AQA Specification focus:

‘How government spending and taxation can affect the pattern of economic activity.’

Government spending and taxation play a central role in shaping economic behaviour, determining resource allocation, influencing incentives, and affecting short- and long-term growth patterns across society.

Government Spending and Activity Patterns

Government spending refers to the expenditure by the state on goods, services, and transfers. It directly influences the structure of economic activity by shifting resources and demand.

Categories of Government Spending

Current expenditure: Spending on the day-to-day running of public services, such as wages for teachers and nurses.

Capital expenditure: Investment in infrastructure projects like roads, schools, and hospitals, which supports long-term productivity.

Transfer payments: Redistribution through benefits, pensions, and subsidies, which affect household consumption patterns.

Spending choices guide the composition of aggregate demand (AD), as government expenditure is a direct component of AD, but also reshape supply-side potential when directed towards infrastructure or education.

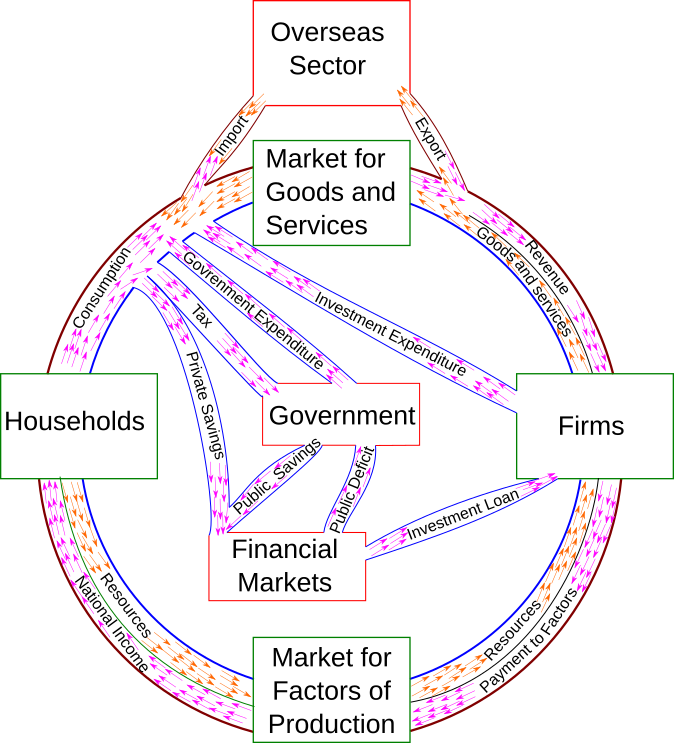

The Circular Flow of Income model depicts the continuous movement of money between households, firms, and the government. In this model, government spending acts as an injection into the economy, stimulating demand and influencing overall economic activity. Conversely, taxation represents a leakage, reducing disposable income and potentially dampening consumption. This dynamic interaction underscores the significant impact of fiscal policy on economic patterns. Source

Government Spending: The total expenditure by the state on goods, services, and transfers designed to provide public services, redistribute income, or stimulate the economy.

Government priorities, such as favouring capital investment versus transfers, determine whether economic activity is more consumption-led or investment-driven.

Taxation and Activity Patterns

Taxation provides revenue for public spending but also shapes incentives, affecting consumer behaviour, saving decisions, and investment by firms.

Main Types of Taxation

Direct taxes: Levied on income and wealth, such as income tax or corporation tax.

Indirect taxes: Levied on spending, such as VAT or excise duties.

Different forms of taxation influence activity patterns by altering disposable income, relative prices, and profitability of enterprise.

Taxation: The compulsory financial charge imposed by government on individuals or firms to fund public expenditure and influence economic behaviour.

For example, higher VAT discourages consumption of certain goods, while lower corporation tax may encourage business investment.

Interaction Between Spending and Taxation

Government spending and taxation interact to influence patterns of economic activity in both the short term and long term.

Short-Term Effects

Expansionary fiscal policy (higher spending or lower taxes) stimulates consumption and investment.

Contractionary fiscal policy (lower spending or higher taxes) restrains demand, controlling inflation.

Long-Term Effects

Investment in education, healthcare, and infrastructure raises productivity and competitiveness.

Tax structures can encourage innovation, entrepreneurship, or alternatively discourage labour participation.

Aggregate Demand (AD) = C + I + G + (X – M)

C = Consumption expenditure

I = Investment by firms

G = Government spending

X = Exports

M = Imports

Since G is a direct element of AD, any changes in spending or taxation that affect disposable income and consumption (C) also shift the overall level of demand.

