AQA Specification focus:

‘The role and relative merits of different UK taxes.’

Fiscal policy in the UK relies heavily on taxation, which provides government revenue, redistributes income, and influences behaviour. UK taxes vary in design, role, and economic impact.

The Role of UK Taxes

Raising Revenue

The most fundamental role of taxation is to provide government revenue to fund public services such as the NHS, education, defence, and welfare programmes. Without sufficient taxation, governments would be unable to sustain their expenditure commitments.

Redistribution of Income and Wealth

Taxes are used to achieve greater equity by redistributing income. Progressive taxes, such as income tax, place a larger burden on high earners, helping to reduce income inequality.

Influencing Behaviour

Taxation can be used to modify behaviour by discouraging the consumption of harmful goods or encouraging environmentally friendly activities. For example:

Excise duties on tobacco and alcohol aim to reduce consumption.

Carbon taxes aim to cut greenhouse gas emissions.

Economic Stabilisation

Through fiscal policy, taxation contributes to managing aggregate demand. Higher taxes can reduce demand during inflationary periods, while lower taxes can stimulate demand during recessions.

Allocating Resources

By altering incentives, taxes can reallocate resources within the economy. For instance, subsidies and lower tax rates for renewable energy encourage investment in sustainable sectors.

Types of UK Taxes

Income Tax

The largest single source of government revenue in the UK. It is a direct tax levied on personal income. Progressive in nature, income tax supports redistribution and provides predictable revenue.

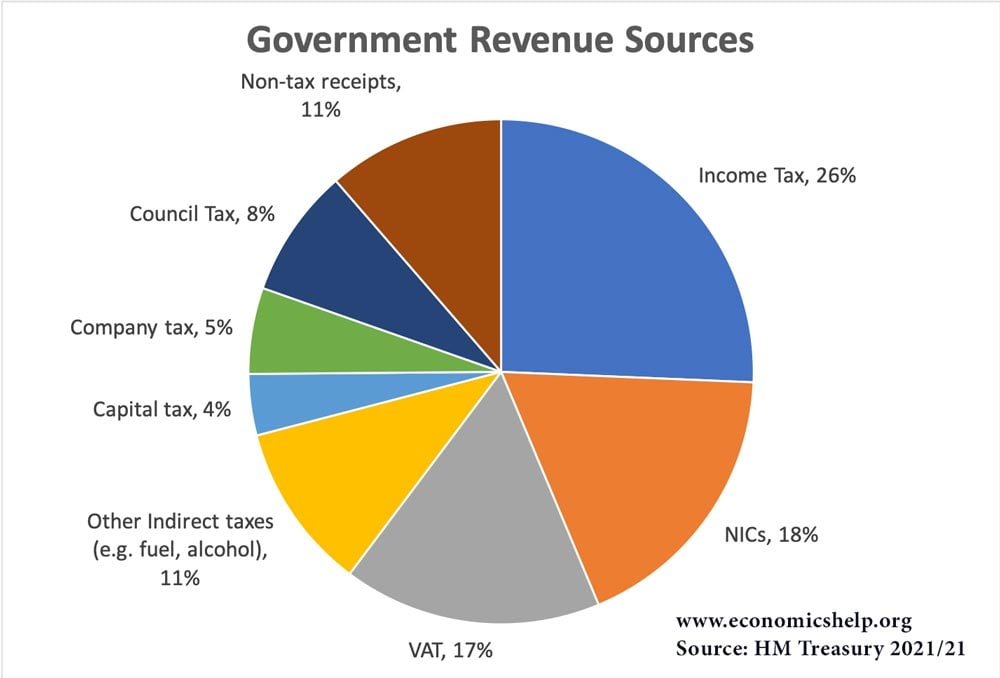

This chart displays the percentage contributions of various taxes to the UK's total tax revenue, emphasising the dominance of income tax and NICs. Note that the chart includes additional tax categories not detailed in the study notes. Source

National Insurance Contributions (NICs)

Paid by both employees and employers, NICs fund state pensions and certain welfare benefits. They are often criticised for being regressive since lower earners contribute a larger proportion of income.

Value Added Tax (VAT)

A broad-based indirect tax applied to most goods and services at a standard rate of 20%. Although highly efficient in raising revenue, VAT is regressive as it takes a higher percentage of income from low earners.

Corporation Tax

Levied on company profits. While it contributes significantly to government revenue, rates are kept competitive to attract investment and avoid discouraging business activity.

Excise Duties

Taxes on specific goods such as alcohol, tobacco, and fuel. Their dual role includes raising revenue and discouraging consumption of demerit goods.

Council Tax

A property-based tax collected by local authorities, linked to property values. While simple to administer, it can be regressive since it does not directly reflect household income.

Stamp Duty

Charged on property transactions. It raises revenue and moderates speculative activity in the housing market, though it can reduce housing mobility.

