AQA Specification focus:

‘Students should be able to assess the economic significance of changes in the level and distribution of both public expenditure and taxation.’

Introduction

Changes in government spending and taxation affect resource allocation, income distribution, and overall economic performance. Assessing their significance helps evaluate impacts on growth, stability, and welfare.

Understanding Spending and Taxation Changes

Government Spending

Government spending refers to the use of public funds to purchase goods and services, transfer payments, and investments. It directly influences both aggregate demand and long-term productive capacity.

Government Spending: The total expenditure by the government on goods, services, and transfers to achieve economic and social objectives.

Spending changes can be expansionary (increased outlays on health, education, or infrastructure) or contractionary (reductions in welfare or departmental budgets).

Taxation

Taxation is the compulsory levy imposed by the government on individuals, businesses, and goods. Changes in taxation alter disposable income, business costs, and incentives.

Taxation: The system by which governments collect money from individuals and firms to fund public spending and redistribute resources.

Taxation can be direct (income tax, corporation tax) or indirect (VAT, excise duties). The type of tax change matters for distributional impacts and economic efficiency.

Assessing the Level of Spending and Taxation

Impact on Aggregate Demand (AD)

Higher spending boosts AD by increasing government demand for goods and services.

Tax cuts raise disposable income, encouraging consumer spending.

Higher taxes reduce AD by lowering disposable income and discouraging investment.

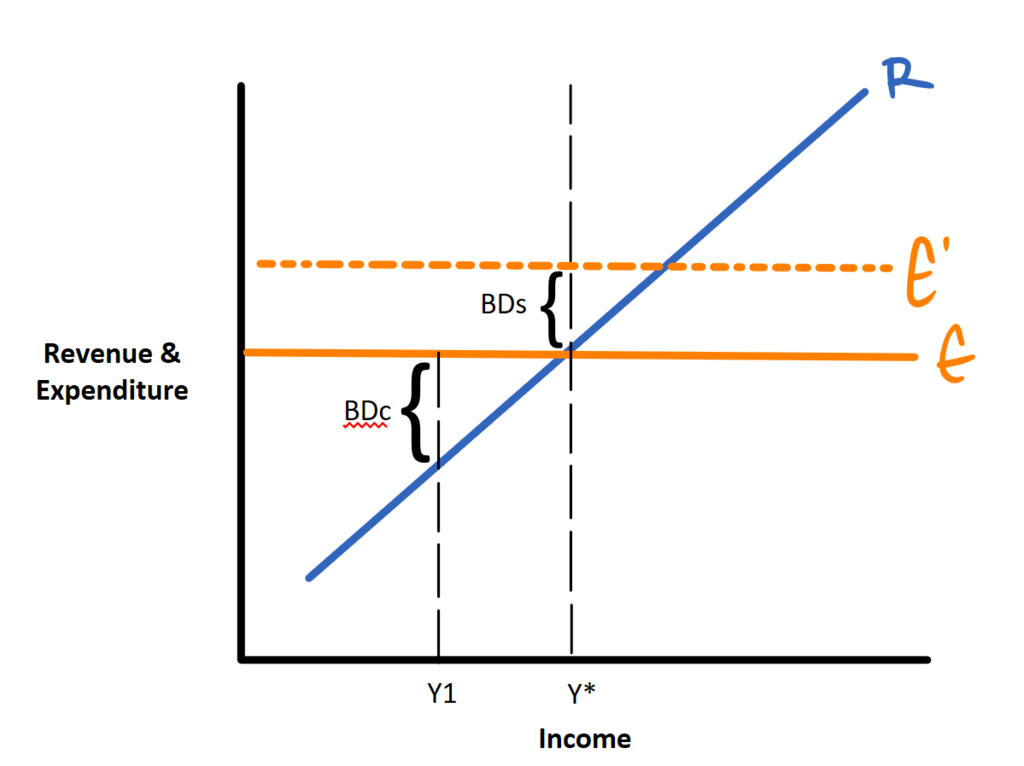

This diagram distinguishes between cyclical and structural deficits. A cyclical deficit occurs due to economic downturns, while a structural deficit persists regardless of the economic cycle, often due to long-term imbalances in government spending and revenue. Source

Impact on Aggregate Supply (AS)

Targeted spending on education, training, and infrastructure can improve long-run productive capacity.

Business tax changes affect investment and innovation, influencing long-run growth.

Assessing the Distribution of Spending and Taxation

Distributional Effects

Spending and taxation policies influence how income and wealth are shared:

Progressive taxation (higher earners pay proportionally more) narrows inequality.

Regressive taxation (lower earners pay a higher share of income) widens inequality.

Spending priorities (health, welfare, housing) disproportionately benefit lower-income households.

Equity and Fairness

Equity is a key principle of taxation and public spending. Governments must balance horizontal equity (equal treatment of equals) and vertical equity (unequal treatment to address inequality).

Economic Significance of Spending and Taxation Changes

Short-Run Significance

Stimulates or restrains economic activity through demand-side effects.

Alters employment and unemployment levels.

Can reduce or exacerbate inflation depending on demand pressures.

Long-Run Significance

Influences productivity growth through investment in human and physical capital.