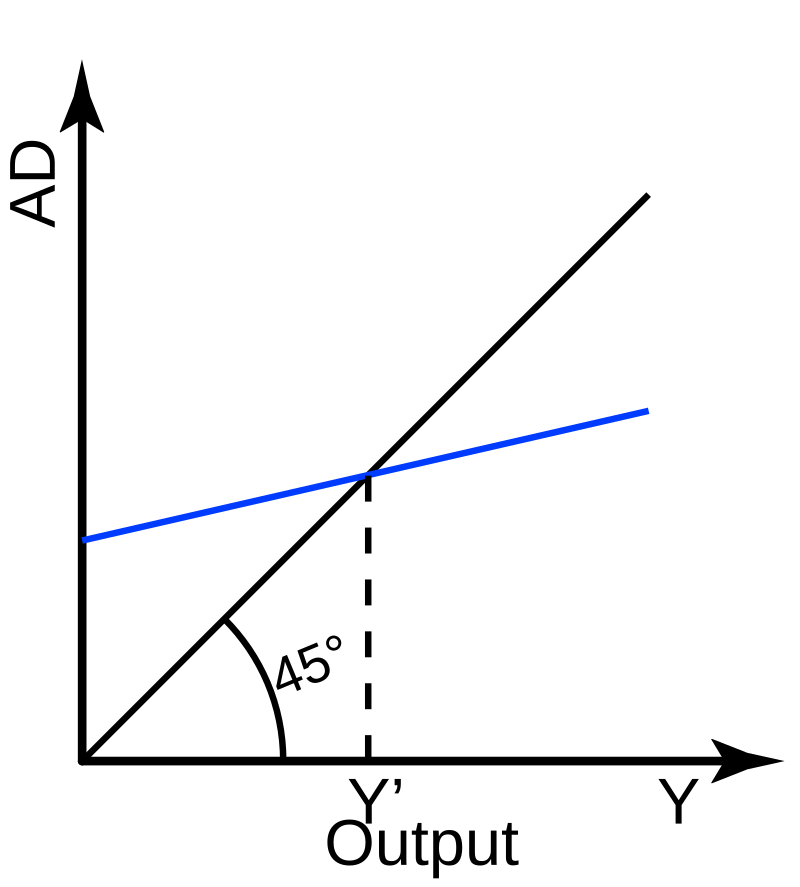

The Keynesian Cross diagram showcases the relationship between aggregate expenditure and national income. The equilibrium point, where the expenditure line intersects the 45-degree line, indicates the level of output where planned spending matches actual income. Shifts in this equilibrium, due to changes in government spending or taxation, highlight the multiplier effect and the broader impact of fiscal policy on economic activity. Source

Distributional Impacts on Economic Activity

The balance between spending and taxation has distributional consequences, influencing the pattern of activity across income groups, regions, and industries.

Redistribution

Transfer payments target low-income households, increasing their consumption and altering demand structures.

Progressive taxes shift resources from higher to lower earners, potentially narrowing inequality.

Regional Development

Public investment in specific areas stimulates regional economies.

Tax incentives can attract businesses to deprived areas.

Patterns of activity therefore reflect not only the total amount of fiscal intervention but also its distributional design.

Supply-Side Influences

While spending and taxation are often associated with demand management, they also influence the supply side of the economy.

Spending on education and training enhances human capital, shifting the long-run aggregate supply (LRAS).

Infrastructure investment reduces production costs and increases efficiency.

Tax incentives for research and development encourage innovation, expanding productive capacity.

These effects ensure fiscal measures influence not just immediate activity but also the trend rate of growth.

Behavioural Effects of Taxation

Taxation changes can alter incentives, which feed into broader patterns of economic activity.

High marginal income tax rates may reduce the incentive to work or invest.

Reduced business taxes can encourage investment and job creation.

Indirect taxes on demerit goods (e.g. tobacco duty) reduce demand for socially harmful products.

Such behavioural responses explain why fiscal choices shape activity beyond simple revenue raising.

Evaluating Fiscal Impacts on Activity Patterns

When assessing fiscal policy, economists consider both intended effects and unintended consequences.

Advantages

Targeted spending can stimulate priority sectors.

Redistribution supports social cohesion and increases equality.

Tax incentives can improve efficiency and long-term growth.

Drawbacks

Poorly targeted spending may create inefficiencies.

Excessive taxation can distort behaviour and reduce competitiveness.

Fiscal interventions risk crowding out private investment if financed by borrowing.

By balancing spending priorities and tax design, governments influence not only the size but also the pattern of economic activity.

FAQ

Capital spending, such as on infrastructure and education, enhances productivity and boosts long-term growth potential.

Current spending, like wages for public sector employees, supports short-term demand but has less impact on future output.

An economy that prioritises capital expenditure is more likely to see structural improvements in efficiency and competitiveness.

Direct taxes reduce disposable income directly, influencing household consumption and saving decisions.

Indirect taxes affect spending behaviour by altering the relative prices of goods and services.

For example, excise duties can reduce demand for tobacco, while VAT changes may shift spending between goods and services.

Investment in transport links or regional infrastructure encourages economic activity in less developed areas.

Targeted subsidies or grants can support industries vital for regional employment.

Regional tax incentives may attract private firms to invest where activity is weaker.

Such redistribution aims to reduce regional disparities in growth and employment.

Tax cuts for households raise disposable income, boosting consumption demand.

Conversely, corporate tax reductions or investment allowances encourage firms to expand capital expenditure.

Government priorities determine whether activity patterns lean more towards household-driven growth or long-term productivity improvements.

Higher income tax may discourage additional work effort, reducing labour supply.

Cuts in corporation tax can incentivise firms to reinvest profits rather than distribute dividends.

Indirect taxes on demerit goods alter consumer demand, changing market structures.

These behavioural shifts create ripple effects that shape overall economic activity.

Practice Questions

Define government spending and explain one way it can affect the pattern of economic activity. (2 marks)

1 mark for a correct definition of government spending: expenditure by the state on goods, services, and transfers.

1 mark for a clear explanation of an effect, e.g. investment in infrastructure can stimulate economic growth by improving productivity.

Discuss how changes in taxation can influence the pattern of economic activity in the UK. (6 marks)

Up to 2 marks for clear identification of how taxation changes affect economic activity (e.g. higher income tax reduces disposable income and consumption; lower corporation tax may increase investment).

Up to 2 marks for use of economic terminology and explanation of mechanisms (e.g. leakages, incentives, redistribution).

Up to 2 marks for evaluative comments, such as considering the scale of the tax change, the state of the economy, or unintended consequences (e.g. higher taxes might reduce incentives to work).