AQA Specification focus:

‘The relationship between the budget balance and the national debt.’

Fiscal policy involves choices about spending and taxation, and the budget balance and national debt lie at the centre of these decisions, influencing economic stability.

Budget Balance

The budget balance refers to the difference between government revenues (mainly from taxation) and government expenditures (spending on goods, services, and transfers) over a given period.

Budget Balance: The difference between government revenue and government expenditure within a financial year. A surplus occurs if revenue exceeds spending, while a deficit occurs if spending exceeds revenue.

Governments monitor the budget balance closely because it indicates whether fiscal policy is expansionary (deficit spending to stimulate demand) or contractionary (surplus to reduce inflationary pressure).

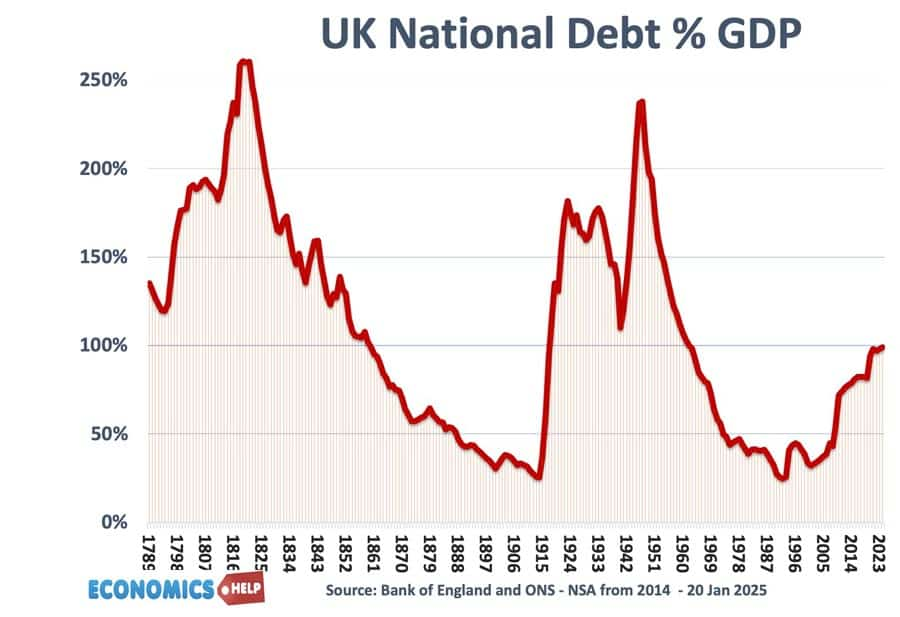

Historical trends in the UK's national debt as a percentage of GDP, showing peaks during major conflicts and economic downturns. Source

Types of Budget Balance

Balanced budget: Revenues equal expenditures.

Budget deficit: Spending exceeds revenues, requiring borrowing.

Budget surplus: Revenues exceed spending, allowing debt repayment or savings.

National Debt

The national debt is the accumulation of past government borrowing that has not been repaid. It builds up when governments run consecutive deficits, since each deficit requires financing.

National Debt: The total stock of outstanding government borrowing built up from past budget deficits, usually measured as a percentage of GDP.

Unlike a one-year budget deficit, the national debt is a stock variable, representing liabilities owed by the government to domestic or foreign holders of its bonds.

Debt as a Percentage of GDP

Economists typically measure the debt-to-GDP ratio, since this indicates the scale of debt relative to the country’s productive capacity.

Debt-to-GDP Ratio (%) = (National Debt ÷ GDP) × 100

National Debt = Total outstanding borrowing by the government

GDP = Gross Domestic Product, the total value of output in the economy

This ratio helps assess sustainability: higher GDP growth can make a given level of debt more manageable.

The Relationship between Budget Balance and National Debt

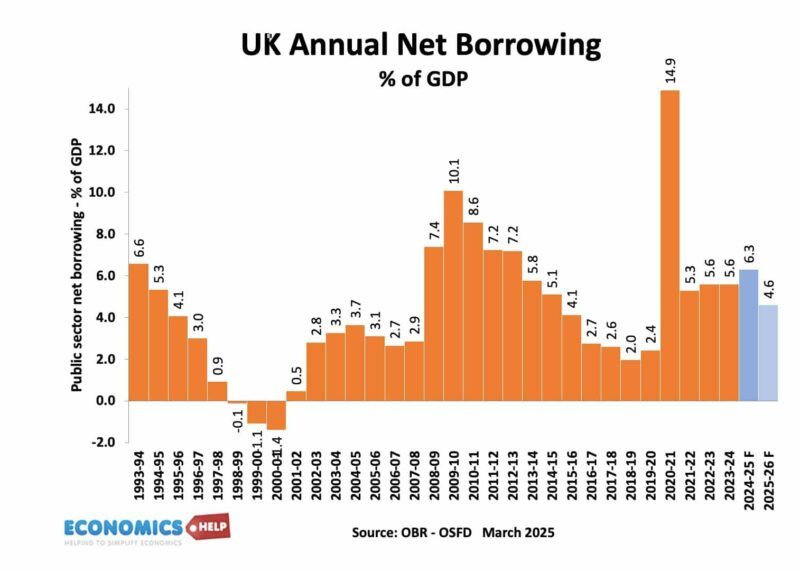

The specification emphasises understanding how the budget balance links to the national debt. Deficits add to the debt, while surpluses reduce it. Key mechanisms include:

A budget deficit requires government borrowing, usually via issuing bonds. This directly increases the national debt.

