AQA Specification focus:

‘The difference between progressive, proportional and regressive taxes.’

Taxes are central to fiscal policy, and understanding progressive, proportional and regressive taxation is essential for analysing fairness, efficiency, and economic impacts within the UK and global economies.

Types of Taxation Structures

Progressive Taxes

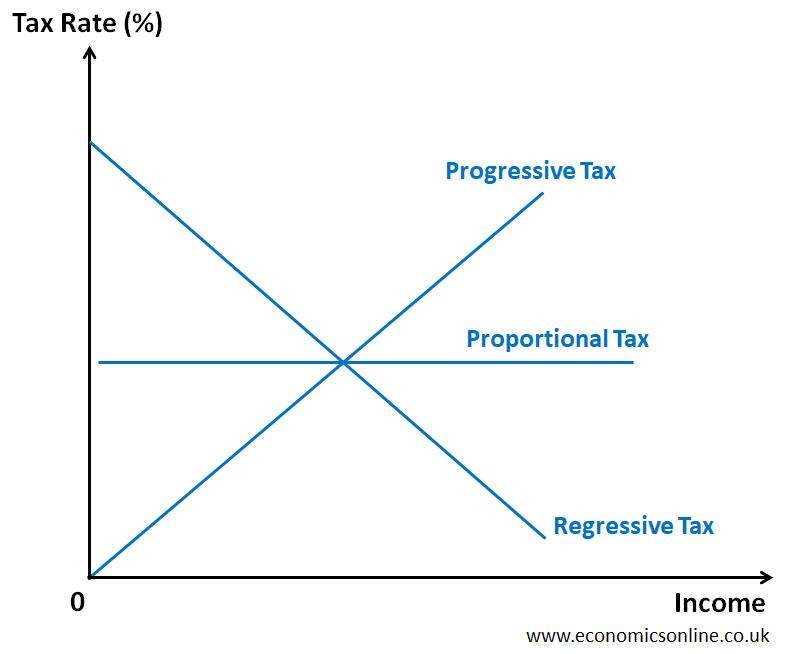

A progressive tax system imposes a higher tax rate as income rises, meaning wealthier individuals contribute a larger proportion of their earnings compared to lower-income groups.

Progressive Tax: A tax where the average rate of tax increases as income increases, placing a greater relative burden on higher earners.

This structure is grounded in the principle of equity: those with a greater ability to pay should bear a larger share of taxation. Progressive taxes help redistribute income and reduce inequality, making them a key tool in modern fiscal systems.

This diagram depicts a progressive tax system, where higher incomes are taxed at higher average rates, reflecting the principle that those with greater ability to pay should contribute more. Source

Proportional Taxes

A proportional tax system, often referred to as a flat tax, charges the same percentage rate regardless of income.

Proportional Tax: A tax where the average rate of tax remains constant, regardless of the taxpayer’s income level.

Although proportional taxes seem “neutral,” their real effect on disposable income may be regressive if lower earners spend a greater share of income on essentials, leaving less flexibility after taxation.

Regressive Taxes

A regressive tax system places a heavier relative burden on low-income individuals, even if the tax rate itself does not increase. Many indirect taxes, such as sales taxes or VAT, tend to be regressive.

