting, and policing, which private markets would underprovide because they are non-excludable and non-rival.

Public Good: A good that is non-excludable (people cannot be prevented from using it) and non-rival (one person’s use does not reduce availability for others).

The Dual Nature of Fiscal Policy

Interconnection of Macro and Micro Roles

The macro and micro functions of fiscal policy overlap significantly. For example, investment in education (micro function) increases human capital, which raises long-term productivity and enhances aggregate supply (macro function). Likewise, welfare spending supports household consumption, which boosts AD.

Short-Term vs Long-Term Considerations

Short-term (macro focus): Stabilising fluctuations in the business cycle by adjusting AD.

Long-term (micro focus): Shaping incentives, correcting market failures, and improving efficiency for sustainable growth.

Limitations and Trade-Offs

Fiscal policy effectiveness is constrained by:

Time lags in implementation and impact.

Potential crowding out, where government borrowing raises interest rates and reduces private investment.

Conflicts between goals, e.g. redistribution (equity) vs efficiency.

Crowding Out: A situation where increased government borrowing leads to higher interest rates, reducing private sector investment.

Role in Supply-Side Performance

Although primarily seen as demand management, fiscal policy also influences the supply side of the economy. Spending on infrastructure, innovation, and skills development can raise long-term productive capacity. Tax reforms altering work incentives can also improve labour market efficiency.

Key Takeaways from the Specification

Fiscal policy operates at two levels:

Macroeconomic functions: Managing AD, stabilising growth, controlling inflation, and supporting employment.

Microeconomic functions: Correcting market failures, redistributing income, and improving resource allocation.

Both roles are critical for shaping overall economic performance and ensuring resources are used effectively.

FAQ

In a recession, the macroeconomic function focuses on boosting aggregate demand through higher spending or tax cuts, aiming to reduce unemployment and stimulate growth.

The microeconomic function becomes relevant in targeting specific groups or sectors, for example, subsidies for struggling industries or welfare spending to support low-income households. Both roles interact, but the macroeconomic aim is stabilisation, while the microeconomic aim is redistribution and resource allocation.

If government policy only targeted macroeconomic stability, inequalities and market failures would persist.

Macroeconomic focus ensures growth, stability, and low unemployment.

Microeconomic focus ensures fairness, efficiency, and correction of market failures.

Balancing the two prevents conflicts, such as reducing inflation while still funding education or healthcare, which serve longer-term structural needs.

Yes. A single measure often contributes to both.

For example, increased government spending on renewable energy:

Macro effect: Stimulates aggregate demand and creates jobs.

Micro effect: Corrects negative externalities by reducing pollution and shifting production towards sustainable resources.

Such policies highlight the overlap between stabilisation and resource allocation.

A narrow macro focus may achieve stability but create:

Greater inequality if redistribution is ignored.

Under-provision of public goods like healthcare or education.

Persistent market failures, such as unchecked environmental damage.

This can weaken long-term productivity and social cohesion, undermining the stability that macroeconomic policy aims to achieve.

Micro policies like investing in education or correcting externalities build stronger foundations for long-term growth.

Better skills increase labour productivity.

Public goods provision supports a healthier, more educated workforce.

Correcting externalities improves efficiency and sustainability.

These improvements raise potential output and reduce structural weaknesses, reinforcing the macroeconomic objectives of sustainable growth and stability.

Practice Questions

Distinguish between the macroeconomic and microeconomic functions of fiscal policy. (3 marks)

1 mark for identifying a macroeconomic function (e.g. managing aggregate demand, controlling inflation, influencing economic growth, reducing unemployment).

1 mark for identifying a microeconomic function (e.g. correcting market failure, redistributing income, providing public goods).

1 mark for making a clear distinction between the two (macro = overall economy-wide objectives; micro = targeted allocation/redistribution at individual or sector level).

Explain how government spending on education can have both macroeconomic and microeconomic functions. (6 marks)

Up to 2 marks for macroeconomic explanation:

Improves long-term productivity and increases aggregate supply (1–2 marks).

Supports potential growth and reduces structural unemployment (1–2 marks).

Up to 2 marks for microeconomic explanation:

Corrects market failure in education provision (1–2 marks).

Ensures equity and access to essential services (1–2 marks).

Up to 2 marks for development/analysis:

Linking how better skills improve efficiency and competitiveness (1 mark).

Showing how redistributive effects reduce inequality and create social benefits (1 mark).

(Maximum 6 marks — award marks for distinct points, quality of explanation, and linkage to both macro and micro functions.)