AQA Specification focus:

‘Why governments levy taxes.’

Governments levy taxes to finance public services, influence economic behaviour, stabilise the economy, and redistribute income, making taxation a key instrument of economic management.

The Purpose of Taxation

Taxes are not simply a means of raising money; they serve multiple economic, social, and political functions that support the operation of a modern economy.

Financing Public Expenditure

The most fundamental reason for taxation is to fund government spending.

Governments require revenue to provide public goods and services, such as defence, law enforcement, healthcare, and education.

Without taxation, the government would lack resources to meet essential collective needs that markets cannot efficiently provide.

Public Goods: Goods that are non-rivalrous (one person’s use does not reduce availability for others) and non-excludable (people cannot be prevented from using them).

Governments also need taxation to maintain infrastructure, pay public sector workers, and meet international commitments, such as overseas aid.

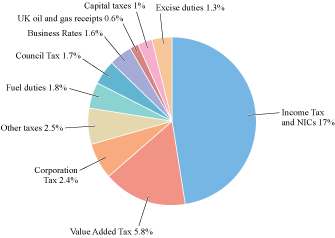

The pie chart displays the distribution of major UK taxes as percentages of GDP for the fiscal year 2010–11. It highlights income tax and National Insurance contributions as the largest sources, followed by VAT and corporation tax, among others. Source

Redistribution of Income and Wealth

Taxation is used as a tool of redistributive justice.

Through progressive taxes (where tax rates rise with income), governments reduce inequality by shifting resources from higher-income groups to fund benefits and services for lower-income groups.

This helps create a fairer distribution of resources and prevents social polarisation.

Progressive Tax: A tax system where the average tax rate increases as income rises, placing a larger relative burden on high earners.

In contrast, regressive taxes, such as sales taxes, can worsen inequality, since they take a higher proportion of income from low earners.

Influencing Economic Behaviour

Governments also use taxation to influence incentives and encourage or discourage particular economic activities.

Pigouvian taxes are levied on goods that create negative externalities, such as carbon taxes on pollution or excise duties on tobacco and alcohol.

Conversely, tax reliefs and subsidies can incentivise desirable activities, such as investment in research and development, renewable energy, or charitable donations.

Pigouvian Tax: A tax imposed on activities that generate negative externalities, designed to internalise the external cost into market prices.

By changing relative prices, taxation alters consumer and producer choices, guiding behaviour in line with wider economic and environmental goals.

Stabilising the Economy

Taxes are central to the government’s macroeconomic management, particularly in stabilising fluctuations in aggregate demand (AD).

During recessions, reducing taxes increases disposable income, stimulating consumption and investment.

During inflationary periods, higher taxes can dampen demand by reducing spending power.

This approach reflects the role of fiscal policy in maintaining economic stability and smoothing the business cycle.

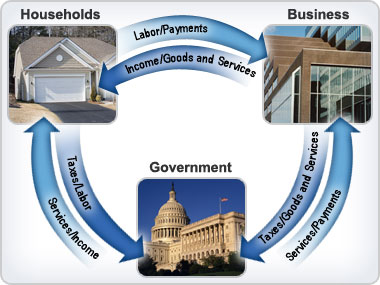

This diagram depicts the circular flow of income, showing how households provide factors of production to firms and receive income in return. Taxes flow from households and firms to the government, which then spends on public goods and services, completing the economic cycle. Source

Correcting Market Failures

Taxation also addresses market failures where the free market leads to inefficient or undesirable outcomes.

For example, congestion charges reduce traffic and pollution in cities.

Taxes on plastic bags or emissions encourage firms to develop more sustainable practices.

Here, taxation is used not primarily for revenue but to realign private incentives with the social optimum.

Ensuring Government Accountability

Taxation links citizens to the government in a fiscal contract.

Citizens fund the state and, in return, expect services, accountability, and transparency.

This strengthens democratic legitimacy and public trust.

International Competitiveness and Policy

In an interconnected global economy, governments must also design tax systems that:

Remain competitive to attract investment and business activity, avoiding excessive capital flight.

Balance revenue-raising needs with incentives for firms to innovate and expand.

Key Roles of Taxation Summarised

Governments levy taxes for several interrelated purposes:

Revenue generation: Funding public expenditure and services.

Redistribution: Promoting equity through progressive taxation.

Behavioural influence: Correcting externalities and incentivising positive activities.

Stabilisation: Managing aggregate demand and smoothing the business cycle.

Market correction: Addressing failures such as pollution or congestion.

Governance: Strengthening the fiscal contract and accountability.

Competitiveness: Designing tax policy to align with global economic challenges.

Balancing Objectives

In practice, governments face trade-offs between these aims. For example:

High taxes may reduce incentives for work and investment but improve redistribution.

Lower taxes can boost growth but may increase inequality and reduce fiscal capacity.

Thus, taxation policy is always shaped by political choices, economic priorities, and social pressures, making it a core instrument of government policy.

FAQ

Governments often choose taxes based on their stability, fairness, and efficiency. For instance, income tax provides a steady source of revenue, while VAT is easier to collect.

They also consider the economic impact: corporation tax affects business investment, whereas excise duties can target harmful consumption.

Political acceptability also matters, as some taxes are more publicly supported than others.

If tax revenues fall short of spending, governments must borrow to cover the gap.

Higher taxation reduces the need for borrowing.

Lower taxation without spending cuts can worsen budget deficits.

Tax policy therefore directly affects fiscal sustainability and the level of national debt.

No. Some taxes are primarily revenue-raising with little behavioural aim, such as general income tax.

However, indirect taxes like duties on alcohol or carbon taxes are specifically designed to alter behaviour.

Many taxes serve both roles simultaneously — raising revenue and encouraging or discouraging certain activities.

Taxation supports growth indirectly by funding investment in education, healthcare, and infrastructure.

It can also create incentives for innovation and investment through tax credits or reliefs.

However, excessively high taxes may discourage entrepreneurship, so governments must balance growth promotion with revenue needs.

The balance depends on economic priorities, administrative ease, and fairness.

Direct taxes, like income tax, are progressive and reduce inequality.

Indirect taxes, like VAT, are easier to collect and harder to evade.

Many governments use a mix, aiming to maintain efficiency while protecting lower-income groups from excessive burdens.

Practice Questions

Define what is meant by a Pigouvian tax and give one example. (2 marks)

1 mark for accurate definition: A tax levied to internalise the negative externalities of a good or activity.

1 mark for a correct example: e.g., carbon tax, tobacco duty, alcohol duty, landfill tax.

Explain two reasons why governments levy taxes other than to raise revenue. (6 marks)

Up to 3 marks for each reason explained (2 reasons required).

1 mark for clear identification of a reason.

Up to 2 marks for developed explanation linked to economic theory or real-world examples.

Acceptable reasons include:

Redistributing income (e.g., progressive taxation reduces inequality).

Correcting market failures (e.g., congestion charge to reduce external costs).

Influencing economic behaviour (e.g., discouraging smoking through higher excise duties).

Stabilising the economy (e.g., reducing taxes in a recession to stimulate demand).

Maximum 6 marks if two reasons are identified and both are fully developed with explanation.