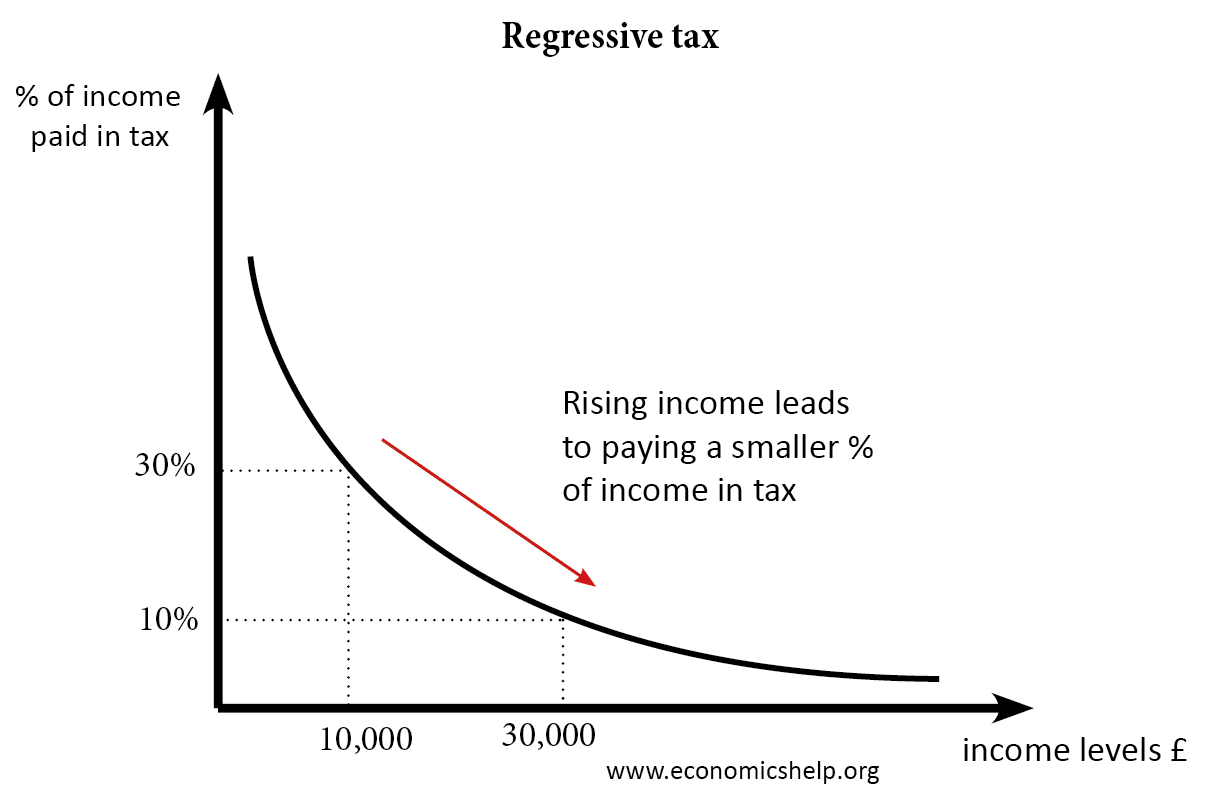

Regressive Tax: A tax where the average rate of tax decreases as income increases, placing a heavier burden proportionally on lower-income earners.

For example, a flat-rate consumption tax (e.g., 20% VAT) means both rich and poor pay the same percentage on goods, but it consumes a much larger share of the poor’s disposable income.

Key Differences in Burden Distribution

Progressive taxation increases the tax burden on high-income earners and decreases inequality.

Proportional taxation spreads the burden evenly in percentage terms, though absolute payments vary by income.

Regressive taxation disproportionately impacts those on low incomes, as a larger share of their earnings goes towards tax.

This variation in burden distribution is critical for evaluating fairness in taxation systems.

This graph compares progressive, proportional, and regressive taxes, showing how tax rates change relative to income. The progressive tax curve rises, the proportional tax remains constant, and the regressive tax declines. Source

Microeconomic Functions of Different Tax Types

Progressive Taxes and Redistribution

Progressive taxes support income redistribution, ensuring that the government can fund welfare systems, healthcare, and education. This microeconomic function promotes social justice and narrows income inequality.

Proportional Taxes and Efficiency

Flat taxation systems are argued to improve economic efficiency by reducing disincentives to earn higher incomes. Supporters claim they simplify tax administration, reducing compliance costs and complexity.

Regressive Taxes and Consumption

Indirect regressive taxes can distort consumption patterns. For instance, higher VAT on goods and services may discourage spending, especially among low-income households, influencing demand in particular sectors.

Macroeconomic Implications

Aggregate Demand (AD) Effects

Progressive taxation can moderate consumption among higher earners but stabilise demand through government spending financed by higher revenues.

Proportional taxation leaves relative consumption unchanged across groups, though overall tax revenue may be lower.

Regressive taxation reduces disposable income among low earners, weakening consumer demand in aggregate.

Aggregate Supply (AS) Effects

Excessively high progressive taxes may create disincentives to work, save, or invest, potentially reducing productivity.