Shapes competitiveness by affecting incentives for work, saving, and investment.

Determines sustainability of public finances and debt dynamics.

Trade-Offs and Considerations

Efficiency vs Equity

Efficiency may require lower taxes to encourage enterprise.

Equity may demand progressive taxes and welfare spending to reduce inequality.

Policymakers must weigh these competing objectives.

Fiscal Sustainability

Increased spending without matching taxation can widen deficits.

Excessive taxation may discourage investment and innovation.

Sustainable fiscal policy balances growth, equity, and debt management.

Key Factors When Assessing Changes

Magnitude of Change

The scale of tax rises or spending cuts matters: small changes may have limited effect, whereas large adjustments can significantly alter economic outcomes.

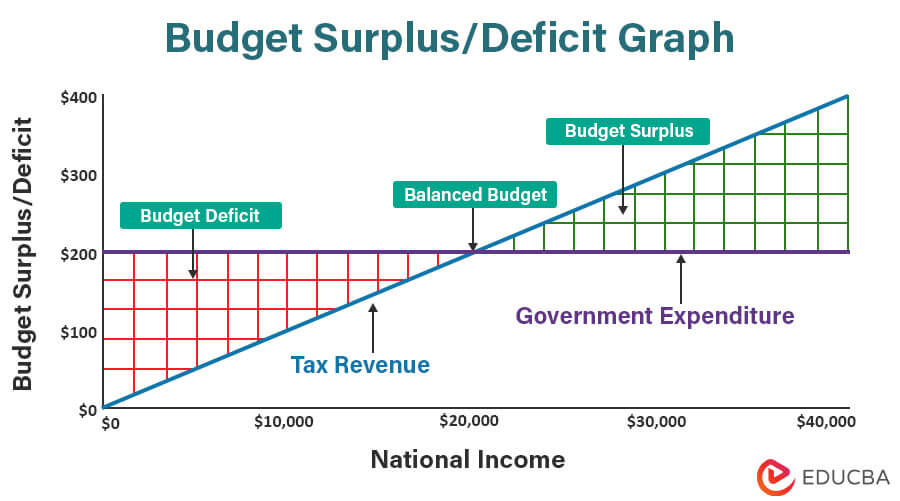

This graph demonstrates how government spending and tax revenue interact with national income. A budget surplus occurs when tax revenue exceeds government spending, while a deficit arises when spending surpasses revenue. The intersection point indicates a balanced budget. Source

Timing and Context

In a recession, spending increases and tax cuts have stronger stimulatory effects.

During booms, spending restraint and tax rises can prevent overheating.

Type of Tax or Spending

Capital spending (e.g. infrastructure) enhances long-run growth.

Current spending (e.g. wages, welfare) influences short-run demand.

Different taxes carry varying efficiency and equity implications.

Bullet Summary of Assessment Points

Changes in spending and taxation affect aggregate demand and aggregate supply.

They redistribute income and influence inequality.

Their significance depends on magnitude, timing, and economic context.

Key trade-offs exist between equity, efficiency, and fiscal sustainability.

Long-term outcomes are shaped by the type of spending and structure of taxation.

FAQ

Government spending is expansionary when it increases overall demand and stimulates economic activity, usually through higher outlays on services, welfare, or infrastructure.

It becomes contractionary when spending is reduced, limiting demand and slowing growth, often linked to austerity or fiscal consolidation measures.

Taxation shapes incentives as well as spending power.

Higher income taxes may discourage work effort or reduce labour supply.

Consumption taxes can shift spending patterns away from taxed goods.

Lower business taxes can stimulate investment and innovation.

Two tax systems may raise the same revenue, yet their effects on inequality differ.

A progressive tax system narrows income gaps, while regressive taxes widen them.

Thus, policymakers evaluate not only how much is raised, but who bears the burden.

Spending in education, infrastructure, and healthcare can improve opportunities in disadvantaged areas.

Examples include transport investment in underdeveloped regions, regional skills training programmes, and health funding boosts to areas with poorer outcomes.

Stable fiscal policy fosters confidence by signalling sustainability and predictability.

Rising deficits from unchecked spending may deter investors.

Well-structured tax incentives can attract foreign direct investment.

Sudden tax increases risk discouraging business planning and expansion.

Practice Questions

Define what is meant by government spending and explain how a change in government spending can affect aggregate demand. (2 marks)

1 mark for a clear definition of government spending: expenditure by the government on goods, services, and transfers.

1 mark for explanation of how higher spending raises aggregate demand by increasing total expenditure in the economy (or how reduced spending lowers AD).

Assess the significance of changes in taxation for income distribution in the UK economy. (6 marks)

1 mark: Recognition that taxation redistributes income.

1 mark: Explanation of progressive taxes reducing inequality (higher earners pay proportionally more).

1 mark: Explanation of regressive taxes increasing inequality (lower earners pay a higher share of income).

1 mark: Reference to equity/fairness in taxation (horizontal and vertical equity).

1 mark: Application to the UK, e.g. income tax and VAT roles in distribution.

1 mark: Evaluation — significance depends on scale of changes, economic context, and whether tax changes are offset by spending policies.