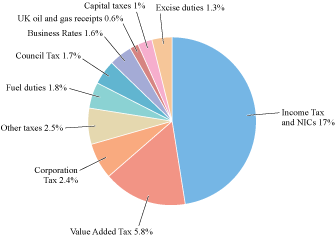

This diagram illustrates the percentage of GDP represented by various UK taxes, highlighting the significance of income tax and NICs. The chart includes additional tax categories not covered in the study notes. Source

Merits of Different UK Taxes

Income Tax

Merits: Progressive, stable, and predictable source of revenue.

Limitations: High rates may disincentivise work or encourage tax avoidance.

VAT

Merits: Efficient to collect, generates high revenue, and covers a broad base.

Limitations: Regressive, disproportionately affecting low-income households.

Corporation Tax

Merits: Captures revenue from profits, helps share the tax burden between individuals and businesses.

Limitations: Higher rates may discourage inward investment or reduce competitiveness.

Excise Duties

Merits: Effective in discouraging harmful consumption, while raising substantial revenue.

Limitations: Regressive, impacting lower-income households more heavily.

Council Tax

Merits: Provides local government revenue and links tax to property ownership.

Limitations: Outdated property banding and regressive impact.

Stamp Duty

Merits: Provides significant revenue and discourages speculative bubbles in property markets.

Limitations: Distorts housing market activity by deterring transactions.

Principles of Effective Taxation in the UK

When evaluating the merits of UK taxes, it is important to consider principles of taxation such as:

Equity: Fairness in tax burden (progressive vs regressive).

Efficiency: Low administrative costs and minimal distortion of behaviour.

Certainty: Predictability for taxpayers and government revenue.

Convenience: Easy collection and payment processes.

Elasticity: Ability of revenue to grow as the economy expands.

Balancing the Tax System

The UK tax system combines direct taxes (income tax, corporation tax, council tax) with indirect taxes (VAT, excise duties). Each has strengths and weaknesses:

Direct taxes tend to be more progressive but can reduce incentives to work or invest.

Indirect taxes are easier to collect and broaden the tax base but often regressively affect lower earners.

An effective fiscal strategy requires balancing these elements to raise revenue, redistribute income, manage demand, and influence behaviour. Policymakers must weigh the relative merits of each tax in achieving these objectives.

FAQ

Income tax is the single largest source of revenue for the UK government, often contributing around a quarter of total receipts.

It funds essential services such as healthcare, education, and defence, and its stability makes it crucial for long-term fiscal planning.

While other taxes like VAT and NICs also raise substantial sums, income tax’s progressive design provides both revenue and redistribution benefits, giving it a central role in the system.

VAT is efficient to collect and broad-based, making it reliable for raising funds. However, it is regressive, as lower-income households spend a greater proportion of income on VAT-liable goods.

Exemptions and zero-ratings (e.g., food, children’s clothes) help reduce regressivity, but these make the system complex and can distort spending patterns.

Supporters argue corporation tax ensures businesses contribute fairly to public finances and helps prevent wealth concentration.

Critics highlight that high rates may deter foreign investment, reduce competitiveness, and encourage tax avoidance.

Balancing corporation tax rates is therefore vital to maintain revenue without damaging business activity.

Excise duties are designed to alter behaviour, particularly reducing consumption of demerit goods such as alcohol, tobacco, and fuel.

They also internalise negative externalities by making consumers bear more of the social cost.

This dual purpose means excise duties serve both fiscal and social policy aims.

Council tax is criticised for being based on outdated property valuations from the early 1990s.

It is seen as regressive, since households with lower incomes may still pay relatively high proportions of income compared to wealthier households.

Reform proposals include revaluation, band adjustments, or replacing council tax with a system more closely linked to current property values or income.

Practice Questions

Identify two main roles of taxation in the UK economy. (2 marks)

1 mark for each correctly identified role (maximum 2 marks).

Acceptable answers include:

Raising revenue for government spending.

Redistributing income and wealth.

Influencing behaviour (e.g., discouraging harmful consumption).

Stabilising the economy (managing aggregate demand).

Allocating resources.

Explain the relative merits of direct and indirect taxes in the UK tax system. (6 marks)

Knowledge (up to 2 marks):

1 mark for defining direct tax (levied on income or wealth).

1 mark for defining indirect tax (levied on expenditure of goods and services).

Application (up to 2 marks):

1 mark for an example of a direct tax (e.g., income tax, corporation tax).

1 mark for an example of an indirect tax (e.g., VAT, excise duties).

Analysis (up to 2 marks):

1 mark for explaining a merit of direct taxes (e.g., progressive, equitable).

1 mark for explaining a merit of indirect taxes (e.g., easier to collect, broad revenue base).

Note:

Award full marks only if the answer refers to both types of tax and compares their merits. Partial answers that cover only one type can gain a maximum of 4 marks.