Proportional taxes aim to maintain incentives while funding essential state functions.

Regressive taxes may encourage informal markets if individuals seek to avoid consumption taxes.

Principles of Equity and Fairness

The debate over progressive, proportional, and regressive taxes links closely to the principles of taxation such as equity, certainty, convenience, and efficiency.

Progressive taxation is viewed as more equitable but may face criticism for dampening enterprise.

Proportional taxation is sometimes presented as fair in treating everyone equally, though in practice it may disadvantage the poor.

Regressive taxation is often justified as broad-based and hard to avoid but raises serious concerns about fairness.

Examples of Tax Types in the UK

Progressive: Income tax, where rates rise with earnings (20%, 40%, 45%).

Proportional: Council tax bands are sometimes described as proportional, though in practice they may be mildly regressive.

Regressive: VAT, excise duties on alcohol, tobacco, and fuel.

These examples highlight how the UK combines multiple taxation forms, balancing revenue generation with considerations of fairness and efficiency.

Advantages and Disadvantages

Progressive Taxes

Advantages: Reduce inequality, align with equity, generate stable revenue.

Disadvantages: May discourage work or investment if rates are perceived as punitive.

Proportional Taxes

Advantages: Simple, predictable, and may incentivise productivity.

Disadvantages: Do not address inequality; burden remains heavier for low earners in practical terms.

Regressive Taxes

Advantages: Efficient, broad base of collection, difficult to evade.

Disadvantages: Increase inequality, disproportionately harm low-income groups, may suppress consumer demand.

Evaluating Policy Choices

Governments rarely rely exclusively on one type of tax. Instead, mixed taxation systems are designed to balance efficiency, fairness, and revenue needs. The debate over reliance on progressive versus regressive systems reflects deeper ideological differences between equity and efficiency.

FAQ

Indirect taxes, such as VAT and excise duties, are applied at the same rate regardless of income. Since low-income households spend a greater share of their earnings on consumption, these taxes represent a higher proportion of their income, making the overall system regressive.

Supporters of proportional taxes highlight their simplicity and efficiency. They argue that flat rates avoid disincentives to work, reduce tax avoidance, and create a transparent system.

Critics, however, suggest that proportional taxes fail to address income inequality and may disproportionately affect lower earners despite appearing “fair” in percentage terms.

Progressive taxation funds public services such as education and healthcare, which are essential for improving opportunities for lower-income households.

By redistributing wealth through higher taxation of the rich, governments can provide greater access to services that support upward mobility. However, if overly high, progressive taxes may discourage entrepreneurship, which indirectly affects job creation.

Goods with flat-rate indirect taxes tend to be regressive. Common examples include:

Fuel (petrol, diesel)

Alcohol

Tobacco

Standard-rated VAT items such as household appliances

Because poorer households spend more of their income on these goods, the tax burden is heavier relative to their earnings.

Yes, most modern tax systems combine all three types.

Progressive: income tax ensures equity.

Proportional: some local taxes or fixed charges can provide simplicity.

Regressive: indirect taxes raise broad-based revenue efficiently.

This mix allows governments to balance fairness, revenue generation, and economic incentives.

Practice Questions

Define a regressive tax and explain why VAT is often considered regressive. (3 marks)

1 mark: Correct definition of a regressive tax (average rate of tax falls as income rises).

1 mark: Identifies VAT as an indirect tax applied at the same rate to all consumers.

1 mark: Explains that VAT takes up a larger proportion of disposable income for lower earners, making it regressive.

Discuss the economic advantages and disadvantages of using progressive taxation as part of a country’s fiscal policy. (6 marks)

Up to 2 marks: Explanation of progressive taxation (average rate of tax rises with income; higher earners pay a greater proportion).

Up to 2 marks: Advantages (e.g., reduces inequality, redistributes income, raises government revenue for public services).

Up to 2 marks: Disadvantages (e.g., potential disincentives to work or invest, risk of tax avoidance/evasion).

Level of response:

1–2 marks: Basic points made with limited development.

3–4 marks: Clear explanation of both advantages and disadvantages with some application.

5–6 marks: Well-developed discussion with balanced consideration of both sides, showing analysis and some evaluation.