A budget surplus can be used to repay existing debt, reducing the total stock.

Persistent deficits without corresponding surpluses cause the debt stock to grow.

Short-Term vs Long-Term Dynamics

Short-Term

In a single year, a deficit may be relatively small and only marginally increase the debt stock.

Governments may deliberately run deficits during recessions to stimulate demand (a counter-cyclical fiscal policy).

Long-Term

Continuous deficits accumulate into large national debts, raising concerns about fiscal sustainability.

A long-run pattern of surpluses can gradually reduce debt as a share of GDP.

Annual UK budget deficit as a percentage of GDP, highlighting periods of fiscal surplus and deficit. Source

Economic Implications of Budget Balance and National Debt

For Government Policy

High debt can limit fiscal flexibility, making it harder to respond to future crises.

A balanced budget rule may constrain policy options, reducing the government’s ability to stabilise the economy.

For the Economy

Deficits may stimulate demand, raising output and employment in the short run.

Surpluses may reduce inflationary pressure but could slow growth.

High national debt can increase the cost of borrowing, as investors demand higher interest rates.

However, moderate debt levels may be sustainable if economic growth is strong.

Funding the National Debt

Governments finance debt mainly by issuing bonds:

Domestic bonds sold to citizens, banks, or pension funds.

Foreign bonds sold to overseas investors.

The sustainability of debt depends on:

Interest rates: Low interest reduces debt servicing costs.

Growth rates: Strong GDP growth lowers the debt-to-GDP ratio.

Debt Servicing

Debt Servicing: The regular payment of interest on outstanding government debt.

As debt grows, debt servicing becomes a larger share of government spending, potentially leading to reduced funds for public services or higher taxes.

Political and Economic Debates

There is debate over how large national debt should be:

Some economists argue governments should aim to balance the budget over the business cycle, running deficits in downturns and surpluses in upturns.

Others suggest debt is not inherently harmful if used for productive investment (e.g. infrastructure, education) that raises long-run growth.

Critics warn that excessive reliance on borrowing may undermine investor confidence, weaken exchange rates, and trigger inflation.

Intergenerational Concerns

Running persistent deficits shifts the repayment burden to future taxpayers. This raises questions of intergenerational equity, as future generations may face higher taxes or reduced public spending.

Evaluating Fiscal Policy Choices

When assessing fiscal policy, students should consider:

The scale of the budget balance relative to GDP.

Whether the deficit is cyclical (temporary, due to recession) or structural (long-term mismatch of spending and revenue).

The level of the national debt and its servicing costs.

The potential benefits of borrowing if it supports long-run productivity growth.

These aspects highlight the close interdependence between the budget balance and the national debt, a central issue in evaluating fiscal policy effectiveness.

FAQ

Gross national debt includes all outstanding government borrowing, while net national debt subtracts government-owned financial assets (such as foreign currency reserves or holdings of its own bonds).

Net debt gives a clearer picture of the government’s actual liabilities because it accounts for assets that could be used to repay borrowing.

Credit rating agencies assess whether a government is likely to repay its debt. A large or persistent deficit may downgrade a country’s rating, raising borrowing costs.

A balanced budget or surplus can improve investor confidence and help maintain low interest rates on government bonds.

Governments may run deficits during recessions to stimulate demand through higher spending or lower taxes.

Deficit financing can also be used for long-term investments in infrastructure, education, or health that raise productivity and future growth.

Inflation reduces the real value of outstanding debt, making repayment easier in nominal terms.

However, high inflation can raise interest rates, increasing debt servicing costs and making future borrowing more expensive.

Cyclical deficits arise from downturns in the business cycle, with tax revenues falling and welfare spending rising. These often shrink during recovery.

Structural deficits occur when government spending consistently exceeds revenue even at full employment, leading to long-term increases in national debt.

Structural issues are harder to resolve and often require reforms to taxation or expenditure.

Practice Questions

Define the term budget balance. (2 marks)

1 mark for stating that budget balance is the difference between government revenue and expenditure in a given period.

1 mark for specifying that a surplus occurs when revenue exceeds expenditure, and a deficit occurs when expenditure exceeds revenue.

Explain how a persistent budget deficit can affect the size of the national debt. (6 marks)

Up to 2 marks for defining budget deficit and/or national debt.

1 mark for identifying that a budget deficit requires borrowing to finance the shortfall.

1 mark for stating that borrowing adds to the stock of existing debt.

1 mark for explaining that repeated deficits over several years accumulate, increasing the national debt.

1 mark for noting that higher debt leads to greater interest payments (debt servicing), which may further increase future deficits.

Maximum: 6